Lending and construction finance for offshore wind farms

Link Bridge Financial LTDA LBFL offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

For this reason, companies use a wide range of financial instruments to finance wind energy projects.

Lending, equipment leasing, government subsidies and other sources help develop offshore wind power.

Some energy companies are selling shares in wind farms to raise additional funds for the construction of new wind turbines.

The interest of large investors in such projects continues to grow against the background of the bold plans of the world powers to achieve carbon neutrality in the coming decades. However, the most popular source of funds remains long-term bank loans, readily issued by most financial institutions.

Link Bridge Financial LTDA LBFL provides large loans for the construction of offshore wind farms for up to 20 years.

Below we have summarized the various financial models and instruments that are widely used to finance the construction of offshore wind farms in Europe and other regions of the world.

Selecting funding sources for offshore wind farm projects

The choice of the most suitable sources of financing for investment needs is carried out taking into account the specifics of a particular wind project and the conditions for its implementation.The structure of financing investment needs is influenced by the form of ownership and organizational forms of the company, business objectives for a certain period of time, internal financial policy, etc.

Attracting significant resources using financial leverage opens up broad development prospects for energy companies. However, in many cases, funding comes from the internal resources of the participating companies.

Internal sources of financing for investment projects include retained earnings, accumulated depreciation charges, proceeds from the sale of assets, compensation for losses, etc. External resources are attracted through additional contributions to the authorized capital, issue of shares, government grants and subsidies.

Debt sources of financing for offshore wind farms include funds raised through long-term bank loans or bond issues, leasing of expensive energy equipment or various tax incentives.

The main sources of financing for projects are profits and depreciation charges, which are accumulated by the company in order to finance extended reproduction of capital. But in modern realities, internal sources of financing are mainly used for operating activities, which reduces the possibilities of their widespread investment application.

Thanks to strong government support for wind energy, favorable market conditions and rapid technological development, the conditions for providing investment loans for the construction of offshore wind farms are steadily improving.

This is critically important given the long payback period of such projects.

For a number of reasons, bank loans remain the most affordable tool for attracting investment resources due to the rapid disbursement of funds and the lack of influence of the loan on the distribution of property rights between the owners of companies (as opposed to the issue of shares).

It is necessary to mention other sources like leasing. It refers to the provision of expensive property to the lessee for exclusive use for a certain period. This asset is initially the property of the lessor. For example, equipment with the required characteristics is purchased for a lessee from an appropriate seller (manufacturer).

The acquisition by the lessee of high-value wind turbines, transformers, submarine cables and other wind power equipment on recurring lease payments is an attractive option.

Skillful combination of loans, leasing and other financial instruments helps to create optimal conditions for the implementation of investment projects of any scale.

Assessment of the investment attractiveness of the project

Each offshore wind farm investment project is based on the search for adequate sources of financial resources.The project should give the investor the maximum profit with reasonable risk, therefore the initiating companies strive to do everything possible to ensure the high investment attractiveness of the project.

The investment decision making process consists of the following stages:

• Preparation of an investment proposal.

• Estimation of the future cash flow of the project.

• Analysis of supply and demand.

• Conduct of negotiations.

The future cash flows of a wind power project need to be estimated with reasonable accuracy, knowing that each project involves some degree of uncertainty.

At this stage, it is important not to take into account the irrecoverable costs, because they are not relevant to a specific investment decision.

Investors prioritize criteria such as payback period, internal rate of return (IRR), net present value (NPV) and debt service coverage ratio (DSCR). Below we will look at these criteria in more detail.

The payback period is defined as the period of time required for a full return on the invested funds.

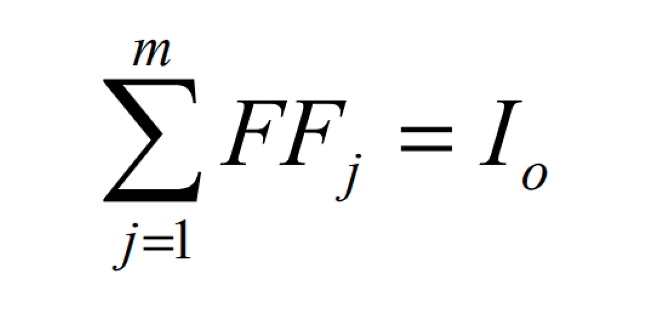

This indicator is calculated using the following formula:

In the above formula, "m" means the point of return on investment; “Io” is the initial investment and “FFj” is the cash flow in the j-period. It is obvious that the investor will choose a project with a lower "m" value.

Some companies set a so-called "cut-off period" beyond which the project is not accepted. For offshore wind farms, the payback period is usually at least 8-10 years.

There is a “maturity with renewal”, which consists in expressing income at current values by discounting at a certain rate. This simple calculation criterion is used to assess liquidity. However, it does not take into account the cash flows after debt repayment, as well as the value of money over time.

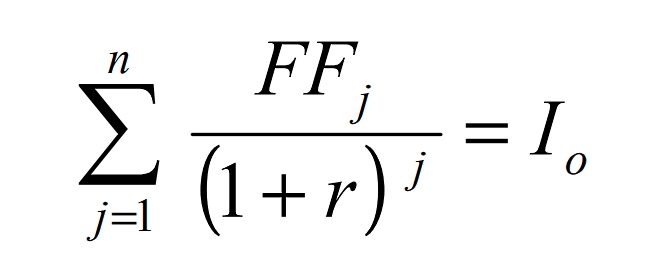

The internal rate of return (IRR) is the rate at which a project reaches zero net present value.

The project is considered appropriate when the above indicator exceeds the cost of capital or corresponds to the company's rate of return.

This indicator is calculated using the following formula:

Once the "R" is determined, it is compared to the minimum rate of return to approve or reject investment proposals.

The advantage of IRR is that it takes into account the cash flows of a particular project, as well as the value of money that inevitably changes over time.

In addition, this method gives an idea of the project's profitability, expressed in terms of the effective interest rate. As for its disadvantages, the method creates a paradox that a high IRR makes a project more attractive, but, in turn, the risk of project failure may increase. Another disadvantage is that the IRR does not provide a clear indication of the magnitude of the project benefit.

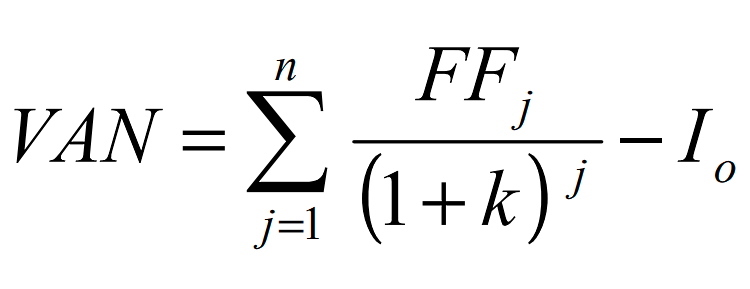

Net present or present value (NPV, VAN) is a clear comparison between the initial investment and the amount of discounted cash flows at a given rate.

The NPV of a wind power project is calculated using the following formula:

An offshore wind farm investment project is considered feasible and acceptable if the NPV is greater than or equal to zero.

Positive NPV values indicate that project financing increases the company's capital. The advantage of NPV is taking into account the time value of funds, and the disadvantage is the lack of an idea of the profitability of the project. In addition, the choice of "cut-off time" is difficult, since specific terms are set arbitrarily by an expert.

NPV shows the value of each project in absolute terms, allowing you to directly compare different projects.

However, financiers argue that the comparison of wind power projects should be carried out in an integrated manner, taking into account several criteria for each project.

Finally, it is important to consider the DSCR (Debt Service Coverage Ratio). It refers to the cash flow available to pay off annual debt payments (principal and interest). DSCR is calculated as the ratio of free cash flow before debt service to total free cash flow.

High DSCR values make the project more likely to access credit. A DSCR value greater than 1 means that the project generates sufficient flows to pay off the debt. Conversely, value less than 1 indicates the financial insolvency of the project.

IRR, NPV and the payback period of the project together will provide the decision maker with the most complete information when choosing a suitable investment project.

Due Diligence processes, the purpose of which is to determine the attractiveness of a project for an investor, turn to the comparison of these and other parameters.

Things to consider when planning an investment

Leading European financial experts point out that the traditional assessment of the attractiveness of investment projects is limited. In practice, many managers seek to be flexible in responding to changing circumstances and thereby adjust cash flows to the real needs of projects.Therefore, when analyzing a specific project, several scenarios should be considered that may arise throughout the life cycle.

The decisions you make affect cash flows and the final cost.

Each business investment project involves some uncertainty and requires flexibility from companies. The real benefits lie in timely decisions such as abandoning an investment project, selling to completion, improving technology or extending service life.

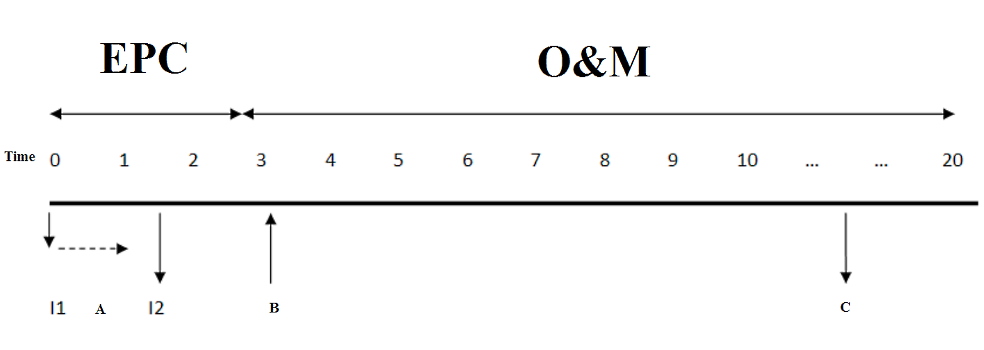

Figure: A timeline for the offshore wind farm project and investment options at each stage.

A – Suspension of the project.

B – Decision to leave the investment project.

C – Decision to expand or modernize the offshore wind farm.

I1 – Assessment of wind resources of the offshore area.

I2 – Arrangement of wind farm infrastructure.

Investment decision options include the following.

The suspension of an investment project may be required until additional information is received about the market situation and other factors that influence investment decisions.

As part of the construction of offshore wind farms, it is advisable to suspend the project in the following situations:

• Lack of resources and equipment to carry out the planned construction works.

• Long-term assessment of wind resources, which improves the quality of the forecast.

• Expected legislative changes affecting the project.

Refusal or closure of a project is usually associated with insufficient prospects and lack of financial resources from the participants.

This is considered a last resort, which could lead to a loss of the company's reputation and a decrease in the potential for further participation in capital-intensive wind power projects.

Possibility of concluding a new contract. If market conditions turn out to be less favorable than initial forecasts, the scale of investments may be reduced. When investing in the construction of offshore wind farms, companies prefer projects that are easy to scale up based on the availability of financial resources and future development scenarios.

The possibility of expanding the project. If market conditions turn out to be more favorable than expected, management may decide to scale up the project. This option can have strategic value, creating opportunities for future growth.

Continuous technological innovation and the downward trend in the cost of megawatt-hour of energy produced offer excellent prospects for considering capacity expansion.

It also comes with additional investment.

Companies developing large offshore wind farm projects may not agree to incur higher infrastructure costs.

This, for example, reflects the cost of installing transformer substations with excess capacity for future expansion.

Various options for engineering and financing offshore wind projects have been a serious research topic in finance since the 1990s. These options deserve in-depth analysis and comparison for each specific project.

Optimal use of modern technical solutions and financial models, these options provide projects with flexibility, increase the value of the project and the participating companies. If you are looking for professional financial consulting services, please contact LBFL anytime.

Reducing the cost of offshore wind farms

The average cost of offshore wind farms in 2021 is about 1.1-1.2 million euros for each megawatt of installed capacity, which means colossal initial investment costs during the construction phase of the facility.Practice shows that attracting external financing is one of the main requirements for the successful implementation of offshore and onshore wind energy projects. In developed countries, the cost of borrowed funds in such projects varies from 4% to 10%, depending on the region, the specific project and the environment for its implementation.

The cost of capital must correspond to the financial indicators of a specific investment project, ensuring the protection of the interests of each of its participants.

For its assessment, various models of financial calculations are used, based on CAPM (capital asset pricing model) and WACC (weighted average cost of capital).

CAPM is a model used to determine the theoretical rate of return that is added to a properly diversified investment portfolio. The WACC is used to determine the cut-off rate by referring to funding allocated to third party equity. The WACC weights the costs of each source of capital used in the project.

Compared to traditional sources, wind farms are characterized by a high proportion of investment costs in the total cost of electricity generation. Since these costs are dependent on the cost of capital, choosing the best financial model for an offshore wind farm project is critical to the success.

So, for a coal-fired thermal power plant, the share of these costs in the cost of energy does not exceed 20-25%.

For coastal wind farms, this figure exceeds 70%.

For this reason, the cost of electricity generated from offshore wind projects is very sensitive to changes in the cost of capital.

An increase in the cost of borrowed funds from 6% to only 15% means a twofold increase in the cost of generated energy. If these costs are transferred to the annual amount of electricity generated, we are talking about additional costs amounting to billions of euros on a global scale.

LCOE of offshore wind farms depends on the following:

• The cost of purchasing equipment and materials.

• The cost of developing technology for offshore wind farms.

• Distance from shore, affecting cabling costs, installation times, O&M costs and others.

• The depth, topography of the seabed and the difficulty of installing equipment on site.

• Wind speed directly affecting the efficiency of wind turbines.

Since the cost of borrowed funds depends on the environment of a particular investment project, participants must take a number of measures to ensure security and create a favorable investment environment.

An important factor is the risk associated with the way the renewable energy sector is regulated and the host country's government support system.

Many developed countries enter into agreements with large financial institutions to provide multilateral guarantees for investors. These guarantees cover the risks associated with changes in the conditions of market regulation and government auctions.

If market rules and government support are predictable and there is a guarantee that acquired rights will be respected, local banks and other financial institutions are willing to borrow money to build a wind farm on favorable terms.

Bank loans for the construction of offshore wind farms

Bank loans are a widespread way of financing large renewable energy projects.This flexible tool enables energy companies around the world to meet their investment needs in a short timeframe.

The advantages of a bank loan are that the high flexibility of the contractual terms helps to best adapt to the needs of a particular project. On the other hand, the borrowing company must provide sufficient collateral, justify the use of borrowed funds and, to some extent, limit its activities at the request of the bank.

Advantages of a bank loan for the construction of wind farms:

• A long-term loan for the purchase of fixed assets and the payment of debts becomes possible without harming the company's budget. The equipment of the wind farm is covered by a manufacturer's warranty.

• The borrower purchases and installs equipment on a prepaid basis, which allows the company to bargain with suppliers and receive substantial discounts.

• The company-initiator of the project continues to build up its competitive advantages by implementing ambitious energy projects quickly and efficiently.

• The stream of income from the use of assets can be directed towards the repayment of the loan.

• The borrower retains the legal right to the collateralized assets, continuing to dispose of them and using them for profit.

• Tax savings due to the inclusion of loan payments in the company's expenses for the reporting period.

• Relatively fast financing procedure.

Banks wishing to maintain a high margin of safety rarely provide loans with maturities in excess of half the expected life of a project.

Thus, long-term loans in the future can be supplemented with revolving loans, which borrowers can use as needed within the limit set in the loan agreement.

The same applies to the so-called bridging financing, but loans to temporarily cover liquidity shortages often come from the sponsors themselves. While investment banks were the main lenders in the case of project finance in the early 2000s, today large commercial banks are actively involved in financing such projects in the form of syndicates.

In addition, the development of global financial markets has led to increased competition and the opening of free access to Eurocredits for many European companies. These are usually very large revolving loans with flexible terms.

Their advantage, in addition to access to a highly liquid market, is the effective management of foreign exchange risk by using other currencies.

International investment loans

Currently, bank loans for the construction and modernization of wind energy facilities are offered by both state-owned banks and large private banks and international financial institutions.The latter play an important role in financing large investment projects related to the renewable energy sector.

The financing conditions depend, among other things, on the legal framework of the destination country. Often these financial institutions provide loans through banks present in the recipient countries, and their high credit rating serves as a guarantee for loans at low rates.

Examples of such financial institutions are the World Bank, the European Bank for Reconstruction and Development, the International Finance Corporation (IFC), DEG, and the Multilateral Investment Guarantee Agency (MIGA), which provides political risk insurance for projects in developing countries.

The World Bank, founded in 1944, is a source of financial and technical assistance to developing countries around the world.

This organization is currently owned by 188 member countries and consists of two development institutions, the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA).

IBRD focuses on middle-income and low-credit countries, while IDA focuses on the poorest countries. These institutions provide loans to developing countries at preferential interest rates for various purposes, including the development of renewable energy sources.

In the crisis year of 2008, the World Bank allocated almost $ 47 billion for various projects in developing countries.

Today the bank is involved in more than 2000 projects around the world.

IBRD offers funding and advice to governments.

The bank operates in market conditions and uses a high credit rating to attract borrowed funds at low interest rates and issue loans at more affordable interest rates

Deutsche Investitions- und Entwicklungsgesellschaft mbH is a member of the KfW Bankengruppe (Credit Institute for Reconstruction, founded in Germany in 1948) and is considered one of the largest financial institutions in Europe for financing capital-intensive projects and companies.

DEG has been financing private sector investments in developing countries since 1962 with the aim of creating new jobs and improving living standards. In the renewable energy industry, the bank actively supports and finances German wind farm builders around the world.

DEG not only becomes an investor, but also offers know-how and business contacts to the market.

DEG usually offers large long-term loans in euros or dollars for up to 25 million euros or more, depending on the project.

The role of export credit agencies

Today, export credit agencies (ECAs) play an important role in financing large projects.These export credit or investment insurance agencies act as intermediaries between national governments and exporting companies in export financing.

ECAs are usually private or quasi-public institutions, which are financed in the form of loans, credit insurance or guarantees. Export Credit Agencies fund hundreds of billions of euros in operations worldwide every year, which is comparable to all other funding sources combined.

An example of ECA is the US Export-Import Bank (Ex-Im Bank), which previously proposed a multimillion dollar program to finance wind energy projects and other renewable energy sources. Other well-known ECAs are Hermes (Germany), Compañía Española de Seguros de Crédito a la Exportación (Spain), Export Development Canada, and JBIC Japan Bank for International Cooperation and others.

If you are interested in a bank loan for the construction of an offshore wind farm, contact Link Bridge Financial LTDA LBFL.

We will find the best financial solution for any project, regardless of its scale.

Project finance (PF) for the offshore wind energy sector

Project finance is a method of financing investment projects, used primarily in infrastructure, oil and gas projects, and the renewable energy sector.Experts highlight certain characteristics of projects implemented within the framework of the PF, but there is no unambiguously accepted definition and there is no consensus regarding the importance of individual characteristics as potential distinguishing features.

The role of project finance for the development of offshore wind energy is extremely important. If in 2010 the share of wind energy projects implemented on the basis of financing without recourse (classical models of project finance) was less than 10%, then in 2020 in some market segments the share of PF increased to 30-50%.

Key characteristics of project finance include the following:

• Establishment of a legally independent design company (SPV \ SPE), which is actively involved in the construction of the wind farm. This company acts as a borrower, isolating the project debt from the initiating companies.

• Capital providers provide financing against the future cash flows of the project, being maximally interested in its launch and reaching the planned capacity within the specified time frame for the return on investment.

• The company implementing the project usually uses high financial leverage with limited opportunities to claim sponsors in the event of a failure. This is limited recourse funding.

• The structure of project financing consists of contractors, initiators, lenders, suppliers and, if possible, end users of the facilities. These parties create a complex network of contractual relationships, aimed mainly at identifying possible types of risks and their distribution.

• Guarantee contracts are usually required at the initial stage of project implementation, since high costs at this stage are not accompanied by income generation and pose a certain risk to lenders. To offset this risk, lenders will require the borrower to sign Power Purchase Agreements (PPAs).

The PF is a special financing mechanism for large-scale investments related to the expected cash flow and their solvency.

This method has grown as a result of increased investment in infrastructure, but today it is often used in renewable energy, environmental and other projects.

This model is based on financing the construction of a wind farm using the initiators' own funds. In practice, financing can simultaneously include equity and borrowed funds in different proportions. In addition to limited recourse and high financial leverage, we consider flexible contract structures and rational risk allocation to be an important advantage of project finance for the construction of offshore wind farms.

Sources of capital in project finance

Ensuring the proper capital structure is essential to the success of a project.It is not only about the capital to debt ratio, but above all about balancing the right sources between limiting recourse and creditors' risk.

Parties should consider the profitability of a particular wind power project and its ability to service debt. Too high capital costs can make the project unprofitable. Since the cost of capital is highly dependent on risk, the task of the bank organizing financing is to create a capital structure that would be optimal both in terms of costs and risks taken by individual project participants.

In addition to obvious economic criteria such as the cost and availability of each source of funding, assessing the suitability of a given instrument for project finance should take into account:

• Flexibility of the instrument in case of unforeseen liquidity problems.

• The impact of this instrument on the project's ability to service the debt.

• The degree to which all available collateral has been used.

• The level of profitability after using this tool.

The most significant source of funds for project finance is external capital, usually in excess of 50% and sometimes as high as 80-90%.

It is considered the most diversified source of capital in terms of instruments.

The main feature of the so-called senior debt, which distinguishes it from the described sources of financing, is its priority repayment of obligations. Senior debt, in turn, is divided into secured (most commonly used) and riskier unsecured debt.

Due to the high capital requirement of a wind power project, funds usually come from several sources. Most often, it is based on a bank loan, but it is most often a syndicated loan provided by several banks.

In addition to bank loans, there are several sources of capital, such as loans from international financial institutions, bond placements in local or global financial markets, leases or obligations to contractors.

These financing methods are summarized in the table below:

Table: Sources of debt financing for offshore wind farms.

| Sources | Brief characteristics |

| Bank loans | Loans are a commonly used form of financing for large wind farms because of the flexibility of banks and their willingness to take on some of the risk that other lenders usually avoid. As a rule, these are long-term loans with a maturity of up to 15 years after the completion of construction, which is especially important for projects with a fairly long payback period. |

| Loans from international financial institutions | International institutions take into account the development of the whole world and individual regions, and therefore they fund energy investments that have a chance to contribute to the prosperity of the region. Interestingly, the participation of well-known international institutions in financing the project increases its credibility and helps to attract other sources of funding. |

| Private placement of bonds | Unlike bank loans, which usually have a variable interest rate, large insurance companies and mutual funds can provide long-term capital at a fixed interest rate. It is an important source of project finance in developed financial markets, especially in the United States and the European Union. The attraction of capital from these institutions takes place by issuing bonds addressed to a closed group of investors. These are usually bonds with maturities ranging from 15 to 20 years. The advantage of this funding source is high liquidity and a fixed interest rate. |

| Public placement of bonds | In the case of large projects, a public issue and placement of bonds is possible. In this case, companies have access to a significant number of instruments, including bonds with variable interest rates, zero-coupon bonds, bonds convertible into shares, and various commercial securities with the possibility of prolongation. |

| Leasing instruments | Leasing is an attractive financing option, especially for the acquisition of capital-intensive machinery and equipment such as offshore wind turbines. Among other things, leasing instruments allow you to take advantage of the so-called tax shield by including lease payments in the company's expenses. This method of financing contributes to the financial flexibility of the company implementing the project, since the lines of credit opened for the purchase of fixed assets can be used for other purposes. |

| Loans from suppliers and manufacturers | The attractiveness of long-term contracts for the sale of materials or equipment means that many suppliers are also willing to financially participate in the project. First, they increase the financial strength of the SPV by ensuring that contracts are executed at pre-determined prices. Secondly, they can participate in equity capital, become sponsors of the project, as well as provide lucrative trade loans. |

| Government support | In the case of strategic offshore wind projects, sponsors can count on government assistance. This can be expressed in the provision of a grant to co-finance the investment. In addition, many countries have established export credit agencies to support local companies. Thanks to the favorable terms of loans provided by these institutions (maturity up to 15 years, fixed interest rate, relatively low interest rate), many projects adjust their structure to this source. |

Link Bridge Financial LTDA LBFL has been organizing project finance for large investment projects in the energy sector for many years.

We are also ready to provide you with professional services in the field of financial modeling, consulting and integrated project management.

Construction of offshore wind farms: the benefits of EPC / M contracts

Today the EPC / M-contract serves as the main model for the implementation of large projects in the field of renewable energy.The EPC / M-model consists in choosing a single general contractor who offers the customer the most acceptable technical and financial solution, further implementing a turnkey project.

The responsibilities of the general contractor cover engineering design, procurement and delivery of building materials and equipment, construction and installation of necessary structures, buildings and structures. The EPC / M contractor is also responsible for the selection and conclusion of contracts with suppliers and subcontractors, taking on the most labor-intensive activities for the implementation of the investment project.

The construction of offshore wind farms usually requires multiple contractors to investigate the seabed, assess wind resources, carry out engineering work, build wind turbine foundations, and install and adjust equipment.

The general contractor can fully or partially entrust these works to subcontractors, distributing competencies in the most rational way.

There are also so-called full cycle EPC contractors who have all the resources to implement the project without involving subcontractors. Obviously, such contractors are considered more reliable.

EPC contracts for the construction of wind farms should be chosen by companies that do not have the material and technical base or personnel to perform the full cycle of work. The EPCM model is recommended for companies that have sufficient professional experience, but who want to add special ideas to the project and control the entire construction process.

Since the construction of offshore wind farms is associated with significant technical difficulties, the EPC / M-model is widely used in this area.

This format allows companies to shift all risks and responsibilities onto the shoulders of professionals with sufficient experience and knowledge.

EPC contract

The EPC contract (Engineering, Procurement, Construction) refers to a special format of contractual relations between the customer and the general contractor, which is responsible for the execution of works on design, construction and launch of the facility on time at a pre-agreed cost.The contractor is responsible for meeting the quality, schedule and estimated costs of the project.

The EPC contract is preferred by companies that do not have the resources and / or the desire to carry out design work and influence the process. By shifting risks and responsibilities onto the shoulders of the general contractor, the customer can fully focus on the main areas of business.

Services under an EPC contract usually include the following:

• Detailed calculation of the project cost.

• Risk analysis of offshore wind farm construction.

• Implementation of a full cycle of design and engineering work.

• Purchase and delivery of materials, construction machinery and equipment to the site.

• Search, negotiation and conclusion of contracts with subcontractors.

• Control over the implementation of construction work and maintaining strict reporting.

• Quality management of construction and installation works.

• Testing and commissioning of the facility.

The EPC model is based on the fact that the general contractor has the necessary professional experience, technology and human resources to carry out all stages of the project from A to Z.

The most important advantages of this model:

• High quality planning and preliminary research.

• The contractor has the maximum interest in meeting the project deadline and budget.

• Fast preparation and implementation of the project thanks to a single responsible person.

• Reduction of legal and financial risks thanks to the experience of the contractor.

• Minimal customer involvement and low requirements for him.

Link Bridge Financial LTDA LBFL with partners has been lending and financing offshore wind farms around the world for many years.

If you are planning a new investment project of increased complexity, we are ready to act as your general contractor and capital provider.

EPCM contract

An EPCM (Engineering, Procurement and Construction Management) contract refers to contracts that provide for the complete management of an offshore wind farm project up to the moment the facility is handed over to the customer, including the fulfillment of warranties by the general contractor.The EPCM contractor is fully responsible for the engineering design, the conclusion of contracts with suppliers and contractors, and manages the investment project as a whole. Such a contractor must have sufficient knowledge and experience to rationally distribute responsibilities between the project participants, control and carry out all stages of construction in accordance with the wishes of the customer.

The EPCM contract for the construction of an offshore wind farm also involves the final setting of the project cost, including a fee to the contractor. The company implementing the project undertakes to strictly adhere to the deadlines.

The list of services under an EPCM contract usually includes:

• Full range of engineering and design services.

• Management of the purchase and supply of equipment, machinery and building materials.

• Professional cargo escort, including quality control and logistics.

• Management of construction and installation works directly on the site.

• Commissioning and commissioning of the facility.

• Control and regular reports for the customer.

It should be understood that the responsibility of the EPCM contractor to the customer is usually limited to the amount of his remuneration, which is provided for in the relevant contract.

Project risks are shared among its participants.

Benefits for the customer

The main advantages of the EPC / M-model for offshore wind power projects are transparent execution and effective control of the customer over the cost, technical solutions and project deadlines.The one-stop-shop approach is especially important for small companies that are unable to dedicate entire sections to negotiate, oversee multiple contractors, and perform a range of complex engineering functions at every stage of a project.

In recent years, EPCM and EPC contracts have become more common in the wind energy sector, reflecting the desire of firms to use more specialized contractors for technically demanding tasks. Against this background, legislation in this area is rapidly improving.

Unfortunately, some developing countries in Asia and Africa still continue to create a legal framework for fixed price EPC / M contracting. For this reason, the implementation of large turnkey projects requires the participation of a professional team of consultants and managers who guarantee the safety, efficiency and success of investments.

On the one hand, an EPC contract in total costs 15-20% more in comparison with work schemes based on direct contact of the customer with contractors and suppliers.

On the other hand, an experienced EPC contractor saves the customer time, guarantees the quality of work and offers a wide range of turnkey solutions.

In the real world, small companies that decide to undertake the implementation of all stages of a wind energy project on their own usually face serious obstacles. Lacking sufficient experience, technology and resources, they incur significant losses, which often translates into a project stop.

If you are looking for professional services in the field of construction and financing of offshore wind farms, contact us for a free consultation.