Project finance for medium and large investment project

Link Bridge Financial LTDA LBFL offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

Lack of sufficient collateral means that their financing poses a high risk for banks.

The risk causes the high cost of financing.

Considering the experience of global crises, when making an investment decision, investors not only focus on profitability, but increasingly pay attention to risk, understood as a chance of project failure and loss of invested funds.

Companies that initiate projects are also cautious when choosing potential investors and methods of financing an investment project.

In the case of investments in energy, heavy industry and infrastructure characterized by huge capital expenditures, this choice is key to the success of the entire project.

To more accurately distribute widely understood risks and increase investment potential, advanced models of project finance (PF) and public-private partnerships are actively used today.

Currently, project finance instruments are most applicable to large projects.

This article talks about the basic principles, types, advantages, participants and features of this flexible financial method.

If you would like to know more about our large project financing services, please contact the LBFL finance team at any time.

Our experts are ready to provide you with detailed financial advice.

What is project finance?

Project finance is defined as a method of financing large investment projects that require significant costs.Other definitions can be found in the world literature, as authors argue about whether project finance is a method, formula, concept or form of financing.

This method was known even in Ancient Greece, where long-distance trade expeditions were financed in this way. Project finance was popular in the 19th and 20th centuries. In the United States, the PF has supported mining and oil production for many decades.

Thanks to this method, among other things, the construction of the largest railways in the United States, the construction of the Suez and Panama Canals, the construction of the London Underground, and the Athens airport were carried out.

The term "project finance" has not yet found an equivalent in most European languages.

This is due to the low awareness of the possibilities of financing large projects through this innovative tool. Therefore, in the literature we can find such translations as "financing of investment projects" or "structured finance".

The latter best describes the essence of the PF.

Table: Key features of project finance.

| Features | Short description |

| Founding of SPV | Funding is attracted by a special company, which is an independent legal entity and is created only for the implementation of a specific project with a limited life cycle. |

| Project participants | SPVs are established by reputable and mature companies that have a proven track record in the industry and are able to provide guarantees for a successful project. |

| Financial leverage | High financial leverage and allocation of funds for a legal entity without sufficient assets is most suitable for capital-intensive long-term projects. |

| Limited recourse | The PF assumes limited recourse to the borrower as the SPV will be solely responsible for financial obligations under the project. Initiating companies do not risk their assets if they fail. |

| Self-financing | Self-financing a project means paying off the debt only using the cash flows generated by the project. The creation of such a project in terms of technical, functional and financial parameters is planned so that its operation would make it possible to pay off debts. |

| Distribution of risks | An investment project must meet market requirements. The distribution of risks established by the contractual relationship is optimal for the needs of the participants. |

| Life cycle | A certain (limited) life cycle of an investment project means the need to pay off debts during this period. |

| New projects | Project finance is used to finance new projects rather than existing investments, although existing projects can also be refinanced with project finance. These are often international projects. |

The growing popularity of financing investment projects with a PF can be explained by its numerous advantages.

First of all, strict diversification of risks between all project participants. A feature of project finance is that financial institutions (for example, banks) assume a significant part of the project risk.

It is important to pinpoint the risks and select participants who can control them as effectively as possible. More flexible financing terms can be negotiated with lenders. Repayment terms, interest or schedules of subsequent tranches, loan collateral, debt repayment procedure are also discussed in detail with creditors.

Another advantage of the PF is off-balance sheet debt.

Sponsors separate a project company (SPV) from their assets, whose task is to raise external capital and implement the project. This allows the project initiating companies not to display the debt in their financial statements.

Off-balance sheet financing allows SPVs to obtain much higher loans by avoiding many of the legal constraints stemming from the nature of the loan agreements.

Due to the off-balance sheet nature of the debt, the bankruptcy of SPV does not mean the bankruptcy of the project initiators.

Project finance also has drawbacks.

This is the most time consuming way to finance investment projects. The latter is explained by a complex organizational structure, which includes many subjects connected with each other by numerous agreements and contracts, which increases the time of negotiations and their term.

The cost of project finance is relatively high.

Commercial banks are often skeptical about SPVs, which is a result of the lack of an adequate risk assessment methodology based on PF models.

Additionally, it is necessary to involve a large number of participants, including experienced management personnel, financial advisors and experts, as well as to analyze the profitability and risks of the project associated with high costs. Lenders take more risk and therefore expect a higher rate of return.

Despite the above disadvantages, PF is almost the only opportunity to implement large projects for companies with limited assets.

LBFL finance team will help you weigh the advantages and disadvantages of each financial model, choosing the best way to grow your business.

Project finance participants and their roles

The organization of an investment project financed by the PF method is very complex and requires a clear structure and coordination of the tasks of each participant.Since each investment project is unique, its participants can fulfill many roles, for example, a company can be a lender and a buyer of a finished product at the same time.

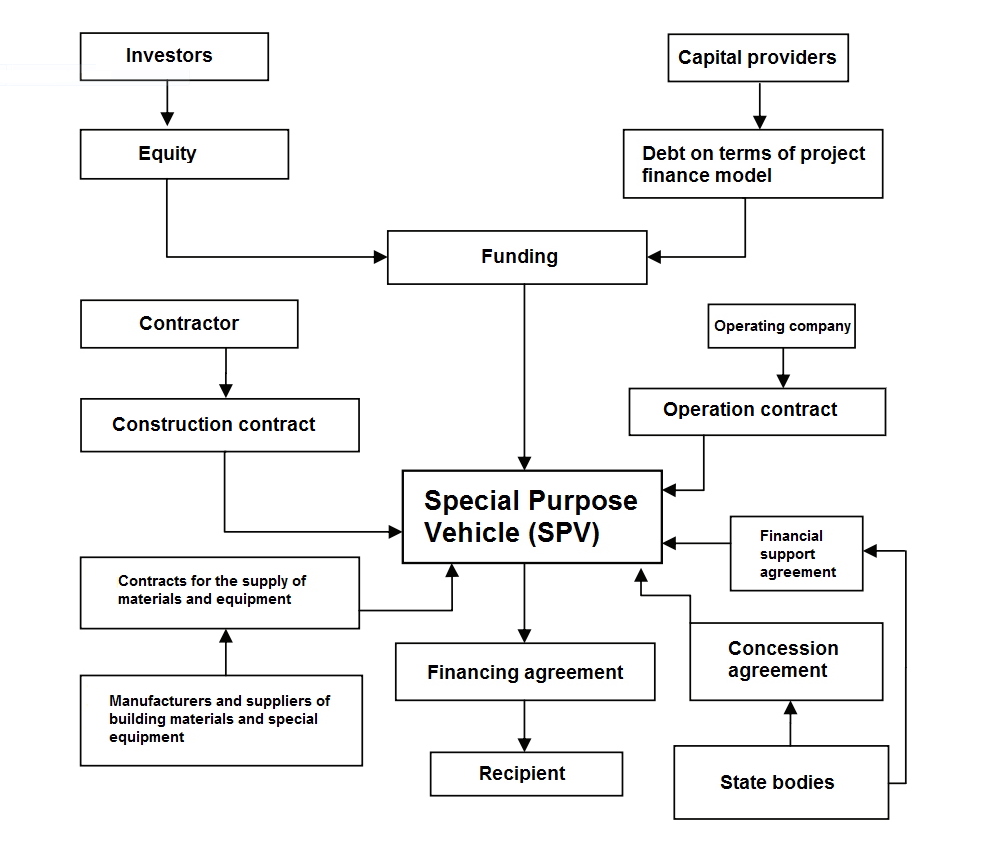

Figure: Basic structure of project finance with its participants.

The first participant in an investment project financed using the PF method is a special purpose vehicle (SPV).

It is an independent legal entity that is created with the participation of national governments, financial companies, sponsors, lenders, international agencies.

The sponsor is the second participant in project finance. This is a subject that provides incentives for the implementation of an investment project. Sponsors create SPV with their capital, transport, technology, land and industry experience.

The next participants are lenders, that is, organizations that offer external capital for the implementation of the project. The lender of the investment project can be its sponsor. This group includes state and commercial banks, leasing companies, investors buying SPV bonds, financial agencies and international institutions.

The state can also participate in project finance.

A ministry, government, agency or state-owned enterprise can participate directly or through concession in projects funded by the PF.

PF participants also include service providers. Their role can be played by other participants in project finance as well as third parties. For example, general contractors who operate on the basis of contracts concluded with a sponsor.

Recipients are an important link in project finance.

Each investment project depends on the demand for the offered product or service (for example, waste recycling or the supply of electricity). In projects financed by this method, demand is most important because lenders and sponsors determine their investments based on projected future cash flows.

If we will look at the PF more broadly, including external consultants, private stakeholders and companies, the list of participants in this scheme becomes much longer. This can eventually cover operating companies, rating agencies, logistics companies, legal advisers, etc.

Table: Project finance participants and their brief description.

| Participants | Brief description |

| Project sponsor | A sponsor in PF is a person or company initiating an investment project. The main functions of the sponsor are project marketing, capital raising, participation in the development of the contract structure, cost optimization, financial participation in the project, as well as assistance in the creation (selection) of the operator and ensuring the commercial use of the newly created infrastructure. The sponsor usually provides land, technology, management services, financial support, business contacts and other necessary tools. Several sponsors can participate in a project, and one sponsor can participate in several projects at the same time, forming a unique investment portfolio. |

| Investors | The task of investors is to provide capital to finance projects in the form of equity, subordinated or debt capital. Investors expect a high return on their investment by earning income from the cash flow generated by the project or by increasing the value of purchased financial instruments and selling them. The investor's goal is to control the project, coordinate development and operation, and optimize taxation. The investor can also be a sponsor. |

| Financial advisors | The range of financial advisers includes state and commercial banks, financial analysts involved in the analysis of the sensitivity of flows, accounting firms involved in international projects, as well as law firms, brokers and others. These project finance participant can remove potential barriers to organizing the financing process and help clients to raise funds. |

| Project finance organizers | Organization of project finance schemes includes the development and negotiation of financing conditions, signing agreements, engineering, financial modeling, coordinating international transactions, etc. The organizer may also be responsible for relations with financial agencies. |

| International financial institutions | Financial agencies and IFIs can participate in the project on the principles of co-financing. They can also provide political risk insurance and support large investment projects in developing countries. |

| Agent | In some cases, a separate company (agent) is responsible for managing the documentation and bank accounts that are associated with the project. This custodial agent may also be the organizer of the financing or one of the participants in the syndicated financing. |

| Lessor | If the structure of project finance includes leasing instruments, then the lessor plays an important role in it. Particular attention should be paid to taxation issues and possible risks that may jeopardize the term of the contract. The goal of the lessor is mainly a high rate of return. |

| Independent experts | Sponsors need to conduct professional research and analysis, which usually requires the involvement of independent experts. This may refer to feasibility studies, market studies, environmental studies, and so on. |

| Legal advisors | The preparation of project finance documentation requires extensive legal knowledge and a deep understanding of the distribution of risks between project participants through various legal instruments. PF is often used for international investments, so the involvement of international legal advisors is highly recommended in such projects. |

| Government | The state (ministry, agency, state or public utility) can also be a participant in the project finance scheme. It can be direct participation and concession instruments. Some projects are regulated by special laws and standards, including international ones, which require the participation of the state. |

| Construction (engineering) company | The construction of the facility is usually carried out by a competent general contractor on the basis of an EPC contract. Under the EPC system, the general contractor is fully responsible for the engineering, procurement and installation of equipment, construction, configuration and preparation of the facility for operation. |

| Operator | The operating company manages the entire infrastructure created as part of an investment project. The operator may be a company associated with the project sponsor or a subsidiary of the sponsor. The latter situation provides the most complete control of the sponsor over the project and ensures that all the actions of the operator correspond to the goals of the sponsor. |

| Insurer | Project finance will usually require insurance. Project implementation and operation insurance packages (project delay insurance, civil liability insurance, environmental pollution insurance, and so on) require analysis in the context of the costs and reliability of the insurer. |

| Suppliers of equipment and materials | Materials and equipment can be supplied on the basis of separate supply contracts. In this context, the capacity of suppliers needs to be assessed to see if they can deliver throughout the construction period. |

| Recipients | A project may have one or more recipients of its products (services). The technical and strategic dependence of the recipient on the product should be analyzed in terms of the loan repayment period and the entire life of the project. Recipients will depend on security of supply, long-term savings, and competitive market advantages. |

| Transport and energy companies | Efficient logistics solutions significantly increase the value of the project for the recipients and make the construction and operation of the facility more reliable. In addition to conventional transport, this also applies to pipelines, power lines and other infrastructure. |

| Rating agencies | The rating agency assesses the ability of sponsors to structure financing. An understanding of the criteria taken into account by the agency is necessary for the preparation of the SPV and project participants. Rating agencies profit from rating reviews, which is prestigious for them. |

Terms and stages of project finance: investment process

Project finance is a broad and multifaceted concept.The specific method of financing will determine the procedure for participants at all stages of the life cycle of an investment project.

The PF cycle is a three-stage process similar to the standard investment process, which includes pre-investment, investment and operational phases.

The first, pre-investment stage, is related to the preparation and provision of financing. The project finance preparation schedule consists of nine key stages, as presented in the table below. The table also contains the time frames of the individual stages, which, if planned well, can be shorter.

However, the preparation of an investment project currently takes from 9-12 months to 2 years or more. If the government and international financial institutions are involved in the PF scheme, the process can be much longer.

Table: Stages and approximate terms of organizing project finance.

| No. | Stage name | Term, months |

| 1 | Market identification and evaluation | 4-6 |

| 2 | Technical (engineering) research | 6-12 |

| 3 | Financial and economic research | 4-6 |

| 4 | Preparing a letter of intent | 2-8 |

| 5 | Obtaining licenses and permits | 2-3 |

| 6 | Creation of a consortium | 3-6 |

| 7 | Preparation of project documentation | 4-18 |

| 8 | Financial closing of the deal | 1-2 |

| 9 | Project management | continuously |

It should be noted that all project finance terms listed are approximate and may vary widely depending on the country, industry and specific project.

For example, obtaining official permits and licensing in developing countries usually presents significant difficulties, especially when it comes to mining and processing of minerals and environmentally hazardous projects. Such factors as corruption, bureaucracy and imperfect legislation can significantly affect the timing of the project.

Search for investment projects

The path to financing begins with the search and selection of the most promising projects by potential investors.Investors are constantly looking for projects and receive information about potential projects from sponsors seeking funding. Mature institutional investors hire experienced teams who evaluate investment opportunities professionally. Such teams are able to filter hundreds of projects within a month.

Selected projects undergo further comprehensive analysis. At the stages of technical and financial analysis, the range of projects is narrowed. A set of engineering decisions that determine capital and operating costs, which, along with the parameters of economic efficiency and other criteria for selecting a project, leads to the selection of the optimal project or its variant.

As a rule, the investment recommendation is based on an analysis that assumes 100% external funding.

Then the project is broken down into several options and analyzed in terms of capital structure and risk distribution among the participants.

Capital raising

Raising funds to finance a large project usually takes the form of a letter of intent, which specifies the funding structure.Before signing agreements within the framework of the project finance organization, these proposals are subject to a comprehensive professional assessment. Then the representative of the company will continue the preparation of project documentation.

This work will include, in addition to technical and financial analyses, the preparation of an information memorandum and obtaining the necessary permits.

The financial closing of the transaction is associated with the receipt of financing (credit funds).

Financing is provided in stages, under the strict control of banks. In some cases, all funds can be immediately made available to the investor, but usually financing is carried out in the form of several tranches, requiring certain conditions to be met and milestones to be reached.

Implementation of the project from idea to operating business

Cooperation with the lender ends with the commissioning of the facility.The parties must confirm that the project was completed on time and is capable of generating profits in line with previous forecasts. Until this is confirmed, the organizer will bear the additional costs associated with the delay and the incomplete compliance of the project with the agreed characteristics.

When the implementation of the project is confirmed by the parties, the process takes the form of classical project finance.

During the operation stage, the cash flows of the project serve as the only source of loan repayment.

The completion of the investment process in project finance is associated with the complete termination of the conditions specified in the statutory documents of the SPV. In this context, we can talk about the early termination of the project by terminating the agreement (for example, in case of critical violations of the terms of the agreement).

Capital structure in project finance

Sources of capital for project finance are relatively limited.It is difficult for new companies created to implement an investment project to obtain a high credit rating for a successful issue of securities in the capital market. Access to the capital market can be obtained if investors attract reliable partners with high creditworthiness and ensure their participation at all stages of the project.

The main sources of capital in project finance are own, subordinated debt and borrowed capital, each of which has its own advantages and limitations in practical use.

The specific risk and expected return of a particular project are closely related to the capital structure used.

Special Purpose Vehicle (SPV) capital consists of funds contributed by all participants that are in any way connected with and contribute to the project. Against this background, it is difficult to talk about equity or borrowed capital in its pure form.

Equity

Internal resources contributed by the company's shareholders often form the basis for further financing of the project.Equity means a kind of safety cushion for creditors.

The level of equity in project finance should be balanced, as a high share of loan liabilities in cash flow may prevent debt repayment. The optimal share of equity, determined based on the profitability of the project and the scale of the assessed risk, should ensure smooth debt servicing.

A significant share of equity in the structure of the project is a guarantee of the involvement of shareholders in the project, being responsible for their motivation and interest. Typically, the share of equity in total project costs ranges from 10 to 50%.

Link Bridge Financial LTDA LBFL offers its clients financing up to 90% of the investment costs of the project, which means the minimum financial participation of the initiators.

Subordinated capital

The main feature of subordinated capital is the contractual subordination to the payment of principal.This character of capital may apply to shareholders, civil works contractors, future partners, commercial banks or other entities associated with investments.

The only source of repayment of such debt is the financial flow generated by the project, reduced by the repayment of the main obligations. Examples of this type of financing are preferred shares and subordinated loans. Subordinated capital can enhance the creditworthiness of the project company as it can be treated as equity for the purposes of calculating debt ratios. It is a much more flexible instrument than equity or pure debt.

A variation of indirect project financing is mezzanine financing.

This is a type of debt capital that carries a high risk. The issue of debt securities, characteristic of this type of financing, is usually combined with a conversion option into shares or an additional right to purchase shares, the so-called warrant.

Borrowed capital

The share of "pure" borrowed capital (the so-called senior debt) in project finance can range from 50 to 90%.This capital is preferred in relation to all other debt obligations of the project company.

Large projects are usually financed by a group of lenders within a consortium or independently from several sources. Insurance companies and pension funds often provide funds for a long period of up to 20 years, while most commercial banks offer loans for an average of 10-15 years.

Link Bridge Financial LTDA LBFL offers financing from 10 million euros and even more for a period of 15-20 years, depending on the financial needs of a particular project. Contact our representatives to find out more.

Project finance risk management

The problem of classifying and allocating risks in project finance is complex.Currently, there is no single universal risk sharing scheme. Most often, such groups are distinguished as economic risk, technical risk and other risks.

The PF assumes the optimal distribution of risks between the participants in order to ensure the most efficient and safe implementation of the investment project. At the same time, an important role is assigned to economic risks, including market and financing source risks, collateral and management risks.

The risk of funding sources lies in the inability to obtain the funds necessary for the implementation of the project. It is important to minimize this risk, therefore the initiators of the project seek to obtain certain guarantees from the project participants, independent insurance companies and financial institutions.

The project feasibility study should include detailed risk identification and analysis.

The risk of funding sources can be mitigated by carefully assessing the financial health of potential investors.

Another way to minimize this risk is to conclude binding agreements (guarantees) with future investors at the pre-investment stage. For example, get a bank guarantee for a loan in full and adjust the loan repayment in accordance with the schedule of the investment project.

Along with the risk of funding sources, mention should be made of macroeconomic risk.

These include exchange rate risk, interest rate risk and inflation risk.

Hedging instruments for this risk include forward and futures contracts, interest rate swaps and interest rate limits, an index-based pricing system and government guarantees.

Collateral risk is a typical credit risk.

In the case of projects implemented using PF instruments, it is important to determine the project's ability to repay debt through projected future cash flows.

In project finance, SPV assets are a secondary element of collateral and usually their value is not enough to cover the debt to the bank.

This is due not only to the formula for financing the project, but also to the low selling price of this property and high specialization (suitability for certain purposes).

The actual value of the assets is usually less than the funds provided, and investors have concerns about its future value. There are tangible assets that are easier to sell, such as equipment, machinery, fuel, raw materials, and cash.

However, if the project fails, its assets are practically devalued.

A decrease in the value of project assets can be caused by the economic situation (changes in indicators such as GDP, unemployment, inflation) or instability of commercial law.

To mitigate this risk, project participants can use the services of a reputable law firm, which will be responsible for the preparation of contracts. Adequate collateral assessment is an important risk mitigation tool.

The last type of economic risk is management risk

The main reasons for this risk are poor work organization and production process, poorly qualified managers, poor work efficiency, cultural or communication barriers, equipment malfunction, improper storage of fuel and building materials.

These factors contribute to a reduction in production, a decrease in the quality of products or services provided, interruptions in construction, an increase in operating costs, which, in turn, causes financial difficulties.

The way to mitigate this risk is to monitor financial statements and prepare appropriate documentation for an investment project.

Choosing the right operator is also important.

Lenders, when investing in an enterprise at an early stage, often pay the most attention to the qualifications and achievements of management personnel.

Consequently, they place great emphasis on the selection of the operator, who must have personnel with extensive knowledge and experience in managing such projects. It would also be advisable to conduct an analysis of the local labor market, through which the qualifications of potential employees can be determined. This allows you to prepare in advance and conduct a training program that will improve the qualifications of future employees and, thereby, reduce the management risks of the investment project.

On the other hand, insurance of machinery and equipment, which will cover lost profits due to equipment breakdown, will reduce the remaining risks of the project.

Banks may also require sponsors to set up a special fund to collect all financial surpluses generated by the project. This fund must guarantee the payment of the debt, and will also motivate sponsors to manage the company as efficiently as possible.

Project finance for large investment projects

A characteristic feature of project finance is the way in which funds are raised.In the case of a traditional bank loan, the borrower's ability to service the debt is critical to providing financing.

Project finance is based on an analysis of the profitability of potential investments, depending on the future cash flow of the project.

In other words, the debt on the PF is repaid only at the expense of cash flows generated after the implementation of the project. Lenders look to future income, not the value of the initiator's assets.

Compared to a bank loan, project finance offers much more flexibility, since the terms of debt repayment and the amount of payments are clearly aligned with the cash flow schedule of the investment project. For example, payments may be deferred and payment amounts change over time. In the case of a traditional loan, the repayment terms do not change, and the payments remain the same (annuity model).

An important feature of project finance is the presence of an independent legal entity, which is separate from the structures of the initiators of the investment project.

This company is created to implement a specific project for a certain period of time (Special Purpose Vehicle, SPV).

After the completion of the investment project and the repayment of the debt, this company usually closes.

Project sponsors, who, being the beneficiaries, are most interested in the implementation of the project. Sponsors set up an SPV and are responsible for contributing share capital. They use their professional experience to successfully build and commission a facility.

There are many benefits to using an SPV that comes from decoupling the project from the initiator's assets.

Cash flows used to implement a large investment project are not related to other investments.

Thus, project finance does not depend on the financial health of individual project participants. SPV is a separate legal entity, therefore the initiators are not fully responsible for the risk of the project with their own assets.

Using an SPV means that project proponents can get more investment than traditional external funding. If the project fails, the off-balance sheet nature of the project finance debt protects the initiators from bankruptcy.

In project finance, risk sharing between participants is part of the agreement of the initiators of the investment.

This means that each party assumes only the level of risk that is acceptable to it.

To minimize their risk, initiators and lenders can delegate appropriate actions to third parties.

General contractors in project finance are responsible for planning, engineering and construction. They provide the tools you need to get your project up and running. The group of contractors usually includes large engineering companies specializing in the implementation of specific energy, industrial, infrastructure or other projects, with specialized equipment and qualified personnel (construction concerns).

A contractor who claims to finance a project becomes more attractive compared to other potential contractors.

Contractors must provide a guarantee that the investment project will be implemented in a certain form within the agreed time frame and cost.

Government structures are also often involved in project finance, creating a favorable legal and economic environment for the implementation of large investment projects. The quality of this environment determines the profitability and success of a given investment plan.

To start activities related to the implementation of the project, different types of permits and licenses are required, which are issued by government agencies.

An important factor influencing an investment project is the tax policy of a particular country. In this respect, regulations concerning labor law and environmental protection are also important. By creating appropriate conditions and supporting investments, the state becomes an active participant in the project.

Despite the many advantages, the implementation of large investment projects using PF has some disadvantages.

First of all, the preparatory stage of the project is expensive, and especially high costs are associated with conducting pre-investment research (financial, tax, legal).

International investment consulting company LBFL has extensive experience in financing large projects in Europe, Latin America, Africa, East Asia and the Middle East.

If you need a reliable partner and advisor, please contact us.