To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Funding for thermal energy projects is declining every year, but the use of fossil fuel energy remains a bridge linking the modern economy with an innovative carbon-free model of the future.

Against this background, investment projects in the field of coal energy over the past decade have decreased by almost 5 times, retaining, however, a dominant role only in the PRC and developing countries of Asia.

According to the Sustainable Finance Program (Oxford University), the cost of borrowed funds for the construction of new thermal power plants in the world is growing, while the development of renewable energy projects is rapidly becoming cheaper.

Loans are becoming more expensive, reflecting the potential risks associated with changes in legislation.

Despite gloomy forecasts, the construction of combined cycle thermal power plants, including gas-fired power plants and innovative integrated gasification combined cycle technology, continues to play an important role in the energy strategy of the United States, China, Russia, India and other countries.

Considering the huge reserves of coal, oil and gas, which will be enough for the energy industry for at least half a century, the energy of fossil fuels continues to be used even in the context of the global energy transition.

Under the new conditions, companies planning to implement fossil fuel energy projects should prioritize the choice of a financial model for a thermal power plant project.

The correct choice of funding sources becomes the key to the viability of such projects in the future.

Bank loan, combined project finance instruments or bond issue?

It is critical to choose the right financial model for a thermal power plant project, the success of which depends on the asset value of the initiators, future cash flows, electricity and fuel prices, demand forecast and other factors. A deep understanding of the market will help you find the most adequate funding for your project.

Finding funds for energy projects on the world market requires practical experience and cannot be successfully carried out without the qualified assistance of financial consultants. Assuming that the thermal power plant project already has a viable financial model, the next step should be to use the services of one or two international banks with sufficient experience in financing energy projects.

Link Bridge Financial LTDA LBFL brings together an international team of professionals providing comprehensive services for medium and large businesses.

We offer project finance services, develop advanced financial models and advise clients on any financial, legal and engineering issues.

Are you looking for a reliable partner for your energy project?

We are ready to act as your general contractor, offering the construction of thermal power plants under an EPC contract.

Contact us anytime with your project details.

Choosing a financing model for a thermal power plant project

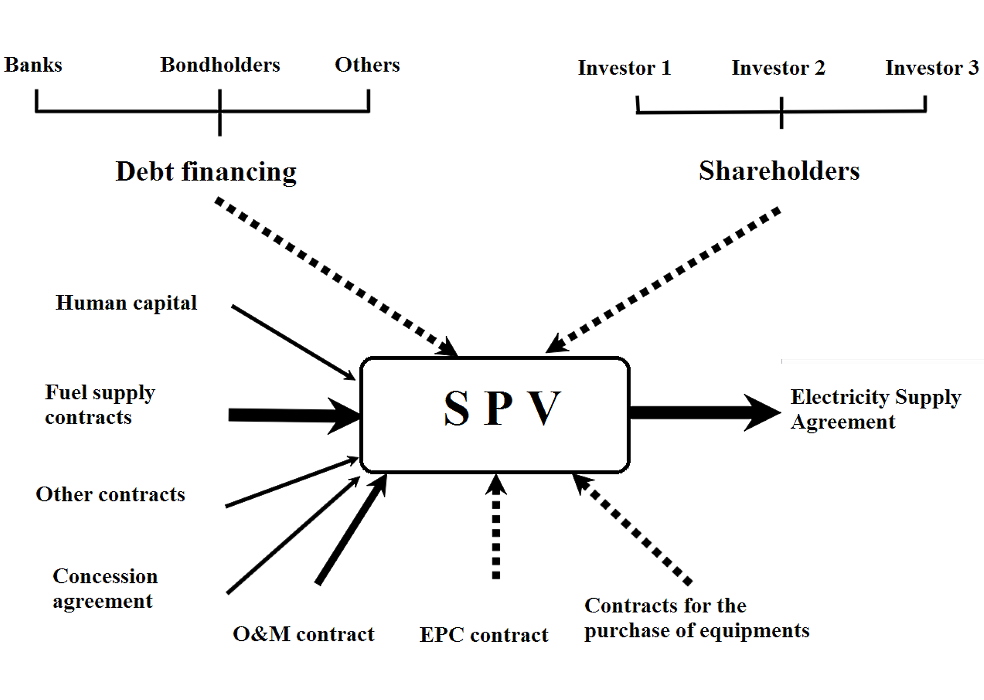

The basic structure of financing a thermal power plant project can vary significantly depending on the model chosen. The standard structure is shown in the figure below.Figure: General financing model for a thermal power plant project.

When structuring project financing, the lender must adapt the construction contract or EPC contract accordingly.

It must be drafted in such a way that the rights of the initiator in relation to the specified contract can be transferred in favor of the creditors.

A professional analysis of the contract as part of the structuring of the financial model for a thermal power plant is crucial mainly due to the following fundamental aspects:

• The lender or investor must have access to any economic benefit that the issuing company receives under the contract. In case of violation of the terms of the contract, these funds can be used to compensate for losses to the party financing the construction of the thermal power plant.

• The proponent of the project has limited financial obligations to the contractor, which are clearly defined by the contract in such a way as to avoid “overestimating” the project. To minimize risk, it is important to enter into contracts on a “one-time payment” basis.

It is clear that the more predictable the project budget is and the more limited the risk of its increase during the construction phase of the facility, the lower the risk for the investor.

The financial model for a thermal power plant project should be designed in such a way that the parties have the maximum interest in the successful completion of this project. It is obvious that the investor sets the following conditions.

First, the funded project must be completed on time and put into operation on schedule.

Secondly, the investor is interested in not having a significant cost overrun during the construction phase.

If the proponent of the project does not guarantee that the aforementioned points are properly provided for in the construction contract, then there is a risk that potential investors will refuse to participate in the project. If the project is financed through the stock markets, the success of the bond placement cannot be guaranteed under these circumstances.

For these reasons, the participation of professional financial consultants is essential for the correct organization of financing for the construction of a thermal power plant and ensuring acceptable conditions for the implementation of the project, whether it is a new or mature project.

Bank lending for the construction of thermal power plants

The successful launch and expansion of any business initiative, including the implementation of large energy projects, requires available sources of financial resources.Bank loans are a very popular source of capital for acquiring assets, financing operating expenses, and fulfilling contractual obligations to suppliers, contractors, customers and other lenders.

Despite the wide range of available funding sources, the issue of financial provision of the project with bank capital comes to the fore. The financial model of a thermal power plant project based on bank lending compares favorably with its simplicity compared to alternative models.

Despite the rapid development of equity markets, banks are much more important sources of financing for the energy sector.

Investment loans in some regions of the world account for more than half of all capital-intensive energy projects implemented.

Investment loans

An investment loan is a long-term loan provided by a bank or other financial institution to finance investment expenses related to running and developing a business, including the construction of large facilities.This loan is used to finance investment projects related to the modernization, reconstruction or expansion of the company's fixed assets.

The funds raised are used to purchase a land plot for construction, build new power units or expand existing facilities, purchase generators, boilers, turbines, conveyors and other equipment.

The loan amount is allocated to the borrowing company in accordance with the individual needs of the project. A loan can be obtained once or, for example, in parts adapted to the schedule of the investment project.

With the construction cost of thermal power plants ranging from $ 600 to $ 1,000 per megawatt, the total project cost can reach several hundred million dollars.

This makes the development of a financial model critical to the success of the project.

The condition for obtaining an investment loan for the construction of a thermal power plant is confirmation of the economic efficiency of this project, as well as the issuance of loan collateral or other reliable guarantees, well-prepared technical documentation and financial plans.

To reduce credit risk, banks often require the borrower to participate in the planned investment project.

Depending on the type of project, the contribution ranges from 10% to 20% of the investment value.

This requirement is based on the assumption that a borrower risking equity capital will be more interested in the success of his investment.

Advantages of bank financing for thermal power plants

Project finance and bank loans are the most common ways to raise funds for the construction of thermal power plants.Each of these strategies has its own advantages. The right choice will depend on the company's short-term and long-term financial goals and the specifics of a particular project.

Table: Key advantages of bank financing.

| Advantages | Detailed description |

| Simplicity and availability | An investment loan has serious advantages over PF instruments and equity financing. Unlike PF, obtaining a bank loan does not entail huge fixed costs, being more organizationally simpler. Unlike equity financing, the loan excludes the sharing of the future profits of TPPs between investors. |

| Flexible financing terms | The loan is usually issued on special terms, taking into account the needs of a specific project. Despite the declining interest of banks in financing thermal energy projects, companies have the opportunity to negotiate the terms of payment, interest rates and collateral. |

| Independent project control | The lender is not involved in the implementation of the project. After the bank approves the loan application, the borrower's only responsibility is usually the timely loan payments. A loan agreement rarely includes clauses that limit the borrower's business decisions. |

In general, a financial model of a thermal power plant project based on a bank loan is the best option for companies that prefer to retain control over the project.

However, companies that prefer to share the risk, minimize the cost of the project and attract industry experts to the project can choose PF instruments or a securities issue.

Bank financing or bond issue: important considerations

Choosing a financing model for any capital intensive project is often a dilemma.Bank loan, project finance or bond issue?

There are many financial and legal reasons in the thermal energy sector that are important to assess in each case.

If the analysis of the financial model for the thermal power plant project showed that it is necessary to take a long-term loan (15 or 20 years), then the international capital market may be a more appropriate solution compared to the traditional bank loan.

With rare exceptions (for example, long-term loans from the International Finance Corporation), the syndicated loan market offers shorter maturities than may be required to finance a TPP project.

On the other hand, bond financing tends to have fairly long maturities with easy setup and restructuring.

For this reason, the financing of the thermal power plant project can be carried out through the issue of bonds. Given the complex nature of the issue, companies need the right financial instruments and professional support to successfully place bonds, especially among international investors.

Bank loans in many cases are simpler and more affordable compared to entering the stock markets or organizing project financing.

However, there are several good reasons to finance a TPP project through international bond markets:

• The company needs large investments, but banks and the local stock market do not have sufficient appetite to finance the project.

• Companies, for certain reasons, are not satisfied with the financing conditions offered by local banks, credit institutions or private investors.

• The project initiator seeks to diversify risk by opening up access to international institutional investors from other parts of the world.

• Placing bonds on the international market makes the TPP project more competitive given the high rates on bank loans and the complexity of organizing project financing.

The choice largely depends on the scale of the project, the supply of fuel (natural gas, coal, fuel oil or possibly biomass), guaranteed demand for electricity, and the availability of strong sponsors with extensive experience in the sector.

It is important to understand that it is more difficult for companies from developing countries to take advantage of certain financial instruments, such as placing bonds on the global market.

The flexibility of debt financing instruments is considered to be an advantage over bond-based financial models due to the broad opportunities for negotiating with the bank on changing debt repayment schedules, as well as restructuring and refinancing loans.

On the one hand, serious energy projects are carefully planned and studied, including a detailed risk assessment.

On the other hand, the construction of thermal power plants in developing countries carries serious risks that may require a revision of the financing conditions at any time.

This is not easy to do in the case of the issuance of project bonds.

The project initiator must also anticipate future legislative changes, which are rapidly moving towards green energy in many countries. Obtaining government guarantees can secure the project and will help to increase its investment attractiveness.

Project bonds: a new word in energy financing

Recently, project bonds have been actively used to finance capital-intensive projects.This can be explained by a number of advantageous features of this type of securities that distinguish them from traditional corporate bonds. Borrowed funds raised by placing project bonds are paid from the cash flow generated by the project, but not from the issuer's current income.

This feature makes project bonds a kind of long-term investment in future projects. Today, project bonds have become very attractive to large financial players looking for stable and long-term investment opportunities.

Such securities are readily purchased by pension funds, large investment funds, as well as insurance companies and other institutional investors.

The concept of project bonds is underdeveloped in some regions of the world, but this method is gradually crowding out traditional debt financing, especially in capital-intensive sectors such as energy, infrastructure and the LNG industry.

An innovative financial model of a thermal power plant project based on the placement of project bonds has a number of advantages for the initiator.

However, some aspects continue to cause debate among entrepreneurs.

The first argument against the use of project bonds to finance large objects is the so-called negative carry.

Its essence lies in the fact that the issuing company receives funds immediately, while the costs of building a power plant are spread over a period of several years.

This leads to a situation where the issuer is forced to regularly pay interest on borrowed funds that are not actually used at a given time. To avoid unnecessary costs, companies should use a special mechanism of deferred payments or issue several series of bonds in accordance with the financial needs of the project.

The second argument in favor of debt financing for the TPP project is limited access to stock markets.

Some companies will not be able to effectively place their bonds on the international market, while the local market is underdeveloped and does not meet the needs of the business.

This problem is especially common in young companies. But on the other hand, such companies rarely undertake the implementation of large energy projects. In addition, small companies with limited assets do not have access to bank loans, turning to project finance instruments.

Despite a number of controversial issues, project bonds are widely used to finance the construction of thermal power plants and for the implementation of other large energy projects.

Since such projects are characterized by very high and stable incomes, which are guaranteed by long-term agreements, investors' appetite for purchasing project bonds is high today.

Project finance (PF) for thermal power plants

The term "project finance" means financing the construction of a thermal power plant from internal financial resources and (or) borrowed funds provided against future cash flows, but not against the assets of the company that initiated the project.Thus, the potential return on investment and risks largely depend on an accurate and reasonable assessment of a particular project by the investor.

Project finance (PF) is widely used in the energy sector due to the attraction of large investments on an off-balance sheet basis.

Thanks to the competent implementation of this financial model for the TPP project, companies can simultaneously build several large facilities without burdening their financial statements with a huge debt.

In most cases, partners create a dedicated project company, whose assets serve as collateral and its future cash flows are used to service debt.

Banks in this case provide about 70-80% of the project cost, but some financial institutions offer to finance 90% of the project and even the full cost.

The complex structure of the contractual relationship in the framework of project finance contributes to the optimal distribution of project risks between the parties who can best cope with these risks. Consequently, the organization of the PF, along with a detailed analysis of the project, requires multi-stage negotiations and time-consuming legal work.

Regardless of the project type and funding method, partners will make a decision to participate based on implementation risks and expected income.

The financing structure, collateral and other points depend on the specific case.

The cost of arranging project finance (fixed costs) is considered to be higher than traditional debt finance models of a thermal power plant project. In this regard, the PF can be used only for the implementation of large investment projects, estimated at tens of millions of euros.

Most often, project finance is used for the construction of large-scale facilities that require expensive R&D, engineering, as well as technically complex construction and the purchase of expensive equipment.

Until recently, project finance was considered quite risky, but in the mid-2000s, a number of economic studies appeared that confirm the significant advantages of PF instruments over traditional corporate lending in a number of investment projects.

This financing method has been used for the construction of numerous thermal power plants, substations and power lines in the United States, Latin America, Africa, Europe, as well as in East Asia, the Middle East and other regions of the world.

Link Bridge Financial LTDA LBFL is ready to offer long-term bank loans on attractive terms.

We also arrange project finance for the construction of thermal power plants around the world, providing a full range of financial, legal and engineering services for energy companies.

Advantages of project finance

Project finance is chosen by energy companies due to several principal advantages, listed below:• Non-recourse or limited recourse financing.

• Off-balance sheet financing of the project.

• High share of borrowed funds in the project, reaching 90%.

• Absence of strict restrictions in the contract.

• Isolated financing, where SPV acts as a borrower.

• Potential tax benefits.

• Minimization of risks.

To better understand the advantages of project finance for the construction of thermal power plants, below we describe in more detail about each of these aspects.

Table: Advantages of using project finance in the energy sector.

| Advantages | Description |

| Non-recourse or limited recourse financing | The PF forms a financial structure in which the sponsor is not liable for the debts of the SPV, or at least has limited liability. Non-recourse financing relieves the initiator of any obligation to support the project if the cash flows are insufficient to pay the principal and related interest. |

| Off-balance sheet financing | In project finance, the project debt is only shown in the SPV financial statements and therefore does not affect the financial health of the sponsors. The benefits of off-balance sheet financing should depend on the specific accounting and legal requirements of the country. |

| High share of borrowed funds in the project | Project finance provides a high share of borrowed funds in the capital structure. The acceptable level of debt varies from project to project, but the debt to equity ratio reaches 70-90%. This is a clear advantage for initiators as it reduces the initial investment. |

| No restrictive clauses in the loan agreement | By using project finance instruments, sponsors can work on new capital intensive projects without breaking the hard constraints they may be bound by. These include limits on debt buildup, limits on guarantees or collateral, limits on capital expenditures, or participation in other projects. |

| Isolated financing | When using PF instruments, the sponsors' credit rating (and, therefore, the cost of loans in the financial market) is preserved. Sponsors can develop several large projects, sometimes risky, without compromising creditworthiness. Project isolation also has benefits for lenders, allowing them to deeply assess the project on a case-by-case basis, and to quantify and manage the risks associated with the construction, commissioning, management and operation of the project. |

| Potential tax benefits | PF allows companies to build an optimal financial model for a thermal power plant project to minimize taxes for SPVs and sponsors. Issues related to taxation, capital gains and dividends should be carefully analyzed before deciding on a project structure. |

| Minimizing political risks | The number of participants (local and international, private or public) in the PF structure usually reduces the political risk associated with the project. If the government of the host country will try in any way adversely affect the project, it will face pressure from sponsors and other participants who are interested in the success of the project. |

Any combination of the above aspects is sufficient for sponsors to consider the project finance method as optimal for project implementation.

But the most important benefits of the PF for the initiator include limited recourse and off-balance sheet financing through the creation of an independent project company.

If you are interested in project finance for thermal power plants, contact the Link Bridge Financial LTDA LBFL financial team. Together with our European partners, we have implemented numerous energy projects in more than 30 countries around the world, so we are ready to use our experience and business contacts to promote your business.

Our services in financing the construction of thermal power plants

Link Bridge Financial LTDA LBFL, an international financial company, has served private companies and government customers for over a quarter of a century.We provide loans, project financing in the energy sector, provide loan guarantees, as well as offer investment engineering services, financial model development and consulting.

The geography of LBFL services covers almost the whole world: USA, China, Mexico, France, Germany, Spain, UAE, Argentina, Brazil, Venezuela, South Africa and other countries. Extensive international experience and deep understanding of the energy sector guarantee the high performance of our solutions.

Our team with partners carries out engineering design, construction and modernization of coal and gas thermal power plants of various types. LBFL offers advanced integrated solutions for industrial customers.

If you are looking for a reliable financial partner or general contractor, please contact us.