Offering memorandum for investment projects

Link Bridge Financial LTDA LBFL offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

This document visualizes main parameters of the project and the factors affecting its attractiveness and possible ways of investing.

A high-quality offering memorandum may become a serious trump card when looking for investors and agreeing on financing terms.

The potential investor gains a clearer understanding of the transaction, making more informed and safer investment decisions due to the complete and substantiated information contained in the memorandum.

Offering memorandum in practice: definition, goals and stages

An offering memorandum is a document, the main purpose of which is to present the current state of the issuer of securities, as well as the prospects for a specific project or directions for the company's development.In addition, it should contain basic information about the company, including a description of its activities, market, financial results and their objective assessment, as well as prospects for future business development.

The term "offering memorandum" is often confused with the concept of a prospectus, which is incorrect.

These documents are related to different issues. An offering memorandum is an investment document intended for financing by an investor (a group of investors) and providing information about a business or project for decision making.

It should be noted that the draft offering memorandum is not a static document, which in practice means ample opportunities for editing and improving it. The issuer can at any time make changes and modify it so that it remains clear and transparent for the selected circle of investors.

Such modifications are also introduced to enable potential investors to more accurately analyze the value of specific investments.

The offering memorandum includes, among other things:

• Feasibility study.

• Description of the specifics of the business or planned project.

• Comprehensive market analysis and competition assessment.

• Estimated project parameters and financial analysis.

• Evaluation of project constraints and possible risks.

• Investment recommendations.

The key features of the offering memorandum as a tool for attracting funding require the provision of minimal information about the project initiator, an assessment of the project cost at various stages of implementation, as well as justification of the structure of the transaction for investors.

This document should contain a full description of the measures that ensure optimal interaction between owners, investors and project managers in the post-investment period.

The goals of writing an offering memorandum include the following:

• Obtaining short or long term funding.

• Ensuring strategic partnerships with investors.

• Preparation for pre-public offering and IPO.

• Private placement of the company's shares.

• Implementation of the issue of bonds.

• Sale of part of the company.

At the initial stage of creating an offering memorandum, the document is filled with information directly related to this enterprise.

This must be complete reference information, including the name and type of company, location, legal form and type of management, capital and list of shareholders.

The second stage of creating an offering memorandum is to determine the specifics of the activities of a particular enterprise to which it refers. This is understood as the totality of all aspects that relate to the subject of the company's activities. Here we are talking about the type of products sold by the company, the team that deals with specific tasks, as well as the concept of organizing the business.

The next step is the collection and processing of comprehensive information about the financial model of the business.

This information has the greatest impact on the broadly understood return on investment. It is generally recommended that this part of the memorandum be prepared diligently and with great care in order to manage the company's budget even more effectively and attract investments on better terms.

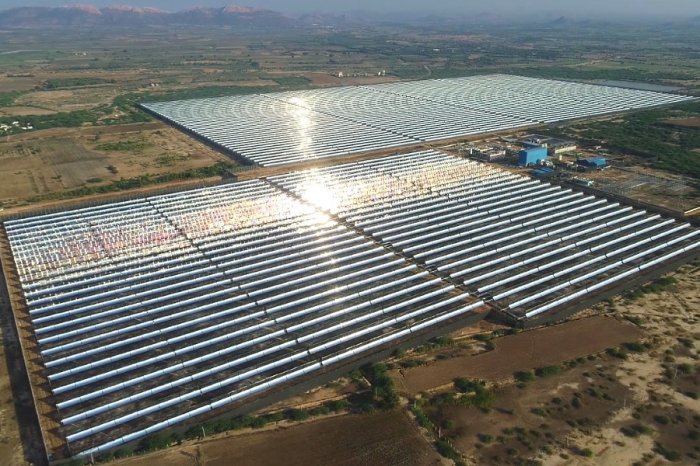

An example of an offering memorandum for business: project funding

The methodology and practical approach to writing an offering memorandum can vary significantly depending on the sector, company or specific project.Below we have given an example in which we have listed the main points and sections to which special attention should be paid when developing this document.

Table: An example of an offering memorandum for a large project or business.

| Section name | General considerations |

| Introduction | The introduction may contain a description of the financed business project, indicating the benefits of this investment for participants. |

| Risk factors |

The risks and limitations of the project are of the greatest interest to investors. This section should include the following:

|

| Persons responsible for the implementation of the memorandum | This section contains a clear and informative statement by the issuing company, presented by the coordinator of the issue of securities. |

| Basic parameters and information regarding emissions |

The section consists of a dozen items, including the following:

|

| General information about the issuing company |

This section of the offering memorandum should give potential investors a clear idea about the company, its level of reliability and financial stability:

|

| Financial statements | The financial statements attached to the offering memorandum are compiled in accordance with current requirements and contain the key information necessary for potential investors to decide on potential participation in the project. |

| Annexes to the memorandum | The list of annexes may vary depending on the content of the memorandum and legal requirements. In particular, such a document may contain an extract from the state court register, the current charter of the issuing company and other. |

Writing an offering memorandum: our services

As we can see, writing an offering memorandum for a large investment project is a complex and multi-stage task, the structure of which depends on the situation and should not be carried out according to a rigid template.If you need support or advice on any investment issues, check out the list of LBFL services and entrust your project to professionals.

The offering memorandum prepared by the specialists of our company will contain all the necessary information about the specifics of the business, a comprehensive analysis of the market environment, and an assessment of existing risks.

All this will help to present your business and a specific investment project in the most favorable light.

Link Bridge Financial LTDA LBFL provides large businesses with a full range of services in the field of investment engineering and consulting, including feasibility studies, development of an investment strategy, business project evaluation, writing an offering memorandum, project financing and much more.

Our approach is professional, comprehensive and innovative, making funding affordable and reliable.

Together with its international partners, including reputable engineering companies and equipment manufacturers, LBFL can offer the construction and modernization of large facilities under the EPC contract.

If you are looking for a reliable investor, please contact our representatives.