To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

We work to help you achieve your success at all stages of an investment project evaluation, from financial modeling to assistance in negotiations.

Cooperation with a serious financial or industry investor, an entrepreneur, in addition to financial resources, receives a full security package in the form of experienced specialists and a wide range of business contacts. This gives the business a strong competitive advantage that allows it to grow rapidly, increasing the chances of success.

Below we have presented some important considerations for companies looking to attract investment for large projects.

If you need assistance in raising funds, please contact the Link Bridge Financial LTDA LBFL finance team.

We are ready to guide you through the entire financing process and provide professional advisory support at any stage of the project.

Main stages of investment project evaluation: attracting financing

Understanding the goals and interests of a potential investor can be seen as the key to effectively attracting external funding for a project.The short-term goals of an entrepreneur are usually to obtain a sufficient amount of cheap resources to implement the project and reach the planned financial indicators.

On the other hand, a financial investor sets himself long-term tasks in the form of achieving high investment returns with an acceptable level of risk. The risk of not achieving the expected results of the project lies with the investor.

Potential investors seek to minimize risks and increase the chances of achieving long-term goals through careful analysis.

Each business idea, especially when it comes to capital-intensive projects, initially goes through several stages of investment project evaluation.

Institutional investors and specialized funds carry out a comprehensive assessment of a business (project), on the basis of which they make a decision on financing on certain conditions. Next, we have listed each stage prior to signing an investment agreement and obtaining funding.

Stage 1: Initial analysis of the project

During the initial analysis of the project, most investors pay special attention to the following:• Team: staff, competencies, experience in implementing large business projects.

• Industry, market analysis in the context of the proposed investment project strategy.

• Business model, its features, advantages, risks and limitations.

• A preliminary assessment of a specific product or service.

• Project financing needs and schedule.

At the introductory stage, investors want to get as much objective and accurate information as possible about a specific project and the company that will promote it on the market.

The more information the presentation contains, the better the project is evaluated (find out more in the section «How to prepare a correct project presentation for an investor?»).

Stage 2: Detailed analysis of the financial model and business plan

If the information provided is met positively and verified by potential partners, investors will want to know more about the business, including the following:• Methodology for calculating funding requirements.

• Estimation of return on investment based on net present value.

• Expected return on investment and payback period.

• Description of the project in the form of a professional business plan.

At this stage, entrepreneurs should prepare as much relevant data as possible, which will prove the initiators knowledge of the business and reflect their thorough approach to raising capital.

It is worth noting that business plans for a startup and an existing business starting a large project are significantly different.

A template for a business plan for a company or investment project should include the following minimum:

• Brief description of the company's business environment, including a description of the industry, prospects for its further development and competition.

• Providing basic information on subjects of activity, including offered goods or services, rights and assets.

• A detailed description of the method for estimating the cost of capital requirements, taking into account the intended purposes of its use within the project.

• The business model should justify the proposed concept of value creation for the participants and their benefits from the developed project.

At this stage of evaluating an investment project, financial experts mention an element that summarizes the business plan and plays an important role in the final decision of the investor.

This is a medium to long term forecast based on the corresponding financial model.

Experienced investors conduct a more detailed review of the information provided in the business plan before moving on to the next stage of the investment process. This stage includes business analysis, financial and legal audit, organizational analysis, and sometimes also analysis of proposed technologies and their environmental impact.

Obviously, such a high level of interaction with investors requires a business to disclose a large amount of business information, as well as intensive consultations with people who manage companies and make strategic decisions.

It should be understood that hints or vague information about the project is not interesting for investors.

They demand facts and figures.

In this context, it is worth mentioning the document, which, on the one hand, is aimed at protecting the project, and on the other hand, limits the ability of investors to evaluate a business. This is the so-called nondisclosure agreement (NDA). Companies looking for funding for large projects can sign an NDA to protect useful information, such as a description of technologies and know-how, tested models of customer acquisition, organization of processes, etc.

Stage 3: Assessment of the investor's participation in the project

Assessment of an investor's participation in a particular project comes down to determining the number of shares that an investor can receive for a certain contribution.Determination of the value of shares offered to a potential investor is based on the use of various multiplicative models and methods for assessing financial flow.

A commonly used evaluation method is based on discounted cash flows.

Business valuation using DCF requires an electronic financial model with a profit forecast, a cash flow statement and balance sheet for the next 5-10 years, where the first 1-2 years should be prepared with monthly breakdown.

In order to consider a large project, investors may also need market analysis, detailed financial analysis and sensitivity analysis of the investment project.

In turn, multiplicative methods evaluate a company based on the economic or operational indicators of companies in the same industry that are listed on the stock exchange or published at the close of an investment round. These methods are used to compare mature companies with a stable operating history, complementing DCF methods for a range of critical indicators.

Stage 4: Determination of the financing schedule and stages

At this stage of the evaluation of the investment project, the companies outline the planned steps towards the successful implementation of the project and determine the project milestones for obtaining funding in several stages.Having a clear understanding of the key stages in the implementation of a specific project, experienced analysts can relatively accurately determine the financing schedule and divide the financial injections into separate tranches.

Each tranche will correspond to a specific milestone, or set of accomplished tasks within the project.

Determining the milestones is important not only during the planning period, but also in the implementation of plans. After the completion of each stage, the effectiveness of the project and the accuracy of the forecasts are assessed. Establishing clear parameters for financing (expected results after each stage of the project) is one of the forms of limiting investment risk.

Stage 5: Offer, negotiations and signing of an investment agreement

The last stage before receiving financing from an investor is the negotiation of the terms of the investment agreement by both parties.The investment agreement specifies, inter alia, the following important financing terms:

• The role of the investor in the project.

• Rights and obligations of each party to the transaction.

• Persons responsible for implementing plans.

• The price of the purchase by the investor of one share of the company.

• Members of the Supervisory Board and a list of their powers

• Conditions and methods of an investor's exit from this project.

In an era of uncertainty, investors are looking for projects and teams that are able to grow their business in difficult conditions, guided by a professionally developed business plan and using reliable financial forecasts and models. The more solid the project presented, the higher the chance of getting funding.

What to expect after the investor leaves the project?

Fruitful cooperation with investors can be long-term, but in many cases financial investors leave projects within 4-5 years after their first investment, less often cooperation stretches for 8-10 years or even more.There always comes a time when a financial investor decides to exit the project.

The most common forms of exit of investors from the project include:

• Repurchase by other shareholders.

• Repurchase of shares by the top management of the company.

• IPO: the first issue of shares on the public capital market.

• Attracting another investor or other options.

The reasons for leaving the project are the desire to gain bonuses from the invested capital ot to reinvest funds in other, more attractive and profitable projects. In some cases, investors can leave the project ahead of schedule, which directly depends on the development of the business. In each case, the exit methods are different.

Methods for evaluating the effectiveness of an investment project

Evaluation of investment efficiency plays a key role in the justification and selection of investment objects.A high-quality comprehensive analysis of the investment project further influences making the right decision regarding the payback period, contributing to the faster development of the company and the entire industry.

Long-term investment management decisions require attention to project evaluation and cash flow forecasting. The objectivity and reliability of project evaluation are largely determined by the use of modern methods of analysis of investment activities.

In the world financial practice, there are many financial and economic methods used at various stages of evaluating an investment project.

Most of them use the same type of performance indicators associated with the calculation of real cash flows and discounting indicators.

The term “discounting” is used to estimate the present value of future cash flows.

The most correct and reasonable methods based on discounting are the following:

• Net present value (NPV) method.

• Method based on the discounted payback period of the project.

• Method based on internal rate of return.

• Cost index method.

Below we will consider in more detail each of the above methods in the context of evaluating the effectiveness of investment projects and explain their advantages.

Net present value

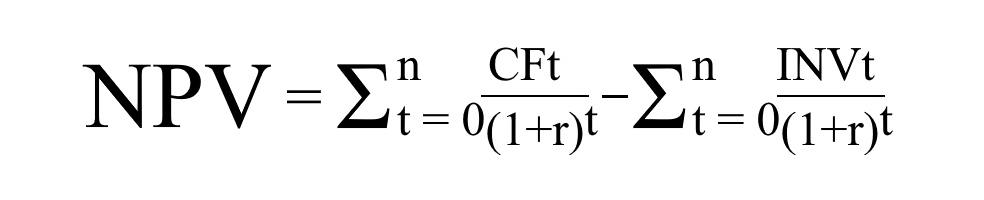

The calculation of the net present value (NPV) is based on comparing the return on investment in the future with the funds that have been invested in the present.Net present value means the difference between the present value of the investment proceeds, discounted at the calculated interest rate, and the initial investment cost.

CF t - net cash flow for period t, million euros;

r - the discount rate that takes into account the change in the value of money over time;

n - the term of the investment project implementation, years;

Inv t - the total investment for the time period t, million euros.

The discount rate used in the NPV formula, given the growing instability of the global economy and unprecedented sanctions pressure on some regions of the world, cannot always be calculated using standard methods.

The advantage of this method of evaluating the effectiveness of investment projects is the consideration of the cost of money over time.

The method is focused on increasing the income of investors, which is also important at the initial stages of project consideration.

The disadvantage of the NPV method is the fact that the net present value is an absolute measure. For this reason, it is difficult to objectively make a choice between several projects with the same NPV and different investment costs. At the same time, the choice of the discount rate is subjective.

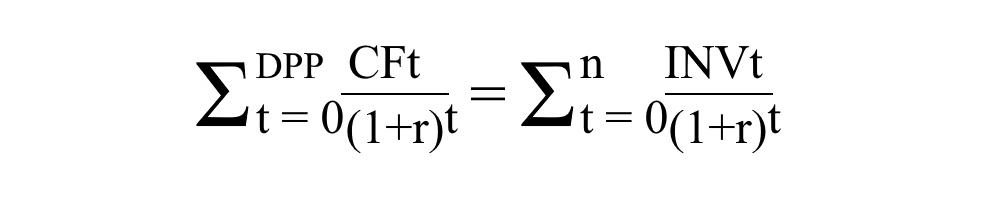

Discounted payback period

Discounted payback period (DPP) is the period over which the sum of the net cash flows, discounted at the completion of the investment, is equal to that investment.

This method, like the previous one, takes into account the cost of money over time, as well as the possibility of reinvesting the income received.

The discounted payback method does not take into account the cash flows at the payback period.

The disadvantage of estimating a project based on a discounted payback period is that this indicator completely ignores the profitability of projects beyond the payback period. Investment projects with the same discounted payback periods, but different implementation periods, can bring different returns, which makes it impossible to directly compare them using DPP.

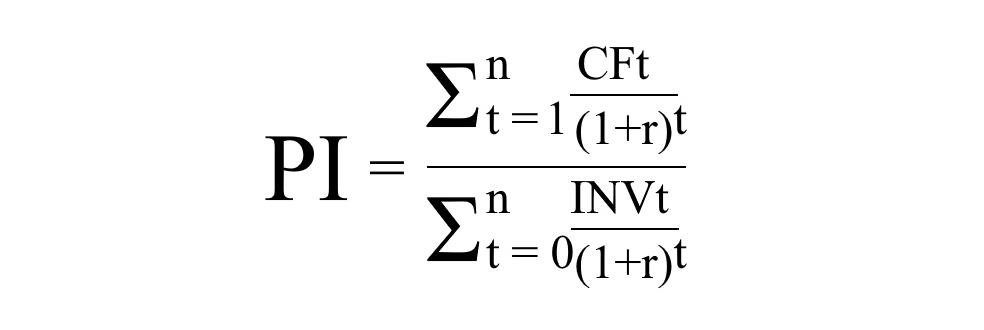

Investment project profitability index

The profitability index (PI) is directly related to the net present value and is defined as the ratio of the present value of cash flows to the initial investment.The formula for calculating this indicator is given below.

When evaluating investment projects, preference is given to those projects for which the profitability index is greater than 1.

When it becomes necessary to select several investment objects, they are placed depending on the PI value.

When making investment decisions, analysts use PI when project metrics have the same NPV. The clear advantage of PI is that it reflects the performance of every euro invested. In conditions of limited resources, such an indicator allows investors to form the most effective investment portfolio.

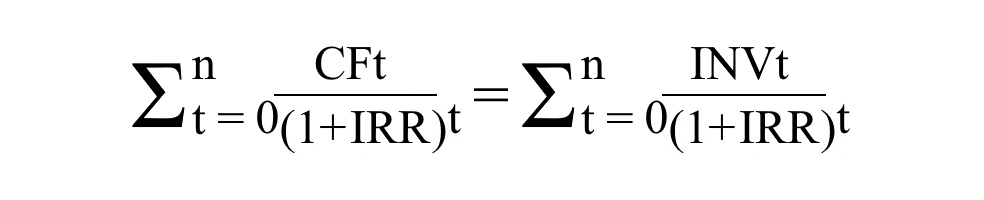

Internal rate of return

The internal rate of return (IRR) is the discount rate at which the discounted cash inflows from a particular project are equal to the discounted costs of the project.It is calculated using the following formula.

From the above formula, you can calculate the interest rate at which the discounted cash flows and investment costs are equal.

It represents the maximum interest rate at which a company can borrow money if it invests with borrowed capital, and the cash flows will be used to pay off loans and interest.

Internal rate of return is the maximum rate of interest on a loan that can be used without prejudice to the business entity. Thus, IRR can be represented as the lower guaranteed level of profitability of the investment project and the maximum interest rate for the borrowed funds, at which the project remains breakeven.

The disadvantage of this method is the complexity of the calculations. In some situations, several options for IRR values are possible. The preference is usually given to the project with the highest value of this indicator, which is not always correct, since projects with low IRR may further bring in higher discounted net income.

As can be seen from the above examples, the evaluation of investment projects in each specific case requires an individual approach.

If you need advice on financing large projects in Europe or outside the EU, please contact the Link Bridge Financial LTDA LBFL finance team.

Types of investors for large projects: practical considerations

The choice of sources of business financing is wide enough today.These can be private and corporate investors, business angels, venture capital funds, commercial and state banks, or even international financial organizations.

Equity investments can be an interesting alternative for companies looking for capital to fund investment projects.

This type of investment consists in providing access to capital to industry investors, venture capital funds in exchange for shares of an investment project.

Investments can be divided into several types depending on the type of company. Institutional and financial investors can hold different shares in the capital of companies and pursue different goals.

Venture funds and seed funding

Seed funds collect funds from investors (individual, corporate and institutional) to invest in projects in accordance with the strategy developed by the fund's specialists.Each of the fund's investors receives his share in the ongoing project.

In case of failure in one project, the losses are compensated for by the profit brought by other investments.

Unlike private investors, seed funds are subject to more in-depth analysis of projects. At each stage of the investment project evaluation, experts assess the risks and potential opportunities in a certain time horizon.

This method of financing is not only fundraising, but also professional assistance and support of experienced investors with extensive knowledge and business contacts. Seed funds work primarily with high-risk projects, but the rate of return on investment, if successful, is expected to be very high.

As a rule, such funds invest in projects and companies before their formal creation, focusing their activities on funding research and the transition of a business idea to the commercialization phase (company establishment and actual business start).

Venture capital funds are focused on financing projects in the early stages of development. Investments of this type are characterized by a medium and long term time horizon in projects with above average growth potential.

The funds received in this way are intended to finance the following expenses:

• Creation of new products and technologies.

• Increase in working capital.

• Increase in production capacity.

• Strengthening the financial balance.

• Entering new markets.

• Expansion of distribution channels.

In both seed and venture capital funds, the high investment risk that arises early in a company's development is offset by the high rate of return expected by the potential investor.

Business angels

Typically, a business angel is an individual who invests in companies with high growth potential.Typically, these are entrepreneurs with outstanding professional achievements and large personal assets that allow them to take on the risk of financing large projects at the start-up stage.

Most often, such investors invest their capital in projects for a period of 3 to 10 years, expecting a high rate of return on invested capital. They can participate in projects in various schemes together with financial companies.

A business angel is a valuable partner for business development in a situation where he has experience or contacts in an industry in which a young entrepreneur wants to come up with his idea. This also allows him to provide valuable development advice to the company, but does not participate in the day-to-day running of the business.

From the point of view of an aspiring entrepreneur, attracting investment from business angels brings several benefits. An important advantage is direct involvement in success, which is especially important when a business angel is a well-known person in the industry.

Well-known business angels are the best way to promote a project.

Any news in the media about the participation of such experts arouses interest in this project, increasing its credibility in the eyes of clients, contractors and future small investors.

Industry leaders

This group of investors includes entrepreneurs doing business in the same or a similar industry as the business in which they are investing.Factors that encourage industry investors to raise capital for new projects include the following:

• Achieve economies of scale for the core business by lowering costs and increasing the company's profitability through expansion.

• A synergistic effect resulting in the expansion of the scale of activities and the strengthening of the market positions of both companies.

• Tax optimization in the light of the provisions of local tax legislation.

Industry investors, in addition to capital and synergies, bring the project knowledge and practical experience in a specific sector of the economy. This allows the experienced investor to comprehensively assess the business and discover potentially invisible risks and business opportunities.

Investors in corporate bonds

A corporate bond is a series-issued security in which the issuer declares that it is the debtor of the owner of the bond (bondholder) and undertakes to fulfill a specific obligation to him (redemption of the bond).An issuer is defined as an entity that takes on obligations in the capital market by issuing bonds. A bond, unlike a stock, does not entitle its owners to participate in the assets of a company, but is a debt security.

From the moment a bond is issued until its redemption, it can change its owner many times. Each subsequent bondholder becomes the issuer's creditor.

The most important characteristics of bonds are as follows:

• The beneficial nature of ensuring the interests of the buyer.

• Early redemption of bonds under certain conditions.

• Converting bonds into company shares or other securities.

• A profitable way of earning money for the bondholder.

The issue of convertible bonds is especially beneficial for innovative projects and startups with good growth prospects.

As a result, the founders of the company have a decisive influence on the direction of its development during the initial stage of growth.

In this case, the company uses the effect of financial leverage. At the same time, the interest rate on convertible bonds may be slightly lower than on ordinary bonds.

How to prepare a correct project presentation for an investor?

Many entrepreneurs offer promising projects, but not all of them successfully pass all stages of investment project evaluation in order to receive financing on adequate terms.If a business idea is presented in an unattractive way, the chances of success are drastically reduced.

Serious investors value time, which is important to use effectively to make money. They are also scrupulous about the feasibility study and risk assessment of the project. These and other reasons require professional presentation preparation.

The presentation of an investment project (pitch deck) is the first step towards attracting investment. This is the first virtual meeting with future partners, which should convince them of the potential of a joint business.

Table: Recommended plan for the presentation of the investment project.

| Pitch deck section | Brief description |

| Company mission (slogan) | This is a vivid and memorable display of an investment project (company), which briefly defines its essence and advantages. |

| Formulation of the problem | Each investment project is designed to satisfy certain needs or solve the problems of potential clients. The description of the problem should be concise and convincing for investors. |

| Solution of the problem | This section describes specific solutions to the problem, indicating their key features and benefits. The novelty and benefit of this solution should be clearly visible. |

| Product or service | A clear and technically / financially sound description of how the new product or service will operate, with a sufficient level of detail. |

| History of the company that initiated the project | This section reflects the history and achievements of the company in the form of concrete figures, facts, charts and other visualizations. |

| Team | This is a very important element of the presentation, which should convince investors of the advisability of cooperation. An experienced team is critical in a risky project. |

| Business model | Professionally designed business model with a forecast of income in a specific time horizon, indicating potential opportunities, risks and limitations. |

| Market | The success of the project is highly dependent on comprehensive market research. The number of customers, sales and growth dynamics should sound convincing. |

| Financing | Funding requirements for the specific investment project, expected cash flows and ways of using these resources. |

| Competition | An important information for considering an project is a competitor analysis, which should display the strengths and weaknesses of the project against the background of other companies in the same sector. |

The purpose of the presentation is to quickly and concretely demonstrate that the proposed business idea is innovative, forward-looking and capable of generating high returns with an acceptable level of risk.

In this context, it is important to correctly represent the essence of the project (product) in the form of specific and reliable data.

Pitch deck is a source of valuable content for investors, based on sound technical and financial conclusions.

Visual materials in the same style that affect the imagination (graphics, photographs) are also appropriate here.

An important fact: in most cases, investors spend less than 5 minutes to determine if an investment project is worthy of further consideration. Many entrepreneurs won't get a second chance to impress a potential partner, so the presentation of the project must be flawless.

Link Bridge Financial LTDA LBFL has extensive business contacts in the EU and beyond, which allows us to successfully provide financing to our clients.

Contact us to attract investment and get financing for your project on the most flexible terms.