To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Currently, the investment needs of companies when planning such projects can easily exceed 10-15 million euros, depending on the type of facility.

Energy companies require significant debt capital to finance the construction of electrical substations and transmission lines.

One of the reasons for the current problems in this sector is the total obsolescence of the electrical infrastructure, the average age of which in many developing countries has already exceeded 30 years.

Attracting large investors and gaining access to long-term sources of debt financing (including on the international capital market) plays an important role in the expansion and modernization of distribution grids in a market economy.

The development of an optimal financial model for an electrical substation in this context becomes more and more important, as structured long-term plans increase the interest of potential investors and lenders in these long-term projects.

When it comes to long-term financing of the construction of electrical substations, companies pay special attention to instruments such as placing bonds on the local or international market, issuing shares or long-term bank loans (including large syndicated loans of up to tens of millions of euros). These financial instruments can be structured based on the future cash flow of investors and appear to be the most viable alternative for financing electricity transmission and transformation projects.

Link Bridge Financial LTDA LBFL offers comprehensive financial services for large businesses, including attracting long-term financing for electrical infrastructure projects.

We are always ready to provide customers with professional advice on financial modeling of electrical substations and other services to contribute to the long-term success of ambitious projects.

Development of financial models of electrical substations

The main long-term goals of the company in the context of the construction of the substation and other electrical infrastructure are to maximize business value and ensure the stability of energy supply.Achieving these goals requires proper planning, financial modeling and project budgeting.

The creation of a financial model of an electrical substation allows the financial team to check the feasibility of the goals set at the earliest stages and more accurately assess the economic effect of investments. The financial model also indicates alternative ways of implementing the project, helping to select the most appropriate sources of capital.

Table: Development of a financial model of an electrical substation.

| Model elements | Short description |

| Electrical substation financial model concept | When developing the general concept of the financial model, the business model is refined, which can significantly affect all subsequent stages and calculations. The basis for making decisions will be the assessment of investment costs. |

| Investment costs, including the cost of research and development, the purchase of equipment. | Since modern electrical substations are technically complex facilities, the construction of substations is associated with the widespread use of advanced technologies, expensive equipment and know-how. This part of the financial model is closely related to capital expenditures, R&D costs, asset sale values, and estimated depreciation rates. This also includes the costs of licensing, project approval, staff training etc. |

| Potential income after substation launch | This element of the financial model requires taking into account the potential income from the sale of electricity to end users in the case of an energy company. It is also important to take into account the direct benefits of consumer plants from starting their own substation (if the project is financed by a large consumer such as a chemical plant or a mining and processing plant). |

| Project profitability | To determine the profitability of each project, it is necessary to comprehensively consider all the potential income and costs of its implementation. As a result of this analysis, the participants will receive a reasonable forecast of the project's profitability over a certain time horizon and the planned margin. |

| Project financing, capital structure and fundraising schedule | This part of the financial model allows us to consider such financing instruments as grants, long-term bank loans, leasing and other instruments. Experts should take into account such variables as the cost of financing, interest rates, scheduling of financing and debt repayment, etc. |

The basis for the success of the project is the experience of the financial team, the accuracy of the risk assessment of the financial plan and a clear understanding of the essence of the project budgeting processes.

One of the main steps prior to executing a financial model is to analyze the market and identify key assumptions in the prepared financial model. In the case of financing electrical substations, this step should take into account the specifics of energy projects. In certain cases, substations are built to meet the needs of a large industrial consumer (for example, a metallurgical plant), so the analysis should include a number of business-specific factors.

The next step is to determine the operating costs that project participants can directly or indirectly influence.

In this case, it is important to know the business of the consumer plant and even obtain information from closed sources.

The financial team must estimate with acceptable accuracy the investment costs that the project participants will incur for the acquisition of fixed assets and intangible assets, as well as determine the sources of financing for these costs.

One of the most difficult tasks is drawing up a financial balance sheet and forecasting future income from the operation of the substation. To achieve this goal, in addition to the above information, market analysis and scenario analysis will be required.

Capital structure in the financial model of an electrical substation

What is more suitable for an energy company: to finance the construction of a substation from internal resources or to attract external financing?Both options have advantages and disadvantages that participants need to be aware of in order to make rational decisions.

The financial goal of any business is achieved by creating an optimal financial structure that minimizes the cost of capital. To achieve this, it is important to evaluate the various assets that the company can acquire and decide on the development of the asset that has the greatest impact on the value of the business. This rule also applies to the energy sector, where commercial interests often intertwine or even conflict with the priorities of the state and society.

It should be remembered that any decisions are made on the basis of assumptions about events that may occur in the distant future.

In other words, financial decisions are made under conditions of risk or uncertainty. This places high demands on the financial model of the electrical substation, which must be professionally organized and based on objective financial information.

The principle of economics states that the main goal of a business is to satisfy the needs of people, or consumers.

Economic systems, including businesses and governments, are called upon to strive to achieve this goal. The problem is that a significant part of financial resources comes in the form of borrowed capital. This requires making the right decisions and the right capital raising strategy to achieve the goals.

There are various sources of financing for electrical substations:

• Internal resources of the companies participating in the project.

• Interest-free loans to a large consumer directly interested in the project.

• Large banks, international financial institutions and / or credit unions.

• National or international capital market.

• State and local budgets.

The capital structure plays a critical role in guiding the future development of a project and setting a certain financial framework for it.

The cost of capital, the ability to attract resources according to the construction schedule and adequate conditions for the return of borrowed funds; all this should be taken into account at the early stages of the project.

The role of the cost of capital in the choice of the financial structure

The cost of capital expresses the financial capacity of a project and usually takes into account the rate of return when assessing the economic efficiency of investment projects.Thus, the concept of the cost of capital is closely related to the expectations of lenders and investors. Investment decisions and capital structure depend on these expectations. The higher the risk associated with the project, the higher the expectations of the investors (the higher the cost of capital).

A particular asset is worth investing in a project if it sufficiently increases the bottom line for the owners or increases the market value of the business.

It can be assumed that there is a level of debt (financial risk) that is accepted by both managers and capital providers.

If the company does not increase the debt / risk above this level, then the efficiently used capital will increase the value of the business.

A basic economic principle should be taken into account when creating a financial model for a substation and developing project financing plans. After exceeding the level of safe debt, the cost of external capital increases significantly, which also increases the risk of the project and the weighted average cost of capital. Along with an increase in risk, an inevitable decrease in business value will follow.

Equity cost

The cost of equity is determined based on the return on the risk-free securities plus the risk premium.This approach uses the concept of opportunity costs.

Each capital provider choosing investment targets must resolve the dilemma of determining the marginal rate of return on investment.

On the one hand, the capital provider can invest in risk-free financial instruments (bonds, treasury bills, bank deposit). On the other hand, he can invest in more risky investment projects such as the construction of an electrical substation or the development of power distribution networks.

Since all commercial activities involve a certain risk, the investor will expect a higher return than the return on risk-free instruments.

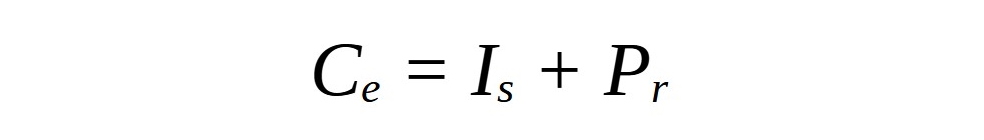

The cost of equity can be represented as follows:

Ce – the cost of equity;

Is – the interest rate on risk-free securities;

Pr – the risk premium expected by the capital provider.

A problematic issue in determining the cost of equity in a financial model is the assessment of the risk premium.

In different countries and industries, it varies in a wide range, depending on the financial health of the company, the state of the industry and development prospects, the current situation on the securities market and many other factors.

Cost of borrowed capital

Almost every large energy company uses borrowed capital to finance its investment activities.Funding for capital-intensive construction of electrical substations and transmission lines is no exception. The cost of external capital varies depending on the type of external source of funding.

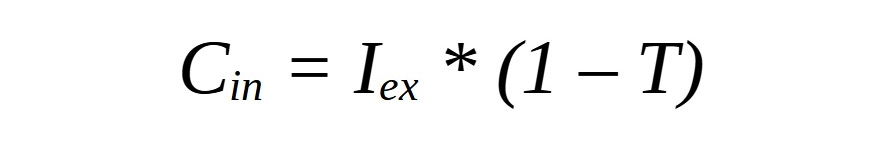

For example, the cost of a bank loan can be estimated as follows:

Cin – the cost of external or borrowed capital;

Iex – the interest rate on a loan or other instrument;

T – the income tax rate.

This formula is based on the fact that the interest on the borrowed capital is written off to finance costs, which are deducted from the tax base. Thus, they cut taxes, creating a so-called tax shield for the future energy project and providing additional benefits for its participants.

Companies benefit from a tax shield in the following cases:

• The project is considered profitable overall.

• Project participants do not initially enjoy tax benefits.

Bank loans, even in developing countries, where the interest rate on loans is much higher than in Western Europe or the United States, is a relatively cheap source of financing. Moreover, the use of the tax shield effect creates additional opportunities for reducing costs.

Weighted average cost of capital

Most companies in the energy sector finance their activities using different types of capital for this purpose, each of which has a different cost.Thus, a specific financial model of an electrical substation can be based on a unique capital structure, selected taking into account the parameters of the given project.

The growing global trend of diversification of funding sources has led to the emergence of the concept of assessing the cost of capital, taking into account both equity and external capital.

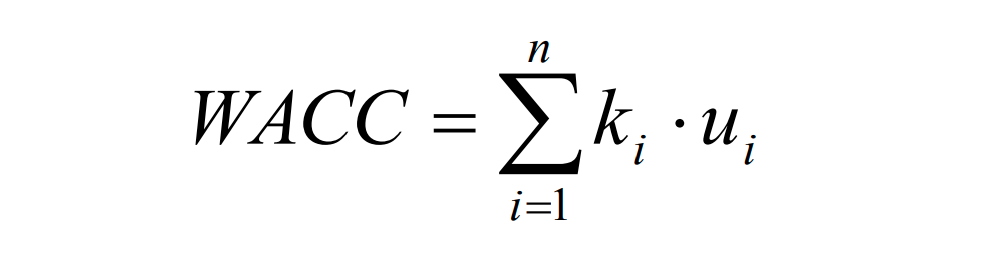

The total cost of capital, called the weighted average cost of capital, is calculated as the average cost of these funds, weighted by their share in the capital of a particular company or a particular energy project:

WACC – the weighted average cost of capital;

ki – the capital costs from the i-th source incurred within the framework of this project;

ui – the share of capital from the i-th source in the total capital of the project.

If the costs for certain types of capital are determined, the calculation of the average cost of capital is not difficult. Despite its simplicity, the weighted average cost of capital is a parameter of critical importance for any energy project with a diversified capital structure. This directly affects the cost of the project.

If you are looking for affordable sources of financing for an electrical substation project and other electrical infrastructure in the EU and beyond, contact an Link Bridge Financial LTDA LBFL representative and outline your plans.

We are ready to offer long-term financing on flexible terms.

Our financial modeling and budgeting services

Financial modeling is one of the most important areas of financial services for modern business.Professional matching of expenses and incomes of a future project in the form of an electronic model increases the reliability of future investments and increases investor interest in a specific project.

Link Bridge Financial LTDA LBFL has assembled a team of professional financiers with over 20 years of experience in various areas of business finance.

Our business offerings include, but are not limited to:

• Development of a personalized tool for analyzing your investment project, including a financial model based on objective data.

• Comprehensive assistance to your team for making the most profitable decisions and choosing the best way to develop your project.

• Legal and financial support of projects, including negotiating, obtaining official permits and licenses, searching for contractors.

• Assistance in finding and obtaining long-term financing in the EU and abroad.

Over the years, our team has successfully helped implement ambitious projects in the energy sector, mining and processing of minerals, the chemical industry, the oil and gas sector, mechanical engineering, real estate and tourism. Now the geography of our services covers almost the whole world with many projects in Spain, Germany, France, South Africa, Saudi Arabia, Egypt, Morocco, Mexico, Argentina, Brazil and other countries.

Contact us and schedule a free consultation at a convenient time to learn more about our advantages.