To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Choosing the most appropriate project finance model is critical to the success of capital-intensive projects in areas such as renewable energy, heavy industry, infrastructure, oil and gas, mining, environmental projects or agriculture.

Link Bridge Financial LTDA LBFL, a finance and investment company with over 20 years of international experience, is ready to provide your business with a full range of professional services in the field of project finance (PF), lending, financial modeling and consulting.

We actively cooperate with leading banks and financial institutions around the world, offering our assistance to clients from the European Union and the United States, Canada, Australia, Latin America, the Middle East, China, Southeast Asia and Africa.

Our financial solutions have helped our respected partners to implement multi-million dollar projects in different parts of the world, confirming our high professional level, customized service and client-oriented approach.

Corporate finance versus project finance model

In today's volatile and uncertain world, managers of large companies who make strategic decisions must take into account global trends, being very sensitive to changes in the financial environment.The current instability of the world economy is directly related to the impact of factors such as changes in consumer and business behavior, transformation of the legal system, rapid globalization and the destruction of old economic and political models.

Under the new conditions, the ability of managers to formulate forecasts, as well as their accuracy in terms of assessing future economic processes, are of enormous importance for the functioning of the company. This becomes the key to the success of investment projects and guarantees the timely provision of the necessary financing. Mistakes made in the process of preparing and implementing investments can lead to serious problems with attracting external financial resources and the loss of competitive advantages.

Processes such as globalization, ubiquitous computerization and the sharp increase in the influence of financial markets on the real economy mean that processes within companies have also accelerated significantly.

As a result, it becomes increasingly difficult to make the right investment decisions and build reliable models for financing large projects in the long term.

The ability of any company to raise capital to finance investment projects depends on its financial condition, debt service potential, the state of the global financial market and, consequently, on the legal and organizational mechanisms for raising capital offered in this area. Since investment projects usually look impressive against the background of the current activities of a particular company, in practice they are rarely financed entirely from the company's internal resources.

Usually, when planning capital-intensive investment projects, such as the construction of power plants or factories, it becomes necessary to attract debt financing. Commercial banks play a dominant role as providers of capital for such projects.

Other sources of funding may include international financial institutions (such as the European Bank for Reconstruction and Development) and financial markets that help raise additional resources through the issuance and placement of securities nationally and internationally.

Comparison of project finance and corporate finance models

The method of financing a particular investment project should be closely related to its specifics and method of implementation.In practice, there are two main forms of investment implementation. This is traditional corporate finance and the so-called project finance.

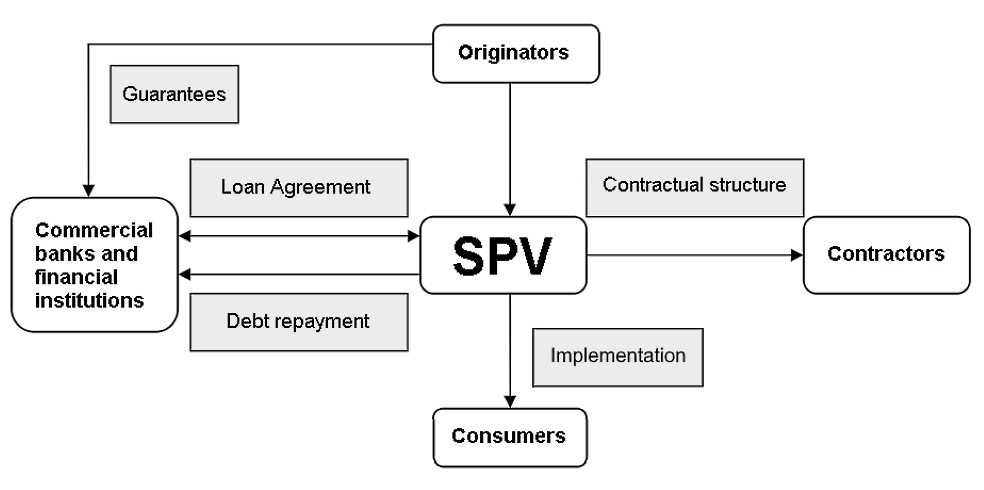

In the latter case, investment projects are carried out within the framework of a special project company (SPV), created for the implementation of a specific project, that is, a legal entity with no operating history and with limited growth potential.

Investment projects implemented according to this formula are usually characterized by a high level of financial leverage due to the use of a significant percentage of external financing (usually in the form of a bank loan). Since the source of repayment of the SPV's debt obligations is the surplus funds that will be generated in the future, the main area of the project analysis is its financial viability and sustainability.

When deciding whether to participate in a specific project, capital providers prioritize indicators such as Net Present Value (NPV), Internal Rate of Return (IRR), and Debt Service Coverage Ratio (DSCR).

Under this approach, all assets created as a result of project implementation or assignment of future receivables based on project revenues become collateral for debt financing.

It should be noted that in practice the project finance formula in its pure form is usually used to finance economically and legally independent projects.

Usually these are new projects (greenfield) that did not work within the framework of the previous activities of the enterprise. This approach is characterized by a very high ratio of borrowed funds to equity capital, since borrowed funds raised on the basis of project finance can cover up to 90% of the total investment costs of a project.

With regard to debt financing in accordance with PF principles, the project sponsors do not provide any guarantees under the SPV (non-recourse financing) or are liable for the project's debts to a very limited extent (limited recourse financing). In providing debt financing, lenders are guided by the borrower's capacity to pay principal and interest (debt service) from the projected future cash flows generated by the project.

At the same time, the value of the borrower's assets and its previous financial results are of secondary importance when lenders make a decision to participate in the project.

This type of financing for investment projects has many advantages in the era of global economic transformation:

• Diversification of risks. Due to the high level of external capital in the financing structure, the risk associated with the project is borne not only by the company sponsoring the project, but also by financial institutions.

• Off-balance sheet nature of debt. In the case of a loan taken by an SPV, the debt does not burden the sponsor's balance sheet, but will only appear in the consolidated financial statements.

• High creditworthiness of a special project company. By separating a capital-intensive project into a separate structure, sponsors can raise much more resources than traditional corporate finance models.

• Flexible terms. Key financing conditions are tailored to a specific project and are aimed at tax optimization.

At the same time, experts note some shortcomings of project finance, such as an increase in the level of costs for raising borrowed funds.

Due to the higher risk, banks expect high margins. At the same time, the volume and cost of project documentation, the complexity and duration of multilateral negotiations, increases significantly. It is also possible for the lender to intervene in the preparation and management of the project.

The traditional formula of corporate finance is the financing of an investment project within the framework of an already operating organization with a certain history, strong assets and a stable structure of funding sources.

In this case, a special company is not created, therefore the risk of the project is directly related to the risk of the borrowing company arising from current activities.

Thus, the risk is not separated from the main business, but the debt of the initiator of the project increases. This significantly limits the investment opportunities of companies, preventing the simultaneous implementation of several capital-intensive projects.

Capital providers in the case of corporate finance seek to exercise tight control over the borrower's activities:

• Contractual clauses limiting the scope of current commercial activities.

• Obligation of the borrower to perform certain actions and maintain certain financial performance.

• Prohibiting certain actions, such as the disposal of assets or the acquisition of other companies.

Linking an investment project to the rest of the business has many benefits.

For example, if necessary, the initiator can support the project with additional funds received from the current activities of the enterprise. As a rule, this approach gives a lower cost of debt financing. However, sponsors should consider the many risks associated with other company activities.

The table shows a comparison of the characteristics of projects implemented according to the formulas "Project finance" and "Corporate finance".

| Feature | Project finance | Corporate finance |

| Special purpose vehicle establishment |

|

|

| Debt financing without recourse to the borrowing company |

|

|

| Debt financing with recourse to the project sponsor |

|

|

| Optimal risk diversification from the point of view of the project sponsor |

|

|

| High cost of borrowed funds due to financing risk |

|

|

| In-depth assessment of the creditworthiness of the borrowing company |

|

|

| Maintaining high creditworthiness of project sponsors |

|

|

| Off-balance sheet financing |

|

|

| Optimization of taxation |

|

|

| Lender's interference in the sponsor's activities |

|

Regardless of the formula for the implementation of an investment project, the analysis of financing opportunities should be based on the following two points:

• The impact of a particular source of funding on the cost of capital and the implications of its use for business management. The cost of debt financing is usually lower, mainly due to the rational distribution of financial risks and the so-called tax shield effect.

• The limit of economic rationality of the use of capital from external sources to finance an investment project. Typically, low interest rates, high yields plus moderate sectoral risk encourage high leverage and tip the scales towards the most appropriate project finance models.

Considering the risks, advantages and disadvantages of various approaches to project financing, financial experts recommend using project finance instruments (PF) for new, legally separate large investment projects with a high degree of risk.

This approach allows companies to raise significant borrowed funds without risking their current business activities.

Sponsors retain the ability to simultaneously implement multiple capital-intensive projects due to the off-balance sheet nature of financing.

Choosing a project finance model for large business

A retrospective analysis and comprehensive assessment of the largest investment projects implemented over the past decades in Europe, the United States, China and other regions of the world, allows us to classify the available financing models based on the type of capital provider, the level of project risk, the method of mobilizing financial resources and their main sources.This classification is shown in the table below.

| Criterion | Project finance models |

| Capital provider type | Bank project finance |

| Non-bank project finance | |

| Project risk level for lenders | Financing without recourse |

| Partial recourse funding | |

| Full recourse financing | |

| Method of raising funds and their sources | Financing from the internal resources of the enterprise |

| Financing through long-term bank loans | |

| Financing through investments (placement of shares on the stock market) | |

| Financing through bonded loans | |

| Financing large projects through leasing | |

| Format of banks' participation in the project | Co-financing by several credit institutions |

| Sequential financing with assignment of claims |

In practice, we see predominantly mixed project finance models, which are combinations of different sources and debt instruments on different terms.

A large investment project is difficult to finance through a single source, so stakeholders usually combine instruments that are most appropriate in a specific environment.

Depending on the format of participation of financial institutions in the implementation of capital-intensive projects, one can distinguish the so-called co-financing and sequential financing. These project finance models deserve special attention as they relate to the largest projects requiring the pooling of efforts and capital of several banks and / or non-bank institutions.

Co-financing by several credit institutions

This method of implementing large projects is based on the simultaneous participation of several capital providers.The need for close cooperation is often driven by the significant investment needs of the project (sometimes billions of euros), as well as the desire of banks to reduce the risks associated with an excessive concentration of financial resources on certain projects or sectors of the economy.

Most often, the co-financing model is used in the energy sector, oil and gas projects, infrastructure and transport. Such projects are usually carried out with the participation of international financial institutions (for example, IADB or EBRD).

Large international lenders try to use only the most reliable commercial banks, usually continuing to finance the most difficult and promising part of the project.

Co-financing comes in two forms.

First, it is a parallel project finance model, which divides an investment project into several parts, simultaneously financed by different banks or non-bank institutions. In the latter case, each lender acts within the framework of a quota determined by the agreement, receiving pre-agreed benefits and being responsible for financing their part of the project. As part of this concept, the consortium conducts multilateral negotiations with the borrower, concluding them by signing a loan agreement.

Secondly, this is the so-called syndicated financing, which consists in lending to a project through a consortium loan issued by several banks to one borrower.

Banking consortia have a clear organizational structure and are managed by one or several major creditors who represent the interests of this consortium throughout the investment project implementation period.

In all cases, co-financing provides substantial benefits to the borrower and lenders. The former receives significant financing on flexible terms, while the latter ensure the security of the transaction and comply with the concentration limits set by each bank.

Sequential project financing

The so-called sequential project financing is carried out in cases where a large bank acts only as an initiator of credit operations, subsequently assigning the right to demand the return of debt to other financial institutions.It is an extremely flexible project finance model that is widely used in the implementation of large investment projects around the world.

A feature of this model is a significant amount of fixed costs incurred by the first bank at the stage of collecting information and conducting a comprehensive analysis of the investment project. The quality and volume of the research carried out determines the chances for the success of the subsequent collaboration. Therefore, after the assignment of the rights of claim, the initiator of the financing receives a significant profit.

The need for sequential project financing today is due to strict requirements in the banking sector, including limiting the concentration of credit funds in certain sectors of the economy. In addition, negative changes in the sector can reduce the bank's appetite for a certain project.

In this regard, the bank that started financing the project can get rid of this project by assigning its rights to another institution on mutually beneficial terms. This practice is becoming widespread in the banking sector.

Financing without recourse

This project finance model is considered the most expensive for the borrowing company, since non-recourse financing carries the greatest risk and requires a thorough analysis of the future project by the lenders.In such circumstances, the capital provider assumes all project risks and expects to receive the maximum return on investment, taking into account the potential risks.

The use of this model is possible only for a narrow group of investment projects that meet the following requirements:

• Well-established and mature technology with a high probability of generating adequate cash flows shortly after launch.

• Open and accessible information sufficient for an objective assessment of project risks and forecasting performance indicators.

• Favorable current state and market prospects, allowing the sale of products / services of a particular facility.

• Sufficient raw material base and access to energy sources, as well as the existence of long-term contracts with other strategic partners.

• High level of political stability and predictable legislative base of the project.

Financing without recourse to the borrower requires the creation of a multifaceted contractual structure, which is associated with additional costs for the services of professionals from different fields.

Due to the high risk for lenders and the high cost of borrowed funds, this model is rarely used in practice in the implementation of large projects. However, it has the right to live in a range of capital-intensive industries such as the oil and gas sector and mining and processing of minerals.

In the case of using this model, the capital supplier remains interested in the successful implementation of the project from the first to the last day, taking an active part in project management, design, modeling, obtaining permits and other aspects.

Lenders often engage third parties in an effort to improve the overall success of the investment project.

Partial regression project finance model

Partial recourse financing is also based on a comprehensive assessment of all risks associated with the implementation of an investment project.Project risks are distributed among the participants depending on their competencies, technical and financial capabilities in such a way as to maximize the security of investments. The cost of financing is relatively low, which has contributed to its widespread adoption.

The benefits of this project finance model for the borrowing company include the following:

• Raising significant funds that could not have been obtained through traditional corporate finance instruments.

• Expanding the circle of creditors and obtaining additional resources due to a rational contractual structure and distribution of project risks.

• Possibility of raising the credit rating and further strengthening the business reputation of the borrowing company without additional risk.

The construction of large factories, dams, power plants, railways, tunnels and other capital-intensive facilities always involves significant project risks that are difficult to predict in advance.

For this reason, financing models with partial recourse to the borrower or with complete recourse to the borrower are of the greatest interest to banking institutions seeking to minimize investment risks.

In this case, the project participants take specific financial obligations, distributing responsibility for various aspects of the implementation of a project. At the same time, the sponsoring company can provide part of its assets as collateral, increasing the chances of obtaining an investment loan.

Full recourse financing

The project finance model with complete regression is the simplest and fastest way to obtain borrowed funds, since all risks in this case remain on the side of the project sponsor company.The obvious advantage of this model is the low cost of financing.

The practical application of this model covers the following projects:

• Strategic projects with low profitability, which are of great strategic importance for the state. This group includes infrastructure and social projects, the financing of which is covered, for example, from income from other activities of the borrower.

• Projects with insufficiently reliable loan guarantees that cannot cover all the financial risks of the lender and require collateral.

• Small investment projects that are too sensitive to increases in estimated costs.

• Projects using export credit instruments.

Financing investment projects with complete recourse means zero risk for the lender, with the exception of the risk of force majeure, which in some cases is passed on to the lender in accordance with the terms of the agreement.

This type of financing is used in the implementation of large public-private partnership (PPP) projects carried out under the guarantee of the central government or local authorities of the host country.

This financing model is considered the most suitable for PPP projects. Government bodies control the implementation of such projects and ensure their safe implementation through the provision of appropriate public services, regulation of pricing policy and changes in legislation directly to meet the needs of a particular investment project or the entire sector.

If you are interested in organizing project financing, please contact the specialists of Link Bridge Financial LTDA LBFL.

Our professional team is ready to offer a large loan for the construction and modernization of large facilities for up to 20 years.

We also provide a full range of financial services for businesses, including the establishment and management of an SPV, financial modeling, guarantees, and more.

Project finance models in the context of public-private partnerships (PPP)

Public-private partnership in the broadest sense is defined as cooperation between the public and private sectors aimed at the implementation of large socially significant projects or the provision of services traditionally provided by the public sector.Government control, complemented by private capital, initiative and managerial expertise, enables parties to implement projects more efficiently.

Each party derives benefits from cooperation, proportional to the obligations assumed.

In a public-private partnership, the parties complement each other, working on the part of the overall task that they do best. By dividing competencies, responsibilities and risks between public and private actors, PPP is becoming the most cost-effective way to build expensive infrastructure and provide public services.

Main features of the PPP project finance model are:

• Comprehensive cooperation of public sector with private capital.

• The targeted nature of projects traditionally carried out by government.

• Optimal division of tasks and distribution of risks.

• Mutually beneficial cooperation.

Formally, there are no restrictions in the PPP formula, therefore, almost all government tasks, especially in the field of infrastructure and utilities, can be the subject of such cooperation.

The success of this model is facilitated by the long term contracts, which are concluded for 20-30 years or more. In Europe, there are cases when financing of projects under the PPP formula was provided for a period of 70 years.

A special purpose vehicle (SPV) in public-private partnership projects can perform various functions, including build, design, operate, raise funds, enter into contracts with project stakeholders, and much more. A variety of PPP project finance models are proposed, a summary of which is outlined below.

Build-Operate-Transfer (BOT)

A special purpose vehicle, which is created for the implementation of a project within the framework of the BOT model, is obliged to design, build, operate and transfer the investment object to a third party interested in the project (be it a state, a company or a group of shareholders).The SPV must attract funding sources and carry out all design work, after which the company has the right to operate the facility for a certain period in order to cover all costs and make a profit at the level stipulated by the terms of the contract. Upon the expiration of the agreed period, SPV transfers the facility to the owner (state), who will continue to manage and operate it.

Within the framework of this model of financing PPP projects, a special project company must independently seek funding sources in the local and international financial market.

The sources of capital in such projects are usually commercial and state banks, non-bank financial institutions and international organizations. Since the project is initially considered viable, its operation for a certain period will generate cash flows to return borrowed funds. In this case, lifespan and cash flows are critical for the company to generate sufficient profit.

Build-Own-Operate-Transfer (BOOT)

In this model, a special purpose vehicle builds, owns, operates, and then transfers ownership of the investment to the customer.The BOOT model allows the interested party to start building and operating the facility without initial payment, however, the SPV is allowed to own the project for a certain period of time in order to return the investment and receive adequate profit.

The difference with the previous model is that the SPV is the formal owner of the constructed facility during the agreed period of operation.

Typically, the BOOT project finance model is applied to capital-intensive government projects that the government seeks to implement in the shortest possible time without significant financial costs. In many countries, the law prevents SPVs from owning public interest assets, which ultimately forces project finance to be aligned with other and PPP formulas.

Build-Lease-Transfer (BLT)

In BLT models, a special purpose vehicle builds a facility and rents it out on a long-term lease to a customer, which is usually the government or local authorities.This model most often refers to infrastructure facilities and utilities systems. Since it is a lease, the owner of the asset leases the property to an interested party in exchange for a series of payments, after which he transfers the asset with the final payment.

BLT is tied to several key contributors to funding.

A special project company builds the facility and attracts the necessary funds, banks act as creditors, and government customers are required to lease the facility on pre-agreed terms with subsequent purchase.

Funding for SPV activities is carried out, in essence, through the sale of project assets, so the real owner of the assets will not be the founders or SPVs, but the banks that are responsible for managing the lease. Lenders are not interested in operating the facility, but their interest is mainly in the leasing business (banks simply lease assets to the government).

Design-Build-Finance-Operate (DBFO)

When financing infrastructure projects such as highways or bridges, cash flows come from fees for their use, but sometimes the user pays not directly, but through taxation.In fact, an ordinary citizen who bears the burden of taxes becomes the source of the project's debt repayment. It is a globally widespread practice that enables states to expand and maintain infrastructure.

Payment is made in several payments, which are tied to the real workload of the asset. A dedicated engineering company is responsible for the engineering design and construction of the facility for the government customer, the true owner of the asset.

The SPV must finance the project during construction and the agreed period of operation.

Cash flows from the government are used to pay off debt, pay out to SPV shareholders, and cover the cost of design and construction services.

Design-Construct-Manage-Finance (DCMF)

This project finance model includes engineering design, construction, management and facility financing through SPV / SPE, backed by a long-term agreement with the public sector.This approach is widely practiced in the construction of non-profit facilities such as research stations, closed-type medical facilities and prisons.

In these cases, the SPV is fully responsible for developing the design of the facility that will provide services to the public sector, after which it sets a contractual price for these services. After agreeing on the details of the project and obtaining financing from a third-party source, the company builds and manages the finished object, charging a fee for the provision of services from the state customer.

Thus, the government does not increase its debt, but the budget will have to bear the annual costs of renting the facility.

Ample financial opportunities for large business

These and other mechanisms for the implementation of projects within the framework of public-private partnerships represent only the tip of the iceberg of financial opportunities that project finance opens up.Unlike traditional corporate finance, PF gives private capital tremendous benefits in the form of off-balance sheet financing and high leverage for business development.

Today, project finance models continue to evolve and improve, including increasingly complex contractual structures, legal mechanisms and financial instruments.

The financial team of Link Bridge Financial LTDA LBFL will help your company choose the best path for each investment project by providing flexible long-term financing and comprehensive professional support.