To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Since the financing of transport infrastructure projects has traditionally been the responsibility of the state, public-private partnership (PPP) instruments with the direct participation of central governments and local governments play an important role in this context.

Link Bridge Financial LTDA LBFL, an international company headquartered in Spain, has brought together a team of experienced financial and investment experts from different countries to help private companies and government agencies in financing PPP projects (toll roads, bridges, subways, train stations and more).

Among other things, we offer long-term loans, credit guarantees, project finance (PF) schemes, investment engineering services, project management, and much more.

Contact an LBFL representative to learn more and benefit from advanced solutions for your project today.

The role of PPP in the financing of transport infrastructure

The fulfillment of the entire range of tasks for the development of transport infrastructure cannot be fully borne by the state.A very promising mechanism for attracting free funds is public-private partnership, which over the past few decades has become one of the most important innovations in public investment policy around the world. However, despite the highest potential, experts draw attention to the many constraints in financing PPP projects that are typical for developing countries with immature financial markets and imperfect legislation.

Constraints on funding public-private partnership projects include the following:

• Insufficient development of the legislative framework.

• Corruption and excessive political interference.

• Inefficient planning and operation of facilities.

• Insufficient support from the state.

• Slow standardization processes.

• Lack of experience etc.

The world investment practice shows that the introduction of various models of public-private partnership in the transport sector is gaining momentum.

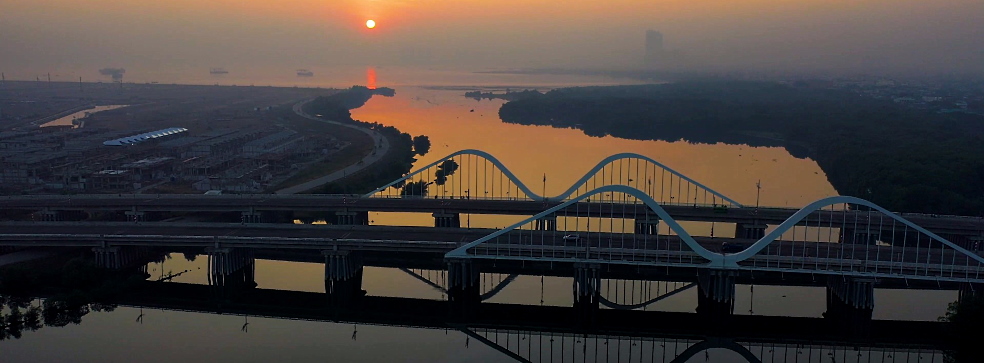

This is especially noticeable in the construction of roads, large tunnels and bridges, which ensure the successful implementation of strategic transport development programs under the control of the government.

In order to attract private capital, effectively manage projects and introduce modern technologies, it is important for the state to find such an economic and organizational mechanism that would support the interest of private investors. In addition, it is necessary to organize a fair tender procedure based on an effective system of criteria for evaluating proposals and increasing the chance for successful implementation of a transport infrastructure project.

This approach also reduces the overall social costs and risks associated with the project.

The need to develop public-private partnership mechanisms and attract non-budgetary sources of financing can be largely explained by the scale of the tasks of developing the transport system, along with the limited resources of governments.

The most common PPP models applicable to the transport industry include the following:

• Concession agreements of various types and structure.

• Government contract for the maintenance of an infrastructure facility.

• Life cycle contract and other types of contractual relationships.

At the pre-project stage, when property rights are clearly defined, an investment agreement is concluded between the state and a private investor with the establishment of a capital structure and rights to the created objects. An agreement can also be signed for capital investments in a state-owned facility, according to which investors return their funds during the operation of the facility.

Financing schemes for PPP projects in transport infrastructure

The concession agreement is considered the most common organizational structure in terms of the number of transactions and the amount of private capital raised to finance infrastructure projects in the world.The concession is widely used for the implementation of socially significant projects, making it possible to harmoniously combine the interests of private companies and the state.

The interest of the parties in signing the concession agreement comes from three main principles:

• The concessionaire is responsible for the construction and operation of the facility with a clear understanding of how to minimize the cost of construction and long-term operation.

• Investments in infrastructure construction are based on mutually beneficial financial terms.

• The organization of the project allows financing faster than through budget financing.

These principles significantly expand the freedom of partners in drawing up an agreement.

Life Cycle Contract, which in some countries is called DBFM (Design-Build-Finance-Maintain), is one of the varieties of concessions. This type of contractual relationship provides for the operation of infrastructure facilities free of charge, in contrast to the concession model, which is based on the principle of paid services (toll roads). In this case, the government enters into a contract for the design, implementation and operation of the facility and makes payment to the private contractor after the commissioning of the facility and during its life.

The operation and maintenance of the facility is entrusted to a private partner in accordance with the terms of the contract.

The contracts developed under this scheme for the transport industry are complex long-term contracts of an investment nature. On their basis, a private contractor-investor designs, finances and builds a highway or other infrastructure facility, and then manages the facility for a long period of operation, ensuring the maintenance and repairs at the service level specified in the contract.

Thus, the main sources of financing for PPP projects in transport infrastructure include funds from budgets of different levels, funds from the private sector, resources from credit institutions, funds from international financial institutions and private investors, and funds from institutional investors.

The high cost of capital in developing countries imposes some restrictions on the financing of PPP infrastructure projects. In such countries, two schemes for financing complex long-term contracts seem to be the most appropriate. Both schemes are variants of PPP with the involvement of non-budgetary sources of financing for the implementation of the investment part of the project.

The first scheme involves the design and construction of a transport facility at the expense of budgetary and non-budgetary sources of funding. During the design and construction phase, the contractor receives a partial payment for the work performed (usually 50-80% of the cost of the work), financing the rest of his costs from his own and borrowed funds. The rest of the cost of the investment part of the project, including compensation for the cost of attracted private capital, is paid to the contractor during the operation phase.

Also, during the operation phase, the contractor receives regular payments for maintenance and repairs from the state customer.

The second scheme involves the design and construction of transport infrastructure entirely at the expense of non-budgetary sources of funding. Design and construction works are fully financed by the contractor at the expense of his own funds and attracted financing (credits, bonds, etc.). The government starts paying for the investment part of the project, including compensation for the cost of attracted private financing, from the moment the facility is put into operation.

Payment is made in regular installments until the expiration of the contract.

During the operation phase, the contractor receives regular payments from the state customer for the main order, as well as for the maintenance and repair of the facility.

These schemes are characterized by different levels of risk for potential contractors and different expected rates of return and other performance indicators. The need for private capital in the second financing scheme is much higher, due to the longer period for the project to be paid by the state. This approach is considered more risky for banks and is more dependent on loans, and also imposes higher requirements on the sustainability and solvency of the project.

In the world practice of financing, there are a large number of financial mechanisms through which PPP projects are implemented.

These mechanisms vary depending on the sources of funding:

• Funds from budgets of different levels.

• Funds of public financial institutions of all types.

• Resources of private companies and investors.

• Funds of public structures and non-profit organizations.

• Credit resources of local financial institutions.

• Funds of international financial institutions (IFIs).

Financing of infrastructure PPP projects is implemented through various mechanisms, the most common of which are corporate finance, project finance (PF) and public funding.

In general, PPP includes a wide range of multilateral contractual relations between the public and private sectors in the field of transport infrastructure development.

World experience in using PPP in financing infrastructure projects

Between 1990 and 2015, 1,653 public-private partnership projects were developed in the transport industry, of which 10.5% were for construction and reconstruction of airports, 7.7% for railways and 25.9% for seaports.The largest share (55.9%) of PPP projects was implemented in the areas of construction, reconstruction and repair of roads, bridges and highways. The volume of public-private partnership investments in the road industry over these 25 years amounted to 248.35 billion US dollars, of which 67.4% accounted for concession agreements.

Analysis of the experience of foreign countries in the field of financing PPP projects shows some differences in such funding. For example, in the United States, the decisive role in PPP is played by the state, whose leadership is the most important factor at the stage of project approval and in the process of its implementation. State control takes the form of regulation of tolls, rates of return on investment, as well as supervision over the operation and technical condition of facilities.

Public companies play an important role in public-private partnerships in the United States.

These are large enterprises created by the government, as well as state and municipal governments on a commercial or non-commercial basis.

Such companies are always owned by the federal government or local authorities.

The development of PPP projects in the United States is regulated by the Ministers of Economy and Finance, as well as the Department of Defense and other central authorities. Innovative forms of PPP project funding should also be identified. In the United States, State Infrastructure Banks (SIBs) have been established since 1995 under the National Highway System Designation Act to provide affordable loans for municipal transportation projects.

SIBs can issue bonds backed by the bank's capital and payments on loans from a pool of local borrowers, which helps reduce risk for investors. The SIB also offers credit guarantees that allow private sponsors to borrow money at lower interest rates, as well as grants. However, SIBs cannot use public funds as grants.

Through this structure, the government can increase its debt limits, especially if the debt is secured by fees for the use of toll infrastructure or other fees.

In Canada, PPPs transport infrastructure projects are actively implemented primarily at the regional level.

The state organizes its regulatory activities in the field of partnership with private business in three main areas:

• Formation of the general strategy and principles of business relations with the society as a whole and with the state power.

• Establishing a favorable legal environment for the development and implementation of partnership projects.

• Direct organization and management of public-private partnerships, including regulation of financial mechanisms.

The main feature of PPP is an adequate added value, sufficient to interest potential participants.

The Department of Finance and the Public-Private Partnership Center are fully responsible for the implementation of PPP projects in Canada.

In Germany, the Ministry of Finance and regional financial authorities, as well as communities, are responsible for the development of PPP infrastructure projects. Two financing models are used, such as project finance (raising private capital against future financial flows of the project, without a guarantee from the public sector) and forfaiting (financing with guarantees from the public sector).

The organization and management of PPP projects in France is carried out by a specially created PPP Development Center, which is a structural unit of the Ministry of Finance.

The main forms of public-private partnership in France include concessions and leasing agreements. It is important to note that PPP projects are mainly implemented in the field of transport infrastructure. 95% of projects are implemented at the local level. PPP projects are financed mainly from budget funding and private corporate sources.

The main form of PPP contracts in the UK is the so-called private finance initiative, in which a private company receives an order from the state (agency, local government or other public institution) to provide certain services. A special infrastructure financing center has been set up at Her Majesty's Treasury to ensure the sustainable development of infrastructure projects and attract additional funding.

Project finance (PF) is considered to be the priority method of financing PPP projects in the United Kingdom.

In Austria, Denmark, Australia, Israel, Finland, Spain, Portugal, Belgium, Greece, South Korea, Ireland, Singapore, much of the funding goes to PPP projects related to the construction and modernization of roads.

They lag far behind other infrastructure projects, including health, education, water and sanitation.

In the group of Eastern European countries, which includes Bulgaria, the Czech Republic, Hungary, Croatia, Poland, Romania, the Baltic countries, PPP projects are mainly implemented in the field of transport infrastructure: construction and reconstruction of roads, ports, railways, bridges and tunnels, light rail (LRT) and airports.

Link Bridge Financial LTDA LBFL is ready to offer a full range of investment, engineering and consulting services for large companies and government agencies, including financing of PPP projects.

The geography of our services already includes Spain, Germany, Great Britain, USA, Saudi Arabia, Brazil, Mexico and other countries.

We are constantly expanding and offering clients new benefits for financing large infrastructure projects.

Contact us to find out more.