To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

The state and quality of infrastructure is one of the criteria for socio-economic development and a powerful lever for the growth of social welfare.

Energy, water supply, transport and telecommunications directly affect the quality of life of the population.

Financing infrastructure projects creates stable jobs and spurs growth in other sectors of the economy.

The key problem in the implementation of new investment projects is the correct choice of financing scheme. This complexity can be attributed to limited government spending and the growing range of potential funding sources offered by markets (including investment loans).

One of the most important models for financing new infrastructure projects is project finance (PF).

In this case, the planning, financing and management of the project is carried out through a special purpose vehicle (SPV), the shareholders of which are companies interested in the project.

With the growing need for financing large infrastructure projects, dissatisfaction with the current quality of infrastructure and limited resources of the state budget, the PF is becoming an increasingly important instrument that meets the interests of business and society.

A prerequisite justifying the need to use project financing is the convenience of its use in public-private partnership projects.

LBFL is an international company that finances infrastructure projects around the world, including Europe, the United States, Latin America, the Middle East, Africa, East Asia and other regions.

We offer investment loans for the construction of roads, pipelines, seaports, electrical substations, wastewater treatment plants and other facilities.

Our finance team helps clients obtain large loans from European banks, attract venture capital and interested private investors. We also offer clients all kinds of financial advice, tax optimization and other services.

The essence of infrastructure projects

Infrastructure can be defined as artificial, permanently located public facilities that form the basis of economic life due to its functions of moving people and goods, supplying electricity, water, and so on.Leading economists also highlight the so-called social infrastructure, which indirectly supports the development of the economy, satisfying the intangible needs of the population.

Infrastructure plays a leading role in the functioning of the social system. Infrastructure activities are usually controlled at the local level, as the development of roads, urban transport, seaports, water pipelines and power grids is the responsibility of local authorities.

Financing infrastructure projects often requires public participation. In Europe, the importance of this issue is emphasized through co-financing from the European budget.

Table: Main types of infrastructure projects.

|

Technical infrastructure projects

|

Social infrastructure projects

|

|||

| Communications | Energy supply | Water supply | Society | Government |

| Transport projects such as overpasses, bridges, seaports, cargo terminals. Communication, including new wireless systems. | Power plants and substations. Oil and gas enterprises. Heating plants. | Water collectors. Sewerage. Water treatment facilities. Desalination plants. | Scientific and cultural centers. Educational institutions. Medical institutions. Stadiums, sports centers, etc. | Public places for various purposes. State bodies. |

Infrastructure projects can also be categorized according to their range (eg international, national, regional, local).

Economists often distinguish between public and private infrastructure.

The term “infrastructure investment” refers to the investment in infrastructure assets to obtain specific benefits at the perceived risk.

There are the following types of financing for infrastructure projects.

First, an investor can buy securities of an infrastructure investment company.

Secondly, a financial institution can provide an investment loan for the construction or expansion of the related infrastructure.

Finally, it can be subsidies and grants for strategic projects.

The company can also decide on direct investments, including expansion, modernization, reconstruction or construction of a new infrastructure facility. In the context of infrastructure investment, so-called intangible investments are important, including R&D expenditures, which play a critical role in sectors such as communications and energy supply.

Infrastructure investments can be classified according to the source of funds. Here we are talking about public, private and public-private investments made jointly by both sectors.

Infrastructure is characterized by specific features that determine the planning and implementation of investment projects.

Obviously, these features influence the choice of financing models.

• Specific objectives: infrastructure facilities provide public services in the area of production or consumption, therefore financing of such projects is important for the whole society.

• Structural cohesion: Infrastructure projects usually require the construction of the entire facility to achieve planned functionality.

• High capital intensity: the construction and operation of infrastructure facilities are associated with significant costs with a long payback period.

• Longevity: Once built, infrastructures can define the landscape of production and population systems for an extended period of time, continuing to serve for decades or even centuries.

• Lack of mobility: infrastructure facilities are permanently connected to a specific region, which implies the use of local services.

The above information reflects the specifics of the infrastructure.

Funding models for infrastructure projects should take into account capital intensity, high risk and long investment project cycle.

This limits the financing options available, and sometimes excludes the participation of a private investor who expects a return on capital invested in the shortest possible time.

Fundamentals of financing large infrastructure projects

Funding for socially significant infrastructure projects is based on three principles, which clearly indicate the distribution of responsibilities between private companies, authorities, other institutions and users:

• Principle of financial responsibility: public authorities are responsible for project preparation, while private partners are largely responsible for construction and operation.

• The principle of decentralization: each part of the project is carried out by the participant who is most effective in the given conditions. The state usually provides technical assistance, subsidies and regulation of the process.

• Principle of microeconomic optimization: this principle is widely applied to users who cannot be directly attracted to finance construction.

In the case of financing private infrastructure projects, the situation changes dramatically.

According to these principles, responsibility, including investment risk, is allocated mainly between private companies and users.

The financial participation of the state in the implementation of large infrastructure investment projects is determined by numerous factors, including the economic activity of the state, its propensity to invest in public projects.

In addition to financial motives, the private sector can participate in financing infrastructure projects (investment loans) for the following reasons:

• An infrastructure project is essential to achieving business goals.

• Allocated public funds are insufficient to finance the growing business needs for maintenance and infrastructure development.

• The participation of private equity in infrastructure investments is a significant factor in negotiations with the authorities.

• Companies strive to serve the community by providing infrastructure services at a reasonable price, quality and quantity.

In the 1990s, Europe saw a shift in responsibility for the transport infrastructure network and utilities, from state to corporate, as it required the highest possible return on investment.

Today, private companies build, operate, maintain and upgrade numerous roads, bridges, tunnels, seaports and terminals, water treatment plants, gas pipelines and oil pipelines around the world.

All this reflects a clear trend towards shifting responsibility for public projects to private companies.

Against this background, the search for funds to finance large infrastructure projects has intensified, since business is looking for the most convenient and profitable sources both in the form of investment loans and in the form of combined PF instruments.

Private equity in financing infrastructure projects

In many European countries, the provision of infrastructure services is still the responsibility of municipalities, which determines their key role in such projects.Municipalities are involved in infrastructure construction in a variety of ways:

• Implementation of projects using the resources of the local community.

• Creation of special purpose vehicles to attract external financing.

• Inclusion of private companies in accordance with applicable law.

Project finance is a principle in which the tasks of municipal authorities are partially shifted to an SPV (Special Purpose vehicle) created for these purposes.

This approach is becoming more common.

As previously outlined, the public sector's objectives in the provision of public services are changing in recent years. Although such projects are traditionally considered unprofitable, it should be noted that there has been a significant increase in the attraction of private equity through SPVs for the implementation of infrastructure projects.

This method of financing has certain advantages for local authorities.

First, an SPV can raise significantly more funds than the limits set for municipal companies in many countries.

Second, paying off the investment loan disciplines utility companies, making them more efficient.

Finally, attracting private investors through SPVs requires significantly less bureaucratic procedures than financing directly from the budget.

To avoid abuse in the implementation of infrastructure projects with state participation, it is important to ensure maximum transparency of investments with the involvement of professional financial and management teams.

In general, insufficient investment in infrastructure with limited resources of the state budget is today the main motive for finding new solutions that would make infrastructure projects more profitable for the private sector.

The starting point for private participation in infrastructure investment is the emergence of management initiative. According to this principle, the management of a public service provider or the management of a private company should be based on the same principles.

This management approach delivers customer focus, efficiency and innovation with benefits for business and society as a whole.

Despite the current significant differences between the management of public and private entities, in both cases the goal is to improve efficiency and increase the value of the company.

Why does this approach find application in infrastructure investment?

It should be borne in mind that the traditional management of infrastructure and the provision of public services by state-owned companies has become ineffective.

The reasons for attracting private equity may be as follows:

• Failure of the public sector to provide adequate quantity and quality of public services in the municipal sector.

• Chronic budget deficits and insufficient motivation of local government to work effectively on infrastructure projects.

• Growing social expectations and environmental demands.

On the one hand, modern conditions have required public authorities to train the private sector and use effective mechanisms already developed in this sector.

On the other hand, they opened the way for private companies.

Thus, models of financing infrastructure projects have emerged, involving increased participation of the private sector in the ownership and / or management of infrastructure facilities.

Infrastructure service models

Currently, there are different approaches regarding the allocation of costs, risk and, as a result, the sharing of rewards.We can distinguish four models in the provision of infrastructure services.

Table: Comparison of infrastructure service models.

|

Ownership

|

|

| Public | Private |

|

German model: public ownership public management |

British model: private ownership private management |

|

French model: public ownership private management |

Industrial model: private ownership private management |

In the traditional (German) model, the responsibility lies with the municipality.

The British model combines the functions of owner and operator in a private company. The private initiative to finance infrastructure services or investments is supported by a related UK government program.

Management contracts, leasing, concession are options of the French model, in which the operator is selected by the municipality through a tender. Without losing control over the infrastructure, the commune can ensure efficient management and modern technology.

Finally, the industrial model refers primarily to industrial infrastructure.

Here, a private owner hands over the infrastructure to specialized operating companies in order to improve efficiency and reduce operating costs.

Each of the listed models has its own advantages and disadvantages. Thus, the German approach to infrastructure projects ensures low cost of public services. On the other hand, the British approach is more flexible and less bureaucratic, independent of politics.

The experience of other countries shows the feasibility of using individual models for specific activities. The German model finds particular application in the water supply, sewerage and heating sectors. It is used in Germany, Portugal, the Scandinavian countries and the USA.

The British model is only popular in the United Kingdom in the water and wastewater sector. The French model, which dominates France and the developing countries of South America, focuses on the wastewater, heating and waste management sectors.

Finally, the industrial model is appropriate when a company that owns an infrastructure wants to improve its functioning. Local government policies also play an important role in this matter.

The World Bank, promoting the French model, describes options for financing infrastructure services in the context of the growing private sector participation in these activities.

BOT, BOOT, concessions, leasing, public-private partnerships, management and maintenance contracts – the implementation of these projects today takes a variety of forms.

An individual or company can participate in infrastructure financing, infrastructure management, and both. Such cooperation can be carried out in the form of leasing, concession, sale of assets or the creation of joint ventures.

Investment loans for infrastructure construction

An investment loan is a type of loan provided to companies to finance new investment projects.This type of financing is characterized by a significant amount of available funds.

To obtain an investment loan for the construction of infrastructure, a company usually needs to make a contribution of up to 20-30% of the total planned investment costs.

LBFL is ready to provide an investment loan on the most favorable terms with an initial contribution of the project initiator of 10%.

Investment loans for businesses can be provided for up to 15-20 years.

This option has a number of significant advantages. First, the company can repay the loan before the agreed period expires. Secondly, banks can provide grace periods.

Obtaining an investment loan

Investment loans can be used exclusively for investing in a specific project.With this financial instrument, companies can buy real estate, vehicles, building materials, special equipment, patents, technologies, etc.

To determine the best option for financing an infrastructure project, it is recommended to consult with a financial expert who can assess the investment risk and select the most suitable product.

An important condition for obtaining an investment loan for the construction of infrastructure is the preparation of documents. The list of documents may differ depending on the financial institution, client profile or investment project.

The main documents for obtaining a loan include:

• Business plan. This document should convince the bank that the investment will be profitable and the company will be able to pay off the debt.

• Financial documents showing balance sheet and assets.

• Statutory documents of the recipient company.

The basis for obtaining an investment loan is always a well-written business plan.

If the company can convince banks of the correct use of borrowed funds, this will be the key to success.

When applying for an investment loan, it is important to provide appropriate collateral and confirm the financial performance of the company for the required period.

Investment loan cost

The cost of an investment loan for infrastructure projects can vary widely.Since projects of this kind are often implemented in cooperation with government agencies, the authorities can act as a guarantor of debt repayment.

Regardless of the choice of the lender, the company must consider the cost of the investment loan.

In many banks, the commission is set individually, but most often it ranges from 1 to 5%. To this should be added the bank's margin (depending, among other things, on the conditions of the loan, creditworthiness or type of collateral), the application processing fee and the early repayment fee.

Some banks, wishing to attract a client, often refuse additional fees, so it is important to get acquainted with all the available offers and competently negotiate with the bank.

Given the interest of national and local authorities in the implementation of public infrastructure projects, the interest rate or other conditions on the investment loan can in many cases be adapted to the needs of the project.

The role of project finance in infrastructure development

The above features of infrastructure projects require careful planning of projects, given their high capital intensity and long payback period.Among the features of project finance for infrastructure projects, it is worth noting the use of high financial leverage, lending to companies without an operating history, and a complex structure of project participants.

History of project finance: global experience

The project finance method is applicable to many investment projects.PF as a concept based on the use of private capital to finance investment in public services has a long history. As early as the 18th and 19th centuries, the road network was renewed in England, where the source of return on private investment was the toll for the use of the road.

The development of railroads, water, electricity, and telephony in the 19th century also required private equity. In the first half of the 20th century, the state assumed these responsibilities in many countries, but over the past 25 years, the process has reversed again.

Project finance in natural resources (coal, oil, gas) began in the 1930s in the United States.

This was followed by the development of oil fields in the North Sea (1970s) and other projects related to the development of mineral deposits in Australia and other parts of the world.

The use of project finance in the energy sector also began in the United States, where the Private Utlity Regulatory Policy Act was adopted in 1978 to support the development of private energy production (IPPs, or Independent Energy Projects).

A consequence of the processes of privatization and deregulation in the United States were similar processes in the energy sector in the UK in the early 1990s and then around the world.

The growth of PF over the past 20-25 years is mainly associated with global deregulation processes.

Co-financing of public infrastructure such as roads, public buildings was particularly intensive in the UK in the 1990s thanks to the Private Finance Initiative (PFI).

Currently, these projects are called public-private partnerships.

One of the areas of use of project finance for infrastructure projects is also telecommunications, in particular the financing of mobile networks, which developed intensively in the late 1990s.

Today, project finance is also supported by the internationalization of investment processes.

Leading investors, consultants and lenders have projects from all over the world in their portfolios and use the experience gained in numerous projects.

Project finance is perceived as a method of financing large and complex investments with increased risk. However, there are no restrictions on the amount of debt, so the use of the PF is possible for relatively small projects, including those implemented in small settlements for the local community.

New opportunities for infrastructure projects

As already mentioned, PF is a method of financing capital-intensive, usually long-term investment projects.This fully applies to infrastructure projects.

Savings on the scale of the project, capital intensity, long construction period - these features force investors to use project finance tools. The use of high leverage means the need to provide appropriate securities to guarantee creditors debt repayment.

Due to the need to issue securities and the high risk of infrastructure related activities, companies are looking for new solutions.

Off-balance sheet financing of infrastructure projects allows companies to make investments without risking other commercial activities.

SPV enables off-balance sheet financing and lending to a company without an operating history or high credit rating.

At the same time, the project company allows companies to control all the cash flows that ensure the safety of the project. The PF is also suitable for financing infrastructure projects that cannot quickly generate reliable cash flow.

Significant cash flow generation can be guaranteed by take-or-pay contracts.

Where such contracts can be used, project finance can also be used.

Take-or-pay contracts can be successfully used in infrastructure construction in areas such as energy, water supply and sanitation. Projects with payment for services (Shadow-toll scheme) relieve the project from market risk.

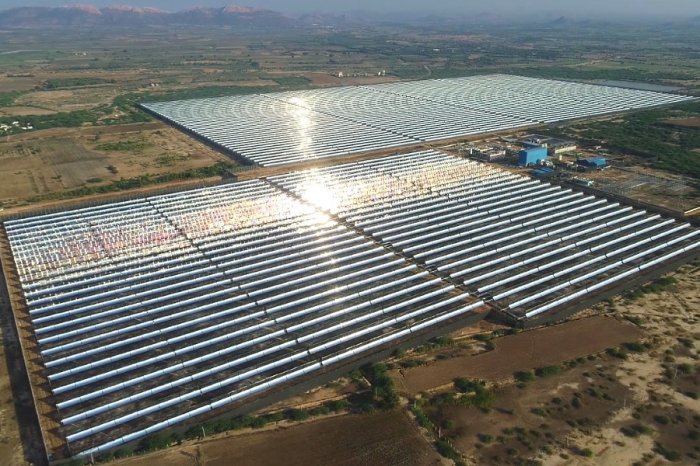

The scope of this mechanism may include, but is not limited to, refineries, solar power plants, seaports, roads and bridges.

Also, PF can be used for investment in real estate (residential, commercial, industrial), including social infrastructure (culture, leisure, recreation).

In the latter case, the return on investment is ensured through a stable cash flow from rent or through agreements with the local community. To use the PF, the project must be self-financed, and future financial flows must be secured through contractual relationships with stakeholders.

Typically, project finance is used to finance new investment projects, although it can also be used to refinance and modernize existing facilities. Today PF is widely used in international projects, opening up new business opportunities.

Our investment services in Europe and beyond

The international company LBFL (Spain) provides a full range of financial services related to the construction, modernization or expansion of infrastructure around the world.We offer financing for large infrastructure projects of all types.

Our interests cover the following projects:

• Highways and bridges.

• Sea ports and cargo terminals.

• Power plants, substations and transmission lines.

• Wastewater treatment facilities.

• Oil and gas pipelines.

• Social infrastructure, etc.

Interested in raising funds for the implementation of large infrastructure projects?

LBFL consultants will answer any of your questions regarding investment lending and project finance.