Investment Project Financing

Financing of Investment Projects and Businesses

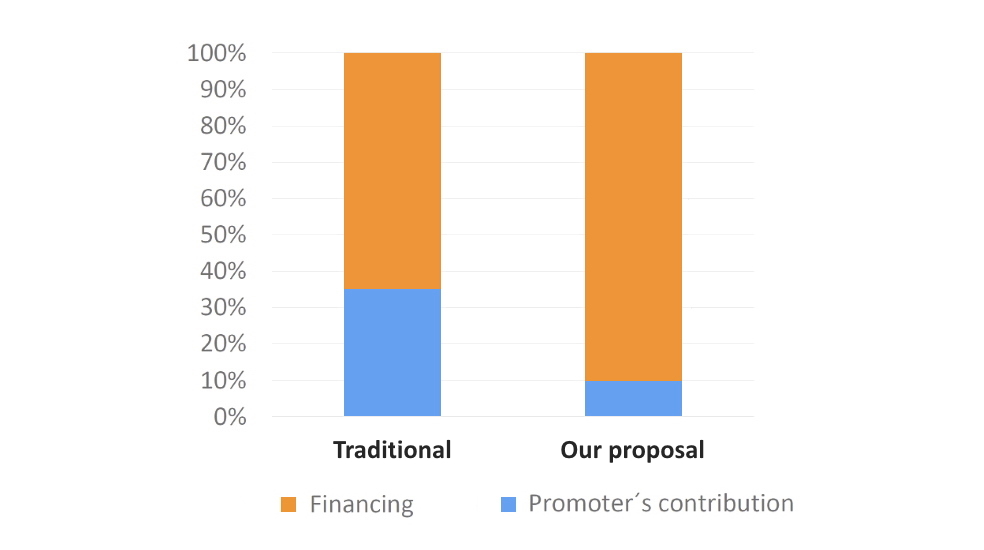

1. Link Bridge Financial LTDA LBFL offers financing with a minimum contribution of the Project Initiator (Promoter) for any industries: energy, mining, chemical wastes, industrial, agriculture, machinery, infrastructure, logistics, real estate, tourism etc.Proposed funding: from $ /€ 5 million or equivalent and more.

Loan duration: from 10 to 20 years.

To consider Your application, please provide us with a brief description of Your investment or business project, fill out the form and send it to us by e-mail (download the application form).

Please note: if the client does not have liquid assets, the application will not be processed.

We employ top-level professionals and asset managers who study every specific case providing a financial solution that allows the Promoter to finance the project in the long term with the minimum possible contribution.

Equity is replaced by guaranteed financing.

2. Contribution of the Promoter (Initiator) to the Project prior to obtaining a building permit.

In all cases, the Promoter must cover the running costs prior to obtaining a construction permit. These costs will be considered the contribution of the Promoter to the Project. The cost of land or obtaining rights to it is also paid by the Promoter.

It is supposed to study which option is most convenient for the Promoter in each case.

3. A flexible combination of Bank Financing and contributions from Financial Investors is proposed for the period of construction and at least 15 years of operation of the facility, replacing the traditional Project Financing.

SPV will be created only for the construction of the project in which the loan guarantor will have a majority stake only during the construction period. The necessary credit will be insured by external guarantees in such a way that the Promoter´s Bank will have no problem in financing the construction.

At the end of the Construction the Assets will be acquired by an Investor who will receive an annual income for at least 15 years, giving the option to buy back the Asset to the Operating Company. The future annual income of the Investor must have a guarantee from the Operator´s Bank.

4. Procedure to carry out until the operation of the business.

An exclusive collaboration agreement will be signed between the Initiator (Promoter) and our company jointly with the advisory financing and investment structuring company proposed by us.

In this agreement all the steps and conditions necessary to obtain the financing are foreseen:

• Advice on hiring of the construction company.

• Obtaining a conditional offer from the Bank to finance the construction of the project.

• Obtaining a conditional offer from the Bank to ensure the future annual income of the Financial Investor for the exploitation period.

• Obtaining a non-binding offer from the Financial Investor.

• Preparation of the final Business feasibility study.

• Obtaining the Credit Guarantees and financing for construction.

• Obtaining the Financial Investor for the exploitation period of the business.

• Agreement for the establishment and management of a SPV in charge of financing and carrying out the construction of the project.

• Advice the agreement between the Promoter, business Operator and the Financial Investor for the exploitation period.

• Advice for the use of international legal and commercial instruments until start of business operation.

All the financial and structuring costs will be included in the Project financing budget and deducted from the financing granted.

Contact us for more information.

We will consider your question as soon as possible, and our experts will help to solve the tasks