To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Demonstrating growth of 10-15% annually, these tools open up new opportunities for the implementation of capital-intensive projects around the world.

Structured investment finance services in the USA is associated with world renowned financial players such as Bank of America and BofA Securities, Citigroup, Goldman Sachs, JP Morgan Chase, Morgan Stanley and others.

Link Bridge Financial LTDA LBFL, a financial company with an international presence, opens up new horizons for American business for productive partnerships with European financial institutions on favorable terms.

Structured finance can be used for a variety of purposes, such as business expansion and growth, entering new markets, restructuring a company, mergers and acquisitions, etc. If you are interested in structured investment finance services in the United States, contact our finance team anytime.

Our rich international experience and business contacts around the world will help you realize ambitious investment projects and take your business to a new level.

The essence of structured finance

Structured finance is a special area of project financing. In essence, structured investment finance is a complex of financial transactions, products, services and instruments offered by large financial institutions primarily to support the allocation or transfer of risk between funding participants.The reasons for the rapid development of structured investment finance in the United States include the following:

• Due to high competition and market uncertainty, large investors do not want to take high risks, so they prefer to participate in financing with rational risk sharing.

• The emergence and development of new capital-intensive projects, mainly in the US IT sector, requires large assets and facilitates the use of complex structured finance schemes.

• More and more investors seek to avoid some of the organizational difficulties and associated financing of complex legal entities acting as borrowers.

The table below lists the general goals, characteristics and typical uses of structured investment finance.

| Goals | Typical uses | Characteristics |

| Reduced financing costs (asset acquisition) | Buying a business | Financing based on the future cash flows of the investment project |

| Reducing conflicts of interest between investment project participants | Financing the company's growth | Attracting significant financial resources on flexible terms |

| Optimization of the tax burden for each of the participants | Financing the development and implementation of a new business concept (the need for a sharp turn in the development of the company) | Each participant in structured finance has special economic, legal and tax parameters that require their coordination with the participation of third parties that are not investors. |

| Increasing the liquidity of the initiator, founder of the business | Financing recovery after the crisis | |

| Implementation of large investment projects, especially capital-intensive projects with high risk and long payback period | ||

| Financing of foreign trade operations | ||

| Financing securitization operations |

Structured finance scheme includes the following points and processes:

• Securitization is a financial practice in which various financial assets are collected in so-called pools, the sale of each of which brings a small amount of funds to the project.

• Tranching is the process of issuing certain classes of bonds with varying degrees of risk and maturity.

• Modification of the loan portfolio. These are actions, approaches to improving the loan portfolio of structured finance or some structured financial products, carried out through the subordination of loans.

• The involvement of credit agencies is required for the compilation of credit ratings.

Each of the above aspects requires deep professional analysis and planning to achieve business goals.

Link Bridge Financial LTDA LBFL (Spain) with its international partners provides a wide range of structured investment finance services in the United States and other countries.

If you are in need of professional financial advice, please contact us at any time.

Structured investment finance services in the USA

Structured investment finance schemes can take many forms.The US government can participate in structured finance as partners and regulators, but, nevertheless, this investment scheme operates on a purely market basis.

Credit rating agencies are important participants in structured finance, without which this process cannot be organized.

They play their expert role in initiating structured finance by performing the following tasks:

• Assessment of the credit risk of the company initiating the project.

• Assessment of potential risks of an investment project that will be financed through structured finance instruments.

• Assessment of the structure of the business being funded, including the structure of assets, products and financial statements.

• Assessment of the potential risk of other participants in the structured finance scheme, including investors.

A special project company, also known by the acronyms SPV / SPE is a legally independent company that is created only for a specific purpose, and after the completion of the project, this company is liquidated.

Usually it is created by the participants for the implementation of a large project. The definition of a project company varies from country to country, which does not prevent it from being used for large projects in the United States and around the world.

Most often, a project company is created in the form of a subsidiary, which is an independent legal entity. Given its specific financial role in a project, an SPV is usually in the form of a limited liability company, but its organizational structure depends on the legal requirements of the host country. The most suitable jurisdictions for SPVs are considered to be countries with lighter tax regimes and transparent investment laws.

Reasons for the formation of SPV in the framework of structured finance:

• Significantly restricting lenders' access to investor assets (limited recourse financing).

• Off-balance sheet financing, which allows the initiator company to separate the project debt from its own financial statements and maintain high creditworthiness.

• Reliable protection of the investment project from the negative consequences of the bankruptcy of the initiating company.

Finally, an important participant in the scheme is the guaranteeing institution, which is usually a reputable financial institution (bank).

These structured finance participants provide a guarantee in the event that the initiator cannot meet its obligations. The right choice of partners along with the professional legal arrangement of the scheme significantly increases the chances of a successful financing.

The process of organizing structured investment finance in the United States can be divided into the following stages:

• Organization of the financing process.

• Issue of securities to provide initial funding by the initiator of the project.

• Choosing a credit rating agency to assess the rating of potential partners, investors and other participants.

• Selection of the most suitable participants in an investment project by credit rating and other parameters.

• Transfer of funds by investors to participate in a special project company, purchase of additional SPV assets.

• Management of the acquired assets in accordance with the objectives of the investment project.

• Project implementation and reporting on the results of asset management

• Generation of cash flows to service debt.

If you need to use a special purpose vehicle for structured finance in the United States or for other purposes, please contact the Link Bridge Financial LTDA LBFL international finance team.

We are ready to become your reliable partners in the implementation of business projects in any jurisdiction of the USA, including well-known offshore jurisdictions.

Link Bridge Financial LTDA LBFL offers the following services:

• Long-term financing of large investment projects on flexible terms.

• Formation and qualification of a special purpose vehicle (SPV / SPE) in the United States.

• SPV management, organization and control of current records, accounting and tax filing.

• Professional project management and consulting.

• Engineering services.

Securitization as the basis for structured finance

The concept of securitization is used by structured finance participants to create a pool of assets, which in turn will be used in the next step to create a new final financial instrument.Securitization is the financial practice of combining different types of loans, such as mortgage contracts, business mortgage contracts, car loan agreements, contracts to fulfill other debt obligations.

Typically, these different types of loans are combined to form a consolidated loan. It is important to note that this is reflected in the balance sheet (does not change the capital structure of the company) and acts as off-balance sheet financing.

On the basis of the consolidated loan, new securities are issued, which are offered to a wide range of American and foreign investors, since the purpose of securitization is to find financial resources.

Most often, these securities are divided into two groups:

• Mortgage-backed securities (MBS).

• Asset-backed securities (ABS).

The advantages and disadvantages of securitization are summarized in the table below.

| Advantages of securitization | Disadvantages of securitization |

| A more efficient use of the company's capital is ensured. | The ability of investors to control and manage the risk of their own investments is limited, which is why they cannot formulate adequate requirements for the expected profitability. |

| Securitization reduces the concentration of credit risks (concentration of large loans in companies). | Given the transformation of one type of securities (assets) into another type through securitization through multiple investors, the relationship between the issuer and the investor is disrupted. This often leads to underestimation of risks, as well as non-compliance with the standards for issuing securities in some countries. |

| Securitization helps to attract cheaper resources, this is especially true for initiators with a low rating. | Securities are accounted for as off-balance sheet assets, and therefore they do not formally change the capital structure, but in practice it does. This distorts the image, affects the assessment of the issuer's credit risk and misleads credit agencies when they have to assess the credit rating. |

| An alternative investment, which investors are looking for new opportunities to achieve their goals. | A loan pool consists of loans that have different characteristics, with each loan changing in different ways over time. This makes this pool much more difficult to manage. |

| Securitization makes it possible to better manage project risks, interest rates and initiators' liquidity. | |

| Through securitization, a better distribution of risk between project participants is achieved. | |

| Diversification of investors is being achieved. |

Securitization stages

Based on the peculiarities of structured investment finance in the United States, financial experts identify a certain structure of securitization.The general structure of securitization includes the following stages.

At the first stage (the stage of transferring the pool), the initiator provides certain assets to finance the project. He seeks to increase his capital or restructure his debt, believing that the company's finances should be better structured and regulated from a legal and economic point of view.

There is a practice of transferring assets to a special project company (SPV) to protect assets in the event of financial insolvency.

This is basically done in three ways:

• The initiator sells the assets of a project company.

• The initiator finances the company created for this purpose.

• The initiator attracts financing partly through the sale of assets and partly by injecting its own funds.

The second stage is the issue of securities that can be offered to investors.

An investment agency may also be involved.

The third stage includes a credit enhancement strategy. As part of this strategy, securities are issued that have a higher rating than the original, and are usually divided into classes or tranches. Tranches have different subordination to each other. Securities of each class have different risk and credit requirements. Additional tools can be used by companies for credit enhancement. A reserve fund can be created to improve the class of certain securities.

The fourth stage is associated with the implementation of various procedures related to the securitization process.

The procedures and services related to payments, as well as services related to the monitoring of all types of assets included in the transaction, are also performed by professional financial team that monitors the risk of default.

The fifth stage is debt repayment.

Debt repayment can be made once at a certain time (which is rarely used in practice) or payments are spread over a certain period, depending on the projected cash flows of a particular investment project.

The sixth stage is a comprehensive assessment of the securitization. It includes an assessment of various structural risks, incentives and benefits, and is carried out with the aim of improving key financial mechanisms for the future.

Project finance (PF) as a type of structured investment finance

The term "project financing" means financing a project through an economic and legally separate business entity that deals only with refinancing and has a limited life cycle.The PF concept is the opposite of classic corporate finance and is based on the general principles of structured finance.

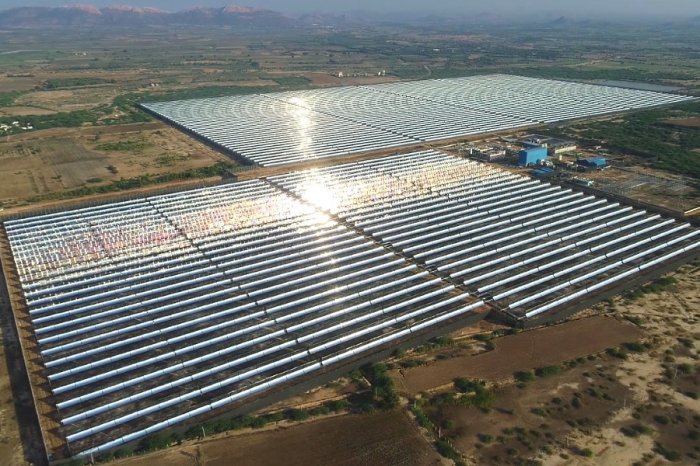

Project finance is widely used in the United States to implement large investment projects in the energy sector and real estate, oil and gas production, heavy industry and other industries. Moreover, this concept originated in the United States in the 1930s as an innovative way of financing highly profitable oil projects.

Project financing in America is developing intensively, exceeding the $ 90 billion mark to date.

By comparison, the total global project finance market reaches $ 300 billion.

One of the most important features of the PF is that financial resources are accumulated not on the basis of the classical assessment of the investor's solvency, but depend on the efficiency of the project itself.

Key features of project finance include the following:

• Loans are provided against evidence of future cash flows from the project, which requires a comprehensive professional assessment of its prospects.

• The risk is distributed in a rational way among the project participants, which helps to minimize potential problems during its implementation.

• Project finance is off-balance sheet financing, so all loans received by the project company remain on its balance sheet without being linked to the participants.

The most suitable areas for project finance in the United States include mining projects, privately financed infrastructure projects and real estate, projects with active participation of the public sector (public-private partnerships), and projects for the supply of raw materials and energy resources (construction of gas pipelines , oil pipelines, LNG plants).

The most important benefits of project finance are listed below:

• A wide range of potential investors.

• Investors' financial reporting structure is improving as a result of participation in projects.

• SPV assets and especially cash flows are much easier to analyze, they are more transparent, and monitoring is associated with less bureaucratic issues compared to classic lending.

• Expected cash flows are more predictable as companies pre-contract with suppliers and consumers.

• New opportunities are created for the implementation of projects in unfavorable conditions (for example, during a political and economic crisis, with a lack of internal resources of the company, etc.)

Models of project finance

The creation of a dedicated project company is not always absolutely necessary for the project, but it provides the legal and economic independence of the project.This option is considered important when organizing project finance in the United States, as it provides a number of organizational, financial and tax advantages.

The participants in project finance who determine the choice of a particular model are listed below.

Sponsors (initiators) are responsible for planning and developing an investment project. The quality of the sponsoring companies is critical to the decision-making of the rest of the participants, especially banks and other lenders. Sponsors are private and institutional investors.

Sponsors perform different functions at different stages of a project. In the early stages of a project, sponsors typically contribute 20% to 50% of the project cost, depending on the risk profile. Our structured finance models in the United States reduce the initial investment of the project initiator to 10% of the project cost, making it much easier for young companies with limited assets to implement a business idea.

Each type of capital, such as banks, investment funds, or stock markets, has unique characteristics, including maturity, interest rate, debt repayment schedule, collateral, participation of the capital provider in the project, and others. In project finance, it is critical to allocate external financial resource providers according to their terms and conditions.

These funding sources can be categorized as follows:

• Subordinated loans.

• Mezzanine financing.

• Senior loans, etc.

Government agencies in the United States are also heavily involved in project finance.

In addition to financing, they can provide specific guarantees, investment incentives, tax breaks or other incentives aimed at the implementation of investment projects in strategic areas.

The operator or contractor is responsible for the construction and commissioning of the facility to achieve the required cash flow for the project. This, if not guaranteed by the sponsors, is done through special contracts for the management of business operations. The operator is also responsible for the maintenance and security of the project sites.

The sale of the products (energy) or services generated by the project is critical to ensure adequate cash flows to service the SPV's debt obligations. For this purpose, customers and suppliers must be bound by contracts in advance.

Insurers most often act as an export credit agency, which covers the following elements of risk:

• Political risks for sponsors and founders.

• Economic and political risks for export supplies.

• Risks of financing a project company, etc.

Professional consultants carry out financial, legal, technical and other types of supervision over the activities of the project company and various elements of project financing.

Other participants in the project finance scheme in the USA may include transport companies, rating agencies, etc.

Structured investment finance in the USA drive business growth

After the start of work, each company goes into a growth phase.This phase can be accelerated by managers and owners by raising additional funding through innovative structural finance models.

The growth phase begins when the company has established itself well both in the domestic and foreign markets. In this phase, the business has already optimized costs, generating high profits and positive cash flows. This can also be achieved through professional management of short-term debt and liabilities.

In such a financial situation, the company has sufficient liquidity to set higher growth goals.

Usually higher growth rates cannot be achieved with internal resources, and a favorable financial situation allows attracting investors on better terms, including the use of innovative structured finance mechanisms.

Potential investors should have certain criteria or benchmarks that help them make decisions about investing in a company in the growth phase.

In general, these criteria include the following:

• A company looking to grow must achieve a certain minimum turnover or sales.

• The company must have a stable financial position, demonstrating a constantly growing market share for several years (at least 3 years).

• The company whose growth will be funded must generate positive cash flow.

• The company must publish regular financial statements in accordance with the requirements of US law so that potential investors can analyze them.

• The company must increase its assets in order to maintain financial stability, thereby guaranteeing the safety of investments.

• The company's strategy should be a strategy for sustainable growth, i.e. this strategy should include integrated economic, social and environmental aspects and solutions.

Structural finance models can be successfully used by businesses in such cases as expansion and growth of the company, the introduction of innovative solutions in various fields, the change in the structure of the company's owners, as well as a fundamental change in the field of activity and production structure.

Link Bridge Financial LTDA LBFL is ready to offer you a full range of structured investment finance services in the USA, including the establishment of an SPV, long-term funding of large investment projects, as well as professional consulting services on any legal and financial issues.