Structured finance of large investment and business projects

Link Bridge Financial LTDA LBFL offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

The development of the financial market enables companies to use an ever wider range of financial instruments adapted to their capital needs, risks and the changing conditions of the competitive environment.

One of the innovative financial solutions are structured products, which are a group of financial innovations that combine traditional instruments (bonds, stocks, loans) with derivative financial instruments.

Today, structured finance has numerous advantages for fast-growing businesses in energy, infrastructure, heavy industry, agriculture, real estate and tourism, taking into account high flexibility and access to significant resources.

Innovative business financing tools

The primary goal of any business is to maximize its value and benefit to its owners.Achieving this goal requires making the right decisions and using tools that precisely match the current market conditions and financial needs of the company.

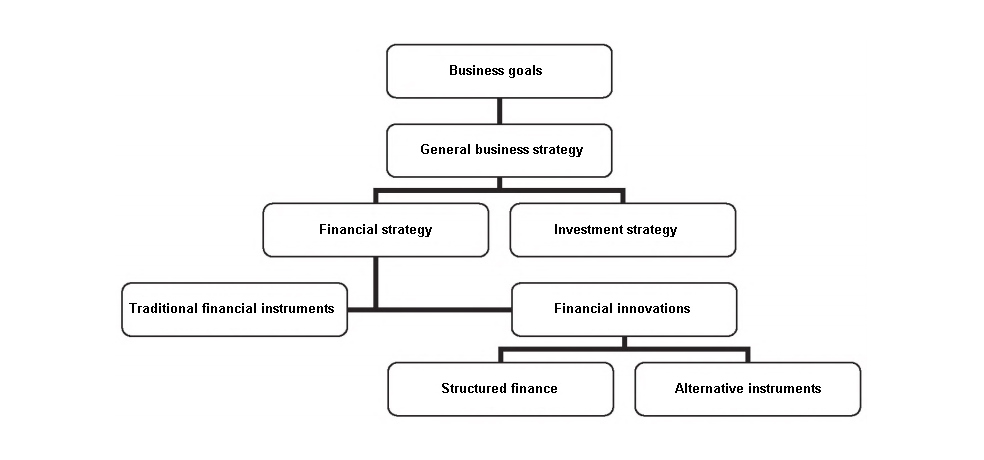

The financial strategy of the business, which covers all aspects of its development, plays a key role in achieving these goals. A company's investment and financial strategies may be based on traditional financing instruments, but in recent years new solutions have emerged that increase the efficiency of doing business and contribute to increasing its value.

A traditional financial strategy uses well-known capital-raising instruments, such as stocks, syndicated bank loans, and numerous long-term and short-term fixed-rate debt instruments.

The main advantage of such a strategy is a good understanding of long-standing financial instruments and the predictability of their impact on the financial health of the company. However, the extremely limited choice of financial solutions reduces business flexibility and makes it impossible to benefit from more sophisticated financial instruments.

On the other hand, an innovative financing strategy for large projects (e.g., hybrid instruments and structured products), allows the business to flexibly shape the capital structure best adapted to the company's financial needs and market environment.

Figure: The role of innovation in business financing.

It is assumed that the use of financial innovation to finance large projects reduces the cost of borrowing and better aligns the cash flows generated by the company with debt service requirements.

It is also important to emphasize the clear relationship between financial innovation and technological innovation.

Implementing technological innovation to improve a company's competitive advantage often requires finding innovative sources and tools to finance operations. This is especially relevant for ambitious start-ups, when traditional forms of financing are not available due to high investment risk and high cost of capital.

LBFL international financing company offers structured financing of large investment projects worldwide with participation of reputable European banks, venture capital funds and large private investors.

We are interested in financing projects in energy, infrastructure, heavy industry, real estate, tourism, waste processing and other sectors.

Structured finance: types and characteristics

Financial innovation is a set of advanced financial instruments, the choice of which is growing due to development of financial engineering.These instruments increasingly meet the needs of investors and borrower companies. In this context, it is important to mention structured products, combinations of simple financial instruments matched in such a way as to improve the risk profile and increase returns.

Structured finance for investment projects combines traditional instruments with various derivatives. This means that the financial benefits of the parties depend on changes in a number of market parameters, such as interest rates, exchange rates, commodity prices, etc. Using a combination of several financial instruments, the business gets new opportunities in terms of attracting capital, meeting the expectations of investors.

The objective of structured finance products is to meet the needs of investors and increase the access of the issuers of these products to sources of financing, which is difficult in the context of fierce competition for capital.

Structured finance is a broad group of financial innovations diversified by bond type, debt security, cost of funds raised, rate of return method, investment term, etc.

Structured financial products are offered in the following forms:

• Structured bonds.

• Structured certificates of deposit (SCDs).

• Structured investment certificates, etc.

Among the popular financial instruments are structured deposits, which are divided by the bank into several parts to ensure the safety of the invested funds.

Funds deposited by the investor, in many cases, are invested in government bonds and options.

The maturity of bonds is adjusted by taking into account the term of the deposit. These deposits, which guarantee repayment and high returns, are characterized by low liquidity. Breaking the deposit agreement before maturity usually results in deduction of a portion of the deposited funds and non-payment of interest.

Structured certificates of deposit are also issued by banks and may be protected by special funds with state participation.

These certificates, since they can be put into free circulation, are highly liquid compared with other structured products.

The profit of a bond purchaser depends on changes of certain market parameters. The issuers of structured bonds can be various companies, including those outside the financial sector. Structured investment certificates may be issued by closed-end investment funds and the investor's return depends on changes in a particular underlying index.

Some certificates may mimic the chosen index, while others allow the investor to earn on a decline in the value of the underlying index and also give the issuer of the securities a viable option of early redemption. Investment certificates can be freely traded, including on a stock exchange.

The legal form of structured finance products determines the list of persons and companies that may issue them. Banks offer structured finance in the form of deposits, certificates of deposit and bonds. Investment funds offer structured investment certificates.

The only form that non-financial corporations can use is structured bonds.

A common feature of structured products is an embedded derivative, usually options and futures.

Derivatives incorporated into structured finance schemes may be based on a variety of indicators, including domestic and foreign stock indices, exchange rates, currency baskets, stock and bond prices of specific companies or sectors, natural resource prices, and interest rates.

These instruments can be used individually or in various combinations, providing the basis for hybrid financial products on several asset classes. Additional investment protection is the most important advantage of structured products for the investor.

Individual instruments can vary in their level of protection, ranging from a 100% guarantee to partial protection. Some structured products offer a minimum rate of return guarantee. However, it is worth bearing in mind that a higher guarantee means a lower return on investment.

The effectiveness of each structured instrument is determined by the method used to calculate the final payoff.

Various solutions are used in this area, ranging from relatively simple and easily interpretable to complex formulas with many variables.

The most commonly used payoff formulas include the following:

• European options: the result depends on the value of the underlying instrument at the time of maturity of the structured product.

• Asian options: the result depends on the average value of the underlying product over the term of the structured instrument.

• Lookback options: The result depends on the difference between the maximum value of the underlying instrument and its initial value.

• Outperformance options: The payoff is highly dependent on the difference between the return on one instrument and the return on the other instrument.

Another feature of structured financial products which determines the rate of return is the participation rate, which determines the investor's share of the return.

If the participation rate is less than 1, the investor is considered to carry less risk.

The participation rate depends on the following:

• The amount of funding involved.

• The price conditions for the purchase of specific options.

• The investment policy of the issuer of the financial product.

• The value of the assets that serve as collateral for the debt.

• The availability of a return guarantee.

• The term of investment.

The higher the amount received by the company, the lower the level of security of invested funds.

The longer the investment term, the higher the participation rate can be.

Another characteristic of structured finance is the wide range of investment terms, which can range from a few months to several years.

There are also schemes in which the investor can end the investment activity before the expected date if a certain rate of return is achieved or if circumstances specified in the terms of the contract arise.

The minimum investment amount for structured finance varies considerably. There are products with a low nominal value, aimed at a wide range of private investors, and there are instruments with a high value, aimed at wealthy investors, funds and companies.

Structured instruments can also be categorized by their ability to generate cash flows for investors.

There are instruments that offer regular cash flows during the investment period, as well as those that only generate returns at the end of the investment period.

Regardless of the choice of structured finance scheme, such financial innovations represent promising opportunities in the capital market, being easily adaptable to investor expectations and the needs of large businesses.

They have the added advantage of providing protection and the ability to invest in markets and instruments that are difficult to access directly for a variety of reasons. The combination of several financial instruments in one combined product also makes it possible to reduce transaction costs which are mainly borne by the investor.

The growing interest in structured products encourages many non-financial corporations to consider using this group of financial innovations to raise sources of financing for their activities, including large long-term projects.

Corporate structured finance products

Banks and financial institutions are the main issuers of structured finance products.However, structured instruments can also be issued by non-financial corporations to obtain the necessary financing.

Structured products issued by corporations are complex financial instruments in which the issuer undertakes to pay an investor at maturity a certain amount depending on the level of the chosen parameter based on a predefined payoff formula.

Corporate structured products are characterized by the fact that (as in the case of traditional financial instruments) they remain part of the capital structure of the issuing company. Their second characteristic is that they are flexible in the way they generate cash flows and adapt to the needs of the issuer in terms of choosing an acceptable range of risk and rate of return.

Corporate financial products are commonly classified into structured debt instruments (promissory notes or structured bonds) and so-called hybrid instruments.

Hybrid financial instruments are designed to simultaneously use the advantages of equity and debt instruments. A special type of hybrid are convertible products that are capable of converting borrowed funds into common or special equity instruments.

A hybrid instrument combines several components of the issuing company's capital. Some hybrid instruments may also contain derivatives in their structure, but they will relate to other products of the same issuer. Investor profits for hybrid instruments depend on changes in one or more variables that are beyond the control of the issuer, such as fluctuations in exchange rates or commodity prices.

Corporate structured finance products can be classified based on different criteria, as listed in the table below.

Table: Classification of corporate structured products.

| Classification criteria | Types of structured products |

| Main product |

|

| Participation rate |

|

| Capital protection |

|

| Maturity |

|

Non-financial corporations create structured instruments using bonds (for long-term financing) or promissory notes (as short-term debt securities for short- and medium-term financing) as the basis.

Corporate structured products can be based on any assets of the issuing company. In practice, a critical role is played by:

• Equity-linked notes.

• Commodity-linked notes.

• Interest rate-linked notes.

• Currency-linked notes.

It is explained by the convenience of combining the process of capital raising with the process of business risk management, in particular, capital structure risks, interest rate risks, currency risks and commodity price fluctuations.

An example of equity-based structured products are convertible bonds, which give the investor the right to convert the bond into shares of a legal entity other than the company issuing the bond. This product consists of a classic bond with an option to buy shares of another company.

Depending on the terms of the convertible bonds, the stock option may entitle the investor to buy a whole basket of shares or to convert into shares of the issuer's stock if they reach the same value as the other shares.

Another type of structured instrument based on stock market performance is structured bonds, which give an investor a higher return as stock prices rise – these are equity bull notes. In the case of unsecured bull notes, their value increases when stock prices or stock indexes rise and interest rates fall. At maturity, an investor may receive a higher value than par, depending on changes in the relevant indicator and participation rate level.

From an investor's perspective, the safest bonds are secured bull notes, which always guarantee a minimum return at maturity, regardless of market indicator volatility.

In addition to various types of medium-term and short-term bonds, companies can issue complex structured products linked to other instruments. This group includes spread bonds (the investor receives money when the difference in yields of the two underlying instruments exceeds a predetermined value). There are also rainbow bonds (an investor receives money when the yields on several underlying instruments reach a predetermined value).

The second category of corporate structured products is tied to an interest rate. In their case, the nominal value and the interest rate are highly dependent on the volatility of the interest rate.

Among interest rate-based structured products are floating rate notes (FRN), in which interest payments are indexed or combined with a floating reference rate or interest rate index and coupon income is paid semiannually.

The FRN cash flow corresponds to a fixed rate bond linked to an interest rate swap.

From the issuing company's perspective, using a combination of these instruments (bond and swap) may be less costly than a floating-rate bond.

By issuing an FRN, the company can tailor the offering to the needs of investors and attract the structured financing that best fits the current situation.

The company will achieve a similar result by issuing inverse floating rate bonds, where the interest payments to the investor increase as the prime rate decreases (inverse floating rate). In turn, dual-index floating-rate interest bonds (dual-index FRNs) are based on the difference in the two reference rates.

A special type of floating-rate bonds are leveraged instruments.

For these structured instruments, the interest payments to the investor fluctuate more than the changes in the benchmark interest rate.

The pre-determined leverage ratio, which changes the underlying risk as a result of changes in the underlying interest rate, determines the magnitude of the change in interest payments.

Another interesting solution is range/corridor bonds, which allow investors to receive above-market payments as long as the reference index falls below a certain level and remains in a certain range for a certain number of days during the financing period.

Another group of interest rate-based structured finance instruments are so-called index-linked amortizing bonds (IANs), in which the par value is indexed to the interest rate in such a way that an increase in the interest rate leads to a longer maturity.

Large companies whose activities involve exchange rate volatility can incorporate this factor into their structured instruments.

Creating structured instruments based on exchange rates will be especially important for raising capital in foreign markets or in a global market in a currency other than the currency of the issuer.

One example of a structured exchange rate instrument is a dual-currency bond that offers investors interest payments in one currency and redemption of the bond in the other currency at maturity.

Interest is usually paid in the investor's currency and at par value in the issuer's currency.

The structure of these instruments includes bonds with a fixed interest rate in the currency of the issuer and a portfolio of forward contracts to sell the currency of the investor in exchange for the currency of the issuer with maturities corresponding to the interest payment date.

Dual-currency bonds are issued to raise capital in the foreign market at a lower price than would be possible in the domestic market.

Structured instruments of this type allow businesses to take advantage and then adjust the funds received depending on the currency chosen.

Another type of corporate structured instruments are bonds whose face value is indexed to the value of the selected foreign currency (principal exchange rate linked securities, or PERLS, and so-called reverse PERLS). In that case, the interest and the face value are paid in the same currency, but the face value is indexed to the foreign currency value on the maturity date of the bond.

If the foreign currency appreciates relative to the currency of the issuer in which the interest is paid and the debt is redeemed, the investor will receive more than the face value of the bond.

An instrument of this type corresponds to a combination of a fixed-rate bond and a foreign currency forward contract.

PERLS reverse instruments, on the other hand, allow the investor to receive more than face value at maturity if the foreign currency loses value relative to the currency in which payments are made. However, in both structured finance schemes, conditions are imposed to ensure that the face value of the bonds does not fall below a fixed amount.

The last group of corporate structured instruments are bonds linked to commodity prices - mainly the raw materials used for the company's operations. In this case, interest payments and face value can be indexed, and for some bonds, increases in the prices of selected raw materials can lower the interest rate on the debt.

Derivative financial instruments (usually options or option warrants) may act as a separate financial instrument and are settled in cash.

The combination of debt instruments and commodity derivatives is viewed as a balance sheet hedge because the commodity price risk embedded in the company's liabilities is offset by the natural exposure to commodity price risk associated with the company's assets.

Because of this structure, debt service is closely tied to the cash flows generated by the company's operations, meaning that debt increases with the value of the issuing company's assets or revenues.

Using this type of structured financing reduces risk for the investor and lowers the cost of funds raised for the company. Examples of a commodity-based structure are gold warrant bonds, which are a combination of a fixed-rate bond and a portfolio of stand-alone gold warrants.

Attaching warrants to bonds allows a company to lower the interest rates on its debt, and investors are able to take advantage of rising gold prices. At the same time, rising gold prices increase the issuer's revenues, allowing it to cover its growing liability to warrant holders.

An additional advantage for investors is that warrants can be separated from the bonds and sold on their own in the financial market, offering their holders a potentially higher return.

The examples presented show how businesses can create a variety of instruments by using structured financing for large projects or other activities in their financing strategy.

This list of structured products is of course not exhaustive. Modern financial engineering allows the creation of increasingly sophisticated and profitable solutions that are better adapted to the needs of investors, allowing issuing companies to raise significant funds.

LBFL's financial team is available to provide you with detailed financial advice at any time. Contact our representatives to learn more.

Structured finance options for businesses

Regardless of the type of assets on which structured instruments are based, the effect necessarily depends on the results of the operation of issuing classic debt instruments and their placement on the financial market.The most significant opportunities and threats to a company's financial position related to the use of structured finance to raise capital are presented below.

Table: Advantages and risks associated with structured finance.

| Advantages | Disadvantages |

| Access to new groups of investors | Complex mechanism of functioning of structured instruments |

| Flexible formation of the capital structure | The need to attract financial advisors and organizations that distribute the tools. |

| Aligning the cash flows associated with servicing debt with the cash generated from the company's operating activities | Competition for investors from financial institutions with structured finance experience |

| Convenient combination of capital raising activities with risk management | Lack of uniform regulatory standards |

| Synergy effect to reduce transaction costs | Risk of ineffective bond issue |

| Liquidity risk |

Through structuring, the company can align its risk allocation goals (not covered by insurance or hedging) with the needs of investors.

A flexible choice of instruments and payment forms allows companies to combine capital raising with effective risk management, which further reduces the cost of risk transfer.

The use of structured finance in a company's strategy allows it to increase its ability to raise funds from investors who are not interested in buying traditional financial products.

The combination of a traditional debt instrument with derivatives provides a reduction in the costs associated with servicing the debt incurred, resulting in a decrease in the weighted average cost of borrowed capital.

At the same time, the ability to achieve higher rates of return due to anticipated changes in the financial market encourages investors to buy the securities offered, helping the company to accumulate capital that meets its needs.

Combining several financial instruments into one, thanks to the synergistic effect, reduces transaction costs associated with the issuance of these securities and avoids the costs associated with managing derivative financial instruments. It also makes it possible to significantly reduce credit, operational and other risks associated with derivative contracts.

A certain limitation for the development of structured finance may be the very complicated structure of structured instruments. Combined with the low financial awareness of private investors, this may discourage them from buying and, consequently, increase the risk of inefficient issuance.

The complex nature of structured finance requires the involvement of financial institutions, both in terms of financial advice and distribution, resulting in additional costs associated with issuance.

Competition from other companies, especially from large financial institutions offering structured products, is an additional threat. Therefore, companies that want to raise capital by issuing structured instruments should prepare their offerings in such a way that they are accessible and attractive to a wide range of investors.

It is especially important to develop transparent rules for payments to investors (payout formula, prime rate, participation rate), to choose transparent underlying assets or to set a low nominal value for the debt instruments offered.

After a successful issuance for some products, the company may be exposed to liquidity risk if investors decide to withdraw from the project and withdraw funds before a specified deadline. Additional risk may arise on embedded derivatives if changes in the underlying financial parameters are significantly higher than expected.

Thus, structured finance offers companies numerous advantages stemming from the ability to flexibly shape their capital structure and cash flows.

However, their proper application in a company's business financing strategy also requires consideration of numerous potential risks.

Companies seeking to raise capital in the financial marketplace are forced to use innovative financial instruments as a result of increased competition, attracting the attention of investors and encouraging their purchase.

Structured products bring significant benefits to investors and issuing companies.

Today, banks and other financial institutions play a dominant role in the structured finance market, but there are examples of successful non-financial corporations that raise capital by issuing such securities.

If you are interested in structured finance, contact LBFL and discuss the project details with our finance team.

We have extensive experience in large projects around the world, and are ready to use our financing capabilities to help your business grow and develop.