International financing of investment business projects

Link Bridge Financial LTDA LBFL offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

They are a key factor in carrying out business activities, improving product quality, reducing costs and ensuring the competitiveness of a modern enterprise.

Investment financing at the global level can influence the gross domestic product of entire countries, reduce unemployment and ensure macroeconomic equilibrium.

Finally, economic growth is achieved by investing in specific activities.

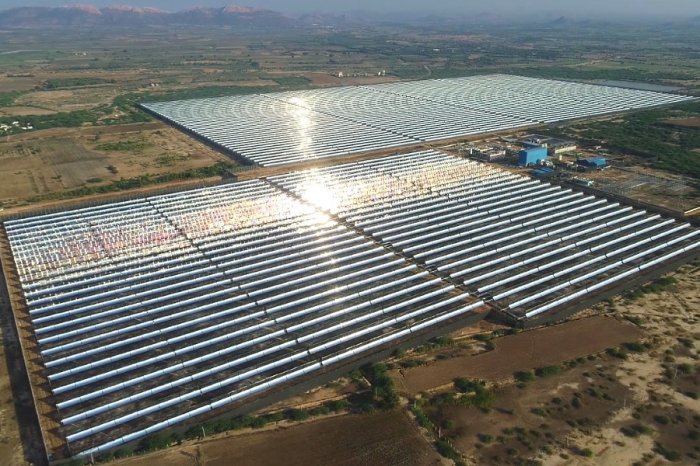

Investments in promising new facilities such as solar power plants, wind farms or waste processing plants provide the investor with substantial income and capital gains over the long term.

A feature of any investment is its return to the investor in an increased amount.

At the same time, the potential return on investment should correspond to the risk of a particular project.

The success of an investment depends on many factors: the economic situation, the efficiency of markets, access to capital, knowledge and skills for investing, and much more.

All other things being equal, knowledge and skills are crucial for finding successful investment ideas, developing them, evaluating and comparing investment alternatives.

Investment financing and project management is a serious challenge for companies that are implementing large projects these days. Sources of low-cost funds are essential for ensuring the efficiency and quality of projects in such economic sectors as renewable energy, infrastructure, environmental protection, industry and agriculture.

The company LBFL offers financing of investment projects around the world.

We provide a wide range of services, including financial modeling, obtaining loans from the largest European banks on favorable terms, guaranteeing financing, etc.

The project financing schemes we develop allow companies to implement large projects with a minimum contribution of the initiator (up to 10%).

Contact us to find out more.

Investment financing: principles and options

The nature of the project and the conditions for its implementation determine the choice of instruments and sources of financing for the investment project.External funding sources can be private or public partners.

The state usually provides funds for the implementation of socially significant projects from the national and local budgets.

The most commonly used investment financing options are bank loans and loans from international financial institutions, syndicated loans, bonds, hybrid securities and others. Partners can be banks, corporate and private investors, international financial institutions and others. Grants from European foundations and international programs are also an important source of long-term financing for projects in the European Union.

Factors influencing the choice of financing options:

• Risks. It is important from the very beginning of a project to clearly assign responsibility for its success or failure.

• Financing as a package of services. The provision of comprehensive services related to the allocation of money, construction, equipment supply and operation of a new facility can be carried out by one large company.

• Benefits for the funder. Lending involves the payment of interest. If investors finance a specific project, they expect a certain return.

• The right time for financing in the context of the life cycle of the company and the specific investment project.

• The technical level of the companies participating in the project.

Investment financing is based on several basic principles, including the principle of division of competences, the principle of equality of participants, the principle of additional financing, the principle of reasonable concentration of funds, and some others. We propose to consider the listed principles in more detail.

Table: Basic principles of investment financing.

| Basic principles | Short description |

| Separation of competences | Within certain limits, funding from centralized and decentralized sources depends on specific goals, priorities, criteria and requirements. |

| Equality of the participants | Investment financing is necessarily carried out on the basis of common criteria, formal requirements and restrictions, which are the same for all interested parties. |

| Additional funding | When providing financial resources, the requirement for additional funding to support project implementation is met. Its essence lies in the broad possibilities of providing additional funds in the event of unforeseen obstacles. |

| Reasonable concentration of resources | An investment project recognized by an investor as the most suitable in terms of financing usually has an advantage over other projects for accelerated completion and commissioning. |

There are also various classifications of sources of financing for investment projects.

Depending on the origin, funds are internal and external (the latter received from banks, investment funds or other partners).

Based on the organizational structure, all sources of funding can be divided into centralized and decentralized. In most cases, large energy and infrastructure projects are funded from a variety of sources.

Sources of financing for investment business projects

External financing instruments for investment projects are widely used at different stages of development.In a broad sense, they are divided into several large groups:

• Debt financing.

• Equity financing.

• Public funding.

Debt financing is a flexible and rather attractive way of providing the necessary financial resources for the implementation of projects.

Debt financing is allocated from resources collected in financial markets, such as bank loans, syndicated loans or bond issues.

Examples of major global financial institutions that finance investment projects include JPMorgan Chase, Goldman Sachs and Deutsche Bank. Our company works closely with reputable banks in Spain and other EU countries to provide you with the best investment financing options for each project.

Table: Types of debt financing for investment projects.

| Financing source | Advantages | Disadvantages |

| Collateralized bank loan | Easy to obtain with collateral. The company retains ownership of its assets and all profits from the business. Attractive when the risk of bankruptcy is assessed as low. | If there is no suitable collateral, practical implementation is impossible. There is a risk of losing assets. Often, loans come with hidden costs that add to the cost of the project. Banks do not share any of the company's financial risks. |

| Unsecured loan from friends | An attractive and affordable option when the risk of failure of a particular investment project is assessed as very low. | Not applicable for large projects. Relatives and friends may feel pressure that will affect personal relationships. |

| Leasing | Reduced investment costs. There are many financial products on offer. Leasing can be used to improve financial performance. | The overall costs are significantly higher compared to many other investment financing options. |

| Crowdfunding | Easily reaches investors, especially for small and promising projects. | Professional support is required to collect the entire required amount. This concept limits the number of potential investors. A powerful informational impact is required. |

| Bonds | It is easy to get financing if the company has assets. Possibility to receive funds at lower interest rates compared to banks. Issuing bonds extends the financial cycle. | It is difficult to achieve sufficiently low interest rates. |

Lending for investment projects is based on several principles, such as profitability, maturity, solvency, security and target nature of the loan.

Loan documentation includes an agreement that establishes the basic conditions (cost of the loan, loan term, ways of using money, repayment, guarantees, measures in case of unfair fulfillment of obligations by the parties, and so on).

There are different classifications of loans and their application varies from case to case. Depending on the scale of investment projects, we distinguish between short-term and long-term loans. Short-term loans are used to cover recurrent costs during project approval, to raise funds to finance the entire cost of a project or to implement specific stages of a project.

For long-term loans, usually provided by international financial institutions, they are most often provided to governments or against government guarantees.

Syndicated bank lending is practiced due to the high cost of some projects. Depending on the nature of the project, loans can be provided without collateral or with limited collateral.

Usually the obligations of the parties depend on the stage of the investment project. During the construction phase, when costs are highest and the project is not yet generating cash flows, the risk for lenders is high. This usually requires guarantees of fulfillment of obligations, including those provided by third parties. In some cases, during the operational phase, when income is generated, guarantees may be optional.

Bonds are a typical investment financing instrument.

Bonds are long-term securities issued by the government, local authorities, banks, financial institutions and companies. Bonds can be seen as a form of long term loans.

Bonds can be issued at a fixed or floating interest rate, which is charged on the par value of the bond. For each bond, there is a risk of non-payment due to the inability to receive the interest and principal amount. The main parameters that determine the adequacy of financing through bonded loans are the scale and useful life of the project, the cost of financing and the repayment profile. These parameters need to be compared with those of bank lending to determine which investment financing option is best suited for a particular project.

Bond loans are an alternative source of financing for investment projects.

It is most relevant for large multi-billion dollar projects for which the banking sector does not offer sufficient liquidity.

A number of energy, environmental and infrastructure projects are funded through bond issues, and timely interest and principal payments are usually guaranteed by insurance companies. The main role of the latter is to provide credit guarantees to bondholders. As a result of the provision of a guarantee, bonds receive a high credit rating, which reduces the cost of borrowed funds for business.

An attractive feature of the bond market is the wide availability of long-term financing.

This not only makes the implementation of projects cheaper compared to bank financing, but also makes it possible to extend the maturity of the project debt, which, in turn, significantly improves the economic performance of the project.

On the other hand, bond financing also has several disadvantages. Bondholders have certain powers, although they may not touch upon such issues as significant changes in the project schedule, documentation, etc. The entire amount is provided to the investor only upon approval of the project contract and accompanying documentation. In some cases, the last condition does not satisfy the recipient.

Regardless of the financial instruments used, debt financing of investment projects has a number of advantages.

It makes it possible to quickly launch large projects with strong financial plans and shift some of the debt burden to future users of the product or service.

It is also necessary to take into account the disadvantages of debt financing of investments. One of them is a long period of interest payments, which can be up to 15 years or more. The ability of business to react flexibly to changes in economic conditions, political priorities, income levels and other factors is extremely limited in this case.

Equity financing is the sale of a company's assets or shares.

The owners of the enterprise give away part of the business in exchange for financing the activity.

Table: Types of equity financing for investment projects.

| Financing source | Advantages | Disadvantages |

| Company resources | A good source of funds for companies with sufficient profits. Own funds accumulated by the owners are used to finance the project. | If the project fails, not only the company, but also some of the owners can go bankrupt. |

| Strategic (corporate) investor | Such an investor has know-how, business contacts and market knowledge. The recipient of the financing can dramatically improve the basic performance of the business. | The risk of losing control over the business. Difficult process of attracting an investor. Slowing down the introduction of new developments and business entry into new markets. |

| Business angels | Know-how and professional experience. This financing option is most suitable for the early stage of the business, so the experience of business angels is an important advantage. A business angel can attract other investors or a strategic partner. | Finding a business angel can take a long time. A business angel invests in projects with good financial prospects. At a certain stage, the recipient may have disagreements with the ambitious and experienced investor. |

| Venture capital | Optimal source of financing for medium-sized investment projects (usually several million euros). Sharing financial risk. An easy choice for promising new projects. | Venture funds are looking for projects in the early stages of development. Careful verification required. Venture funds are experienced in increasing the value of their investments. Some funds have a narrow focus and early exit strategy. |

Benefits of project finance for business

In developed countries, project finance is widely used to implement large investment projects.This option for financing long-term projects (energy, transport, environment), as well as projects in the field of public services, is based on a financial model without collateral with the repayment of debt from the future cash flows of the project.

Project finance offers investors, lenders and other stakeholders the opportunity to allocate costs, benefits and risks in an economically feasible manner by choosing and applying specific financial instruments used for a strictly defined purpose.

The benefits of project finance that differentiate it from traditional corporate finance can be summarized as follows:

• The investor finances the entire project, focusing on cash flows after the start of operation of the finished facility, and not on the existing assets of the initiator of the project.

• Project finance is based on a complex contractual framework involving a series of interrelated contracts with third parties (suppliers, customers and government agencies) that are essential for the provision of funds.

• Refunds are guaranteed by income from the operation of the facility in accordance with the terms of the signed contracts.

• Investors rely on an impeccable, well-thought-out contractual framework to ensure that risks and uncertainties are minimized.

Project finance also has certain disadvantages associated with complex and long-term actions to develop a financial package and high costs of these activities.

Also, this model is characterized by the presence of numerous risks arising from a large number of contractual relationships. Project finance is associated with high interest and debt service fees, additional regulatory procedures with varying impact on the investment project as a whole.

The international company LBFL can act as your financial partner in the implementation of large projects in Europe, Latin America, Africa, the Middle East or East Asia.

We are ready to provide investment financing on optimal terms, as well as offer you a full range of consulting and engineering services at any stage of the project.