To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Private companies and governments must work together to develop maritime trade in a globalized world.

In recent years, the concept of financing a seaport has undergone profound changes, driven by the growing costs of building, maintaining ports and terminals against the backdrop of rapid progress and growing competition.

Shipping companies are no longer able to include multimillion-dollar infrastructure spending in their financial plans, so the industry needs fresh solutions.

The public sector plays an important role in the construction, expansion and modernization of seaports and port infrastructure, interacting with terminal operators and other players to ensure efficient financing of investment projects.

As a result, we see more and more complex financial models based on long-term bank loans, grants, guarantees, bonds and other instruments.

The variety of ways of financing the construction and development of seaport projects varies widely, ranging from full self-financing to the widespread use of external sources of financing in the form of bank lending and various project finance (PF) instruments.

Link Bridge Financial LTDA LBFL, a finance company, offers financing for seaport projects in Europe, USA, Canada, Latin America, China, Russia, South and East Asia, Australia, the Middle East and other regions.

Together with respected financial partners, we guarantee a comprehensive customized approach to each investment project.

We offer loans of 50 million euros or more with a maturity of up to 20 years.

We also use combined project finance (PF) instruments to implement large projects without risking the originator's assets.

Project finance for the construction of seaports

The so-called project finance has been around since the end of the 13th century, but it only became widespread after the 1930s, when banks and other financial institutions began providing unsecured long-term loans for oil and gas projects or other projects with significant growth prospects.The PF mechanism has improved over the years, and financial institutions have significantly improved loan collateral and investment project due diligence to improve the security of financing.

This has had a positive impact on funding requirements and the availability of borrowed funds, which is why the beginning of the 21st century was the heyday of the era of project finance.

Today, this method of financing is increasingly used for capital-intensive investment projects with long payback periods, such as the construction and modernization of seaports, cargo terminals, port infrastructure, etc. The nature of project finance is close to the nature of infrastructure projects, therefore PF instruments are considered the most suitable for financing the construction of seaports.

Benefits of project finance for seaports and terminals

PF tools provide a lot of advantages for participants in the process, allowing them to quickly implement capital-intensive projects with minimal risk.

The main characteristics of the investment process carried out on the basis of project finance, as well as their impact on the project structure and costs, are listed in the table below.

Table: Features of project finance in the construction of seaports.

| Features | Detailed description |

| High leverage | Project finance provides an average of 75% of borrowed funds for the construction of port infrastructure. Often this attitude is 15:85. The main reason is the high cost of funds. |

| High cost of financing | Project finance deals are more complex than bank lending. The variety of risks, along with the need to identify and analyze them, pose many challenges to asset security. This, in turn, results in a high cost of borrowed funds compared to alternative financial instruments. |

| Additional safety for lenders and investors | In order to receive funds to cover investment costs, sponsors must create an appropriate security package for subsequent stages of the project, approved by investors and lenders. The main measures in this context are government guarantees, bank guarantees, third party guarantees, guarantees against political risk, long-term contracts for the provision of logistics services, insurance, etc. Our company widely uses financial engineering tools to ensure project financing. |

| Debt repayment | The return of borrowed funds is possible only through the use of funds generated during the operation of the seaport and its infrastructure. |

| Project documentation | The project must be carefully planned and organized in such a way as to ensure the rights and obligations of all parties involved. Technical, financial and legal consultants must put a lot of effort into preparing the documentation and detailed project appraisal. These activities often represent significant transaction costs, so any slowdown in the consultants' work could delay the construction of the port. |

| Long period of preparation | It often takes several years to obtain the necessary permits and attract financial resources to start and carry out investment work. |

Inherent characteristics of project finance include ensuring that the project has sufficient financial flows that provide a realistic opportunity to service the debt according to the payment schedule.

The financial indicators of the investment project deserve special attention, since the project company incurs significant costs:

• Obtaining expert opinions.

• Preparation of technical and financial documentation.

• Protection of participants from investment risk.

Financing a seaport project, especially when compared to other financing methods, requires an integrated risk management process along with mechanisms to protect the project from potential increases in risks in certain situations.

Such additional costs contribute to a significant increase in the cost of financing (transaction costs can be estimated at 10-30% of the total investment costs).

The effectiveness of project finance is highly dependent on the estimated cost of the project. The higher the cost, the greater the chances of getting a positive effect as a result of using PF. For this reason, project finance is only applicable for the construction of large seaports and terminals.

General structure of project finance

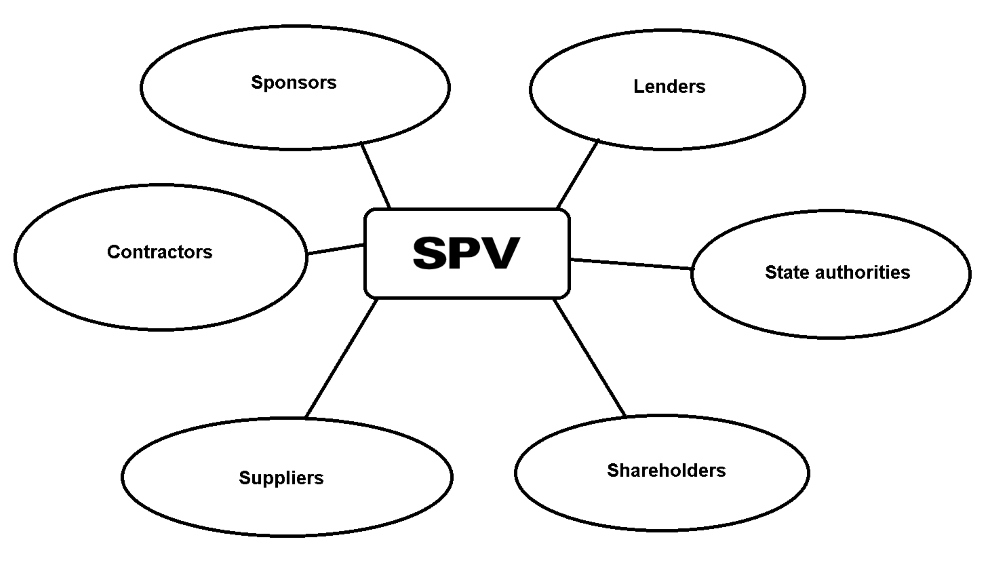

The advantages of using project finance instruments for the construction and modernization of the port (port infrastructure) are due to the special organizational structure associated with the special purpose vehicle, SPV / SPE.Below is a typical structure of an investment project carried out with direct participation or control by the state (this is most relevant to the construction of seaports and other strategic infrastructure). In practice, each project is unique, and some PF participants may play several roles at once. For example, one company can be a project shareholder and a lender.

Figure: Participants in the project finance scheme for the construction of seaports.

A special purpose vehicle (SPV / SPE) is a key link in organizing financing for large off-balance projects.

SPV provides reliable organizational, financial and legal isolation of the project from the assets of its initiators.

After achieving the goal of the project, which is the construction of port infrastructure and the purchase of new equipment, a special project company must pay off the debts, after which it can cease to exist. The organizational form of an SPV may differ from project to project.

Factors influencing the choice of the structure of the project company:

• The number of project initiators and their goals.

• Legal regulations of the host country as well as the country of SPV registration.

• Method of project financing and access to funding sources.

• Financial health of initiators and other participants.

As a rule, the best solution is to create a joint stock company, but in some justified cases, other forms may be more profitable.

The advantage of joint stock companies is the significant limitation of recourse to shareholders. In addition, joint stock companies provide a more transparent ownership structure that protects against the influence of one project participant on the activities of the SPV. On the other hand, other types of companies may be more beneficial when it comes to tax matters or the obligation to disclose business information.

Regardless of the chosen form of SPV, financing the construction of seaports through a special project company gives initiators a number of advantages by separating their core activities from the risks and debts of a new capital-intensive project.

These benefits include the following:

• Connection of financing with future cash flows, regardless of the current financial condition of the project participants.

• Access to large sources of borrowed funds, which the company cannot obtain on its own in the case of traditional financing.

• Limiting the impact of the project on the financial position of the initiating companies.

• High percentage of borrowed funds, reaching 90% of investment costs.

• Rational division of project risks between the participants.

• Increased creditor confidence in the project due to its rational and transparent structure.

• Protection of the project from illegal decisions or actions of any of the participants.

• Separation of obligations to publish information about the project from obligations to publish commercial information about its initiators, which helps to keep commercial secrets.

• Tax incentives, investment incentives, etc.

Finally, project finance in the context of the construction of seaports and terminals is intended to organize close cooperation of many participants, which makes it possible to make optimal use of the knowledge and experience of each of them.

These advantages justify the use of SPV for project implementation.

However, it should be emphasized that the additional costs, organizational and legal issues associated with such a project structure can be so complex that the use of project finance will be impractical for small projects.

If you need professional advice on the project finance, please contact our consultants.

The need for financing and the dynamics of financial flows

In general, financing of seaport projects covers two main aspects.First, it is the definition of the investment project financing structure (consisting mainly of loans with limited recourse to borrowers and a set of other financial instruments that ensure a continuous and sufficient financing process).

Secondly, these are the sources of servicing loans in the form of cash flows received as a result of the operation of the port infrastructure.

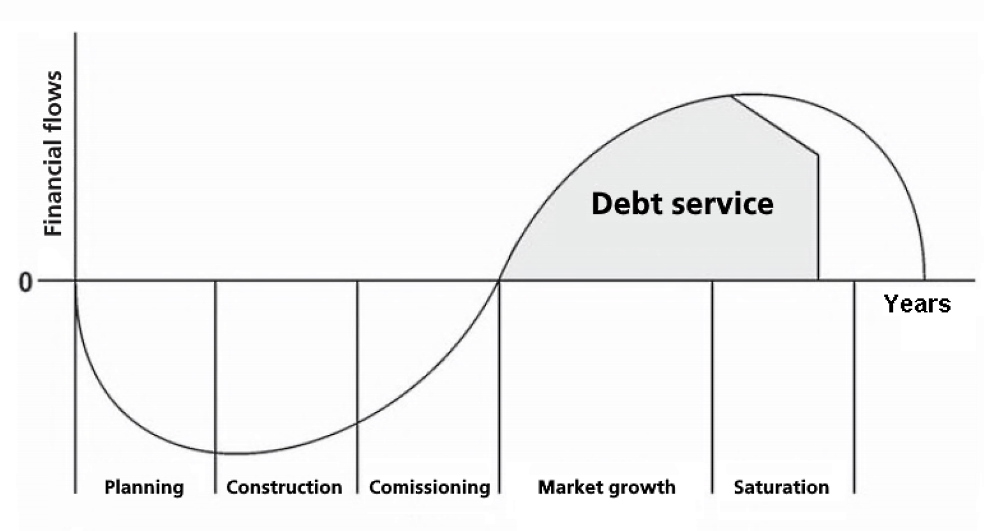

The moment of commencement of repayment of loans taken for the implementation of a specific project begins with the commissioning of the seaport or part of it, and any funds received must be directed to repayment of the debt. Changes in financial flows reflecting the need for financing and the ability to service debt are shown in the figure below.

Figure: Dynamics of cash flows over the life of the investment project.

The basic principle of project finance is to isolate project assets, contracts and cash flows from the activities and assets of sponsors (so-called off-balance sheet financing).

On the one hand, linking financing to future cash flows from seaport activities increases the risk for lenders. On the other hand, it is a powerful incentive for participants to carry out the investment process in such a way as to achieve the planned cash flows on time.

The huge investment needs for port infrastructure around the world are the basis for the further development of project finance models.

The high cost of infrastructure projects requires debt financing, so the PF market, despite the very high risk, will continue to develop.

Link Bridge Financial LTDA LBFL is ready to assist its clients in arranging project financing, including large loans on favorable terms, financial modeling services, preparation of a professional business plan, establishment and management of SPV / SPE, approvals and consulting services.

Current trends in funding seaports and terminals

The traditional model for financing transport infrastructure investments is based on public funds.The key modern trend in financing projects for the construction and modernization of seaports in Western Europe is the transfer of contracts and ownership of port infrastructure from state entities (governments, municipalities) to private capital, which has proven to be effective in the implementation of such projects in a competitive environment.

In order to ensure that the port infrastructure does not lose its public character and develop in accordance with the general directions of the state's economic policy, financing mechanisms based on public-private partnerships began to gain popularity in the construction or expansion of port infrastructure.

PPP projects are actively used today in the following projects:

• Construction of seaports and container terminals.

• Expansion of the existing transport and logistics infrastructure.

• Modernization of transport and logistics infrastructure and so on.

Leading European economists point to numerous positive properties of public-private partnerships for the development of seaports.

Among them, it is worth highlighting the combination of state control and private initiative, which demonstrates high flexibility and adaptability.

PPPs take various forms of cooperation, with the private sector temporarily managing infrastructure and financing or co-financing capital-intensive infrastructure projects. The chronic deficit in public funding can be overcome by attracting private capital, accelerating the development of seaport infrastructure without additional burdens on state and local budgets.

Development of port infrastructure financing models

Taking into account the opposing goals of the public sector (focused on maximizing public utility) and the private sector (focused on maximizing financial benefits), it can be assumed that the participation of the private sector in the construction of seaports is complementary to traditional sources.Attempts to combine the advantages of both sectors are increasingly being undertaken in strategic areas previously under government monopoly, such as airports, seaports and railways.

Such conclusions can be drawn on the basis of studies carried out in highly developed countries (Great Britain, France, Germany, Italy, USA, Canada).

Also, studies conducted by the European Bank for Reconstruction and Development showed that in the countries of Central and Eastern Europe, the share of private capital in financing seaport projects continues to increase. A similar trend is observed in most developing countries in Asia, Africa and Latin America.

In the near future, experts expect an increase in support for investments in the construction and modernization of seaports from the funds of the European Union. A similar scenario is taken into account by private companies, which envisage plans for co-financing from EU funds in the development of infrastructure.

In a number of countries, pressure is now mounting to attract private capital to finance infrastructure investment in port areas.

With this financing model, the private investor takes on the entire investment burden.

In many cases, local authorities enter into long-term lease agreements with private companies for 25-30 years or more, obliging the investor to build and maintain capital-intensive elements of the port infrastructure:

• Arrangement of the seaport water area, approach channels and anchorages for ships.

• Construction of breakwaters, breakwaters or other protective structures in the water area.

• Construction of berthing lines with cargo equipment and terminals.

• Arrangement of areas and premises for storing goods.

• Construction of access roads and railways.

• Arrangement of a ship repair area, etc.

The specific amount of investment is agreed upon by the parties individually, depending on the existing level of infrastructure and the development of the port area.

In addition to financing the development of infrastructure, the investor carries out that part of the investment that is included in his responsibilities in accordance with local laws on ports (construction of warehouses, other elements of the technical infrastructure of the terminal, equipping cargo terminals with the necessary equipment).

In return for investing in infrastructure, the port authority may, for example, lower the investor's rent. In this model, the main income of the port is formed from the payment for tonnage collected from ship owners, as well as a reduced rental rate. On the other hand, the lessee's income includes payments for transshipment and storage services received from the shipowners and / or the cargo operator (depending on the terms of the contract and the method of delivery).

In addition, a public-private partnership project may involve the use of a mixed model, in which the public and private parties share the costs of financing the seaport and terminals project.

Our financial and engineering services

If you are interested in the construction of seaports or you need long-term financing for large infrastructure projects, contact a representative of Link Bridge Financial LTDA LBFL.Our company is ready to organize financing of large projects, advise your specialists and provide other services.

Link Bridge Financial LTDA LBFL's professional services include the following:

• Financing of projects of seaports and port infrastructure.

• Services in the field of financial modeling and investment engineering.

• Operation and management of facilities.

• Project management, etc.

LBFL with foreign partners provides financing, construction and modernization of the port infrastructure under the EPC contract.

Contact our official representatives to find out more.