Project finance and loans for residential property construction

Link Bridge Financial LTDA LBFL offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

Now, as the forecasts of the global economy improve, we see an increase in investments in BTR and BTS construction, and developers are striving to implement flexible projects in the field of residential construction using project finance (PF).

There are many financing options for residential property construction. In addition to self-financing, developers can choose to finance with a long-term bank loan or equity financing, as well as complex project finance tools using SPVs.

Choosing an appropriate financing model for an investment project can be critical to its success, so it is important for sponsors to properly allocate risks.

Financing of residential construction in different countries develops in different ways, ranging from non-repayable financing from state and local budgets to free market mechanisms.

Government policy and social necessity, balanced by competition for financial resources, dynamically changing demand for apartments, together form a complex and contradictory market for modern housing construction, unique for every region of the world.

Due to the investment specificity of real estate and the fact that it is considered a reliable capital protection, many financial models have been developed to finance real estate investments.

The real estate investment financing system fulfills important social and economic goals, along with meeting the business goals of developers and other participants.

Link Bridge Financial LTDA LBFL, a investment consulting company, offers residential construction project finance services and long-term loans on flexible terms.

Our experts are ready to assist in the development of your business anywhere in the world, including the EU, USA and Canada, Latin America, Africa, UAE and the Middle East, India, China and Southeast Asia.

Sources of financial resources for residential property construction

Financing of residential construction, which involves finding or raising capital for large housing projects, is closely related to real estate investment.Rational investment decisions are paramount.

Before deciding on an investment, an investor should carefully consider which project can bring a relatively higher return on equity.

Any investment projects in residential property construction require significant capital investments. Consequently, the initial condition necessary for investment is the availability of large free capital.

These investors can be large companies, banks, credit communities, pension funds, venture capital funds, wealthy private investors or government customers. The methods of participation and approaches to evaluating investment projects for these investors differ significantly.

The way of investing capital and the potential for its increase depend, first of all, on the financial resources of the investor. Based on the source of capital, experts usually allocate internal resources and external capital (debt financing or equity financing).

The table below provides classification of sources of capital for financing residential development.

Table: Internal and external sources of funds for residential property construction.

| Internal sources of funding | External sources of funding | ||

| External | Internal | Refundable | Non-refundable |

| Initial contribution of the project participants | Financial flows from current business activities | Bank loans | Budget subsidies |

| Issue of shares | Depreciation | Project finance tools | Government programs |

| Issue of securities | |||

| Leasing | |||

Own assets of companies and individuals remain a significant source of financing for residential construction in the world.

The most common sources of investment in the construction and purchase of real estate are current income and proceeds from the sale of other assets. Security is a key advantage of this type of financing as there is no credit risk. Unfortunately, usually this source is not enough, so the developer is forced to resort to other financing mechanisms.

By its nature, real estate can be called a capital-intensive investment object that requires the use of external sources of financing, mainly bank loans. Activities related to both the acquisition and maintenance of real estate require significant financial resources from the company.

Link Bridge Financial LTDA LBFL offers project finance services for large investment projects in residential construction, as well as loans for the construction and renovation of real estate.

Find out more about our services right now.

Essence of residential property construction project finance

Project finance is one of the most popular and promising methods of financing investment projects in the field of residential construction.PF is based on a number of unique features. The object of financing in each case is a separate investment project (usually a new project), the financing of which is organized by an independent legal entity, a special purpose vehicle SPV / SPE.

The financial structure of such a project is characterized by a high share of borrowed capital, reaching in most cases 70-90% of the total project cost. However, lenders do not have full access to sponsors' assets or have limited access. Unlike corporate finance, the source of debt repayment for SPV is the projected cash flows of the investment project and, ultimately, the assets of the project.

Table: The main differences between financing residential projects based on PF tools and traditional corporate financing (long-term investment loans).

| Corporate finance | Project finance |

| Projects are more often implemented by old companies with a long operating history, which are well known to banks and potential investors. One company can be engaged in several types of activities and implement several different projects. | PF usually refers to financing a specific development project of a newly formed SPV / SPE with no operating history or credit rating. This limits the possibility of the simultaneous implementation of other investment projects. |

| The sponsor's creditworthiness is assessed based on previous financial transactions. | The creditworthiness of the project company is assessed based on the projected financial results of the project. |

| Any assets of the borrowing company, not necessarily related to a particular project, are considered as collateral. | The loan is secured by property owned by SPV / SPE. |

| With traditional financing, the life of the company and its project are closely related, therefore, the bankruptcy of the project can lead to the bankruptcy of the borrower. | Separating the project from the borrower's financial statements reduces the impact of the project on the fate of the enterprise and vice versa. The bankruptcy of the project does not mean the bankruptcy of the shareholders. |

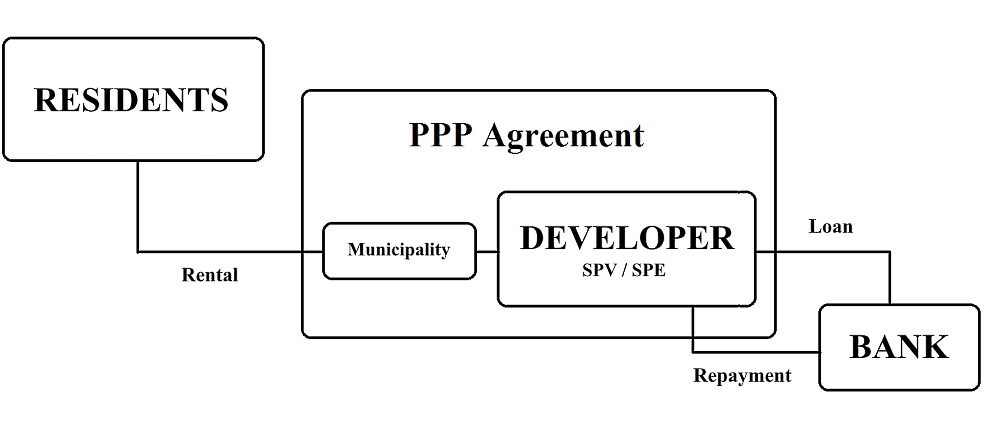

Project finance is the most widely used in the world in financing large infrastructure projects implemented in the PPP formula, including the construction of toll sections of highways, power plants, hospitals, stadiums and tourist facilities. To a certain extent, PF tools are also applied to the financing of residential construction, which is confirmed by the successful practice of European countries.

Benefits of project finance for developers

The ubiquitous use of project finance to finance the construction of residential real estate is supported by the fact that it generates constant cash flows from rentals, allowing SPVs to repay loans along with interest and commissions.It should be noted that SPV is a formally independent entity from the companies and banks that established it. This independence from the founders has important advantages.

The growing popularity of project finance can be largely attributed to the diversification of risks that are shared between sponsors and other project participants.

In this case, banks assume greater risk compared to other methods of financing investment projects.

Since LTV (Loan to Value) can easily exceed 90%, project finance is ideal for young companies that do not have sufficient assets or free funds to implement a large construction project. It is also a suitable option for companies that are simultaneously implementing several capital intensive projects in tough market conditions.

Another advantage of the project finance method is the lack of sponsor liability for the SPV's debt obligations (except for the provision of a guarantee). The borrowed funds are provided against future financial flows, regardless of the assets of the borrowers.

Thus, future income from rent or sale of apartments is of primary interest to lenders.

Another advantage of this method for companies with no experience in the market is the ability to attract significant financial resources for the construction of an apartment building or other real estate for rent. The latter is a common requirement for classic corporate loans. It should also be emphasized that the possible bankruptcy of SPV does not have any catastrophic consequences for the developer.

It is also important to consider the benefits of project finance in the context of tax optimization for the project company and sponsors.

The SPV pays income tax, VAT and property tax, but the remaining funds can be split between project participants in the form of tax-free dividends. In addition, interest on subordinated loans is usually deducted from the tax base of the project company.

Despite the many advantages, the use of this financing method has some disadvantages. The most painful disadvantage for sponsors is considered to be a complex, expensive and time-consuming preparatory stage. The PF requires the preparation of detailed documentation with the participation of numerous consultants, as well as numerous analyzes (for example, profitability analysis, tax or legal analysis of an investment project).

Residential construction project finance is costly and time-consuming.

Often, the lack of coordination of actions leads to a conflict between the parties. It is highly recommended to seek professional support from the very beginning.

Important requirements for organization of financing

In order to ensure the attraction of sufficient financial resources for the construction of a residential complex, the project participants will have to fulfill a number of requirements regarding the investment object, financial indicators, legal security of the upcoming transaction and other important aspects.The capital provider will carefully analyze the project as it takes on some of the risks.

This usually means extending the pre-investment stage, because a detailed analysis of potential risks will be required, as well as the preparation of an appropriate system for their distribution.

The construction project will also have to provide a minimum level of income from the rental or sale of apartments and retail space.

For this reason, the bank may require detailed information regarding future sources of income, including demand analysis, rental rates, and so on.

The bank needs to check the rental agreement in the context of the possibility of reducing rental rates and assess the risk of early termination of the lease. The bank will also check the level of vacant space in the area for rent, the minimum OPEX ratio (operating expenses) and minimum CAPEX (capital expenses) for this class of properties, as well as analyze the potential for tax optimization.

The optimal EBITDA level in certain years of investment activity is also of great importance.

The investment project must demonstrate a sufficient debt coverage ratio (DSCR), which determines the company's ability to repay debt from the generated cash flow. In other words, DSCR matches cash flows with payments in a specific time period.

The loan obtained in this way by SPV / SPE for the construction of a residential complex is secured exclusively by the future income from the implemented project and its assets.

Residential property construction project finance is generally characterized by higher bank profits with high risk.

However, the PF is also beneficial for SPV shareholders due to the possibility of distributing risks between project participants and high financial leverage, sufficient for the implementation of large capital-intensive projects.

World practice of using project finance in residential construction

The construction of housing for rent (BTR market) in Europe and the United States is developing rapidly for several reasons.This is facilitated by demographic changes, a free lifestyle with very frequent movements and a high level of income, however, insufficient for buying a home.

For example, in the United States in 2016-2017, Build-to-Rent construction showed an increase of 6.5%, which is the best indicator in the previous decade and a half. The UK market has also been quite successful with a 4x increase in the number of completed BTR projects between 2016-2021. Despite the market slowdown as a result of the pandemic, this concept has a promising future.

In European realities, project finance is often used for the construction of apartment buildings for rent.

Such projects generate cash flow in the form of rent paid by tenants or by a government customer (municipality) in accordance with a public-private partnership agreement. Such PPP schemes are used in Germany, Poland and a number of other countries.

Figure: Typical financial structure of BTR construction project using public-private partnership mechanisms.

It should be added that project financing of resident BTR projects can also be based solely on the participation of private capital without government intervention.

Such projects can be successfully implemented by private companies in the construction of comfortable residential complexes in capitals or tourist cities, focusing on high rents.

Despite the growing need for rental housing, most companies today focus on the construction of residential properties for sale. In many countries, developers are hesitant to undertake investment projects related to the construction of apartment buildings for rent using project finance, despite unmet demand.

This can be attributed to the uncertain legal status of rental housing and strict tenant protection legislation, which often limits interest in financing for the construction of residential property for rent.

Are you in need of professional legal advice or financial modeling of a large investment project?

Do you need residential construction project finance services abroad?

Contact the LBFL team anytime to enlist our support.