Financing and lending of metallurgical enterprises

Link Bridge Financial LTDA LBFL offers:

• Project financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

The development of ferrous and non-ferrous metallurgy, which is based on large interconnected projects of mining and processing facilities and foundries, requires colossal investments, supported by a favorable market environment, expensive research and development and mature legislation of the host country.

Steel demand can be seen as an indicator of the health of the global economy.

According to the Overview of the steel and iron ore market 2020 (Deloitte), the decline in global steel production last year reached 2.8% amid a 4.3% decline in global consumption.

Global uncertainty has created problems for a number of states and companies.

China has traditionally been the leader in steel production, having increased its indicators in 2017 to 787,000 tons. World leaders also include Japan, India, USA, Russia, South Korea, Germany, Turkey, Brazil, Italy, Taiwan, Ukraine, Iran and Mexico.

ArcelorMittal, formed by the merger of Arcelor (Luxembourg) and Mittal (India) in 2006, has been the largest steel producer in the world for several years.

In 2016, ArcelorMittal produced 95.5 million metric tons of steel, which is 6% of global production.

China Baosteel Group and Wuhan Steel Group merged in 2016 and came in second to form the Baowu Group (PRC), which produced 63.8 million metric tons in the same year, followed by the HBIS Group from China with 46.2 million metric tons.

Under the influence of the protracted coronavirus crisis, prices and demand for steel mill products remain volatile, so the implementation of large investment projects in the near future will be difficult and risky.

In the face of financial crises and uncertainty, raw material prices are predictably decreasing, which creates certain financial problems for the steel industry and requires more flexible production policies and advanced project financing models. Innovative project finance instruments for the construction and expansion of steel mills, along with long-term loans for equipment upgrades, could prove to be a life-saving business revival opportunity that helps weather the crisis and strengthens its position in the global marketplace.

Link Bridge Financial LTDA LBFL, a company with a broad international presence, specializes in financing large projects in the heavy industry, energy, oil and gas sectors and other capital-intensive areas of the modern economy.

We offer long-term financing for the construction and modernization of steel mills, including project finance, guarantees, SPV establishment and management, project management, and financial and legal consulting services.

Steel industry financing problems in developing countries

The globalization of markets and the acceleration of technological progress present new challenges for steel mills based in developing countries such as India, the Russian Federation, Mexico, Brazil, Turkey, etc.Lack of investment and slow implementation of large projects as a result of insufficient funding creates significant risks for economies, since the steel industry in these countries forms the basis for many priority industries, including heavy industry, transport, coke-chemical industry, etc.

Finding innovative models for financing steel mills is a critical challenge for governments, specialized steel companies and financial institutions seeking to overcome negative trends and strengthen local economies in a highly competitive global commodity market.

A number of social, economic, technological and geographical factors emphasize the strategic importance of non-ferrous and ferrous metallurgy for the economy of the current exporting countries of metal products.

The weakening of government influence on the steel industry, which has been observed in many countries of the world over the past 30 years, has been accompanied by an increase in the participation of private capital in the implementation of large projects, such as the construction of steel mills and mining and processing plants, expansion, as well as environmental modernization of equipment in accordance with modern standards.

Most exporters of rolled metal today actively use public-private partnership (PPP) mechanisms and successfully attract external financing to overcome the investment hunger and ensure stable predictable development of the industry.

Nevertheless, the revitalization of the investment activity of steel companies largely depends on the parameters of investment projects and access to adequate sources of financing.

Project finance for the construction and modernization of steel mills is based on a flexible combination of external and internal sources of funds, but the ratio of these sources always depends on the projected financial flows of a particular project, the state of the investment market and, accordingly, on the results of professional analysis of the project at the pre-investment stage.

A serious problem for most resource-based economies has traditionally been insufficient development and implementation of scientific and technical developments in industry. For example, the countries of the former USSR at the end of the last century faced chronic underfunding of science, which naturally led to the separation of scientific institutions from the real needs of the steel industry.

This situation forced metallurgical plants in Russia, Ukraine and other post-Soviet republics to switch to the modernization of production solely on the basis of imported technologies, which significantly limited the options for attracting investment resources and sources of financing for investment projects.

The global practice of developed countries confirms the successful use of state support instruments for financing metallurgical projects aimed at the development and modernization of production. These instruments include the provision of government guarantees, the adoption of favorable and transparent legislation, and the reduction of customs duties and VAT on high-tech equipment.

Expanding partnerships between government and private capital in the framework of project finance contributes to the long-term sustainable development of the sector, improved project management efficiency and improved financial performance.

Link Bridge Financial LTDA LBFL, an investment consulting company, is ready to offer its valuable business contacts and significant financial resources to solve your business problems.

For more than 25 years, we, together with respected partners, have helped clients around the world implement ambitious projects in the steel industry, the energy sector, mining and processing of minerals and other industries.

Basic models for financing the construction and modernization of steel mills

Successful development of any steel mill involves innovation, which requires costly investment decisions to periodically upgrade equipment.If, during periods of economic stability, steel companies rely on internal sources of project financing, such as profits or depreciation charges, problems in the commodity market are forcing businesses to actively borrow funds, including long-term bank loans, placements of securities and combined project financing instruments.

The predominance of internal resources in the structure of financing the construction and modernization of steel mills is mainly due to the desire of companies to use depreciation as the cheapest source of funds. However, this situation is typical only for certain periods of economic development and certain limited circumstances, when the attraction of external funds becomes problematic for the steel industry or a specific company (investment project).

If we consider internal sources of financial resources, depreciation is indeed recognized as the most affordable way of financing investment projects, since these funds are included in the cost of production and are constantly paid by consumers.

For this reason, in developed countries, the share of depreciation charges in financing capital investments reaches 40% and is considered an important source of investment funds for the implementation of large capital-intensive projects in the steel industry.

Unlike loans, depreciation charges do not negatively affect key financial statements.

The use of company profits and depreciation charges as the main source of financing for the construction and expansion of steel mills is due to long-term success against the backdrop of high steel prices.

However, in a period of instability and low profitability, steel companies are actively looking for sources of external financing to implement new projects.

Attracting external financial resources through bond markets is seen as one of the most attractive options, but the insufficient development of this area in developing countries forces businesses to turn to long-term bank loans and structured instruments.

Each source of financing for steel mills has its own advantages and disadvantages in terms of risk, cost of funds, efficiency of their use in specific projects.

Funding projects through the issue of shares is an expensive measure that requires significant fixed costs for the professional issue and placement of securities.

The costs of raising funds, paying dividends to shareholders and repurchasing the company's shares may ultimately exceed the potential benefits.

For this reason, some steel companies at various times carried out share issues in order to obtain public status and strengthen their reputation, which subsequently allowed them to attract significant debt financing on favorable terms, and also increased the efficiency of further issues of debt securities.

Companies from Russia, Ukraine, India and a number of other developing countries have practiced this approach to one degree or another.

Long-term loans for equipment modernization

Finally, a widespread method of financing the construction of steel mills and modernization of production is long-term lending through state banks, commercial banks and other lending institutions.Despite the flexibility and relatively broad possibilities of adapting the loan agreement to the needs of the borrower, bank loans are considered a risky instrument of project financing, the shortcomings of which are especially noticeable in times of crises and market uncertainty.

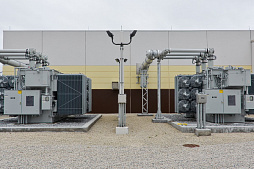

A key condition for maintaining the competitiveness of steel companies is the creation and maintenance of highly efficient and environmentally friendly production, whose products meet strict international quality standards. For a number of countries, the problem of equipment wear and the low technical level of foundries remains urgent, many of which have been operating without serious modernization since the second half of the twentieth century.

For example, some steelworks in the FSU countries exhibit equipment wear rates of more than 50%, making it extremely difficult to produce high-quality rolled products and comply with environmental standards.

Attraction of large borrowed funds for the modernization of steel mills is becoming an acute problem for metallurgy.

Link Bridge Financial LTDA LBFL is ready to provide you with a long-term loan on favorable terms.

We also offer the services of a professional engineering team developing technical documentation for new blast furnaces, rolling mills and other equipment.

To find out more about our capabilities, please contact us at any time.

Funding for large projects is usually carried out through syndicated loans provided by several large banks or several dozen smaller financial institutions, since the investment needs of steel companies can significantly exceed the lending capacity of one bank. The list of potential problems that companies may face when applying for a bank loan may include lengthy loan processing, strict contractual conditions to minimize credit risks, and extensive powers to control business processes within the borrower's company by the bank.

The volatility of prices for ferrous and non-ferrous metallurgy products, along with conflicting expert forecasts regarding the future of the world economy, have recently created unfavorable conditions for financing investment projects through bank loans.

Tighter lending and increased control over borrowing companies are pushing businesses to use more flexible combined financial instruments such as project finance based on the future financial flows of an investment project.

Project finance for steel mills: opportunities and benefits

Project finance (PF) means structured financing of economically and often legally separate entities, provided against the future financial flows of an investment project and not dependent on the assets of the initiators of the project.

PF is widely used by steel companies to implement capital-intensive projects in high-risk environments. A special project company (SPV / SPE) created within the framework of this concept acts as a borrower and serves the debt.

The lifespan of this company is usually limited to the life of the project.

The main feature of this particular form of funding is limited regression. Financial resources are provided solely against the future cash flows of the project.

Project finance differs from traditional corporate finance in three ways:

1. Money in anticipation of future financial flows.

Project finance is usually provided by participants in the expectation of a high profit after the implementation of the investment project, therefore, a detailed analysis of the project serves as the basis for allocating funds. Since the products of steel mills are used in almost all sectors of the economy, such investments usually have very good long-term prospects. Lack of collateral in general is often offset by broader creditor rights. These include, for example, permission to control large transactions and assets, enter into contracts or participate in project management.

2. From the point of view of the project sponsors, the PF instruments have a great advantage as they are off-balance sheet.

The attraction of borrowed funds is shown only in the financial statements of the SPV and does not have a negative impact on the balance sheet of the steel company. In addition to this, lenders cannot obtain the assets or financial flows of sponsors to service the debt.

3. An important feature of project finance is the optimal distribution of risks.

The need for this stems from the scale of projects, the risks of which are unlikely to be borne by individual initiators. The term “risk sharing” means that risks are rationally distributed among all participants. This includes equipment suppliers, lenders and, in some cases, customers. Investment insurance and export credit insurance is offered internationally. For some metallurgical projects, government guarantees or guarantees from the World Bank and the European Investment Bank are also possible.

A special purpose vehicle, acting as a borrower and in charge of project debts with its assets, opens up great opportunities for the steel industry, making it possible to implement ambitious projects through the cooperation of many participants. This is confirmed by the international experience of Link Bridge Financial LTDA LBFL.

We have successfully applied PF tools to implement large industrial, environmental and energy projects in Brazil, Germany, France, Mexico, Saudi Arabia, South Africa and other countries.

If you are interested in financing the construction of a steel mill or a loan for the modernization of equipment, please contact our official representatives at any time.

We are ready to provide financing from 50 million euros and more on flexible terms, guaranteeing comprehensive support from our financial and legal specialists.