Financing public-private partnership (PPP) projects

Link Bridge Financial LTDA LBFL offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

These mechanisms are most applicable in infrastructure, environmental, agricultural and other projects.

The financing of PPP projects is a complex and lengthy process that requires a comprehensive analysis and assessment of a particular project, along with ensuring its effective management.

The participation of governments and local authorities in the implementation of large projects contributes to the expansion of business opportunities, the growth of the competitiveness of strategic sectors and the satisfaction of the urgent needs of society.

Public-private partnership: definition and brief description

PPP as a project financing tool allows companies to attract investments from various sources, in various combinations with different ratios of equity and debt capital (depending on the agreements reached between project owners, shareholders and capital providers).The global growth of PPPs can be partly explained by the recent trend towards transferring responsibility for infrastructure and high-value social facilities from the state to the private sector. In the context of chronic budget deficits, this allows governments to carry out their duties effectively at minimal cost.

In any case, projects based on public-private partnerships always mean a complex and multifaceted contractual structure, which must be carefully planned and developed depending on the needs of a particular project. It should be understood that the volume of attracted investments and the period of return of capital will be largely determined by the interest of private capital.

In the developed world, the most popular sources of financing for large PPP projects are equity capital and long-term investment loans. Bond issues and mezzanine investment instruments are also widely used. On the other hand, developing countries more often use equity capital, loans from international financial institutions and other borrowed instruments, while bond issues and mezzanine capital in such countries are ineffective and not widespread enough.

The difficulty of financing projects in developing countries can be explained by the fact that the risks and high cost of financial resources make many projects impractical.

The risk and complexity of mobilizing financial resources make PPP instruments particularly important in this context.

The most common form of attracting investments for PPP projects has long been lending, which is more accessible and more flexible with the support of the state financial and regulatory machinery. However, structural weaknesses in the banking sector and misuse of the potential for long-term lending over the past decades have led to higher financing costs and a growing mismatch between societal needs and the availability of capital. All this gradually leads to a reduction in the share of bank loans in PPP projects and an increase in the role of international financial institutions.

The structure of financing public-private partnership projects varies significantly depending on the specific area.

According to Eurostat, in the mid-2010s, the equity capital share of PPP projects in healthcare and education was slightly above 5%, while in infrastructure projects it reached 20%.

The share of loans for most economic infrastructure projects is around 70-80%.

The evolution of the legal framework of banking activities has a direct impact on the financing of public-private partnership projects in the long term. For example, the adoption of Basel III had a negative impact on the ability of major world banks to provide long-term financing of PPP projects. The change in liquidity coverage ratios required banks to reduce the share of risky assets, including long-term PPP investments.

Despite the challenges, syndicated lending continues to play an important role in debt financing of PPP projects. This can be explained by the distribution of risks due to the association of banks into large syndicates, which reduces the credit risk and positively affects the cost of capital.

The main creditors of PPP projects are large European banks from France, Great Britain, Germany, Spain and a number of other countries, as well as American and Asian banks. Most of the funding is still going to the European and US markets, but funding for projects in Asia is on the rise.

The share of banks from China, Japan, Australia and other countries in financing PPP projects in the Old World is growing. It is safe to say that the largest banks will continue to finance such projects and expand the geography of their services until the cash flows are predictable and reliable.

Global trends in financing public-private partnership projects

The high efficiency of PPP as a form of interaction between the state, business and society is confirmed by world experience and global trends in the development of PPP.The first trend is a significant quantitative increase in the financing of PPP projects in the world (number of projects and total investment) since the end of the 20th century.

World Bank studies have shown that rapidly developing countries have used the PPP mechanism most actively.

The leaders during this period were such large economies as India, Brazil, Mexico and China.

Traditionally, the financing of public private partnership projects has been actively developed in the EU countries. During 1990-2013 they have implemented almost 1,700 PPP projects with a total value of more than 318 billion euros. Almost two-thirds of the investments were made by the UK (according to 1990-2011 data), but in 2011 France became the leader, providing about 62% of the total financing of public private partnership projects in Europe.

The second global trend is the diversification of the market for financing PPP projects by countries and sectors of the economy.

In Europe, this process has been noticeable since 2006.

The UK has until recently maintained the largest PPP market, although its share continues to decline.

The global financial crisis corrected the trend: funding for public private partnership projects for some time decreased in most countries and sectors, but during 2010-2011 there was a revival, especially in the field of water resources management and recycling of household waste. During this period, there is a more active use of PPP mechanisms to solve the social problems of developing countries (for example, the development of the healthcare system in Africa).

The third trend in the development of PPPs in the world is the infrastructure focus of projects, when governments implement socially important projects through the joint efforts of public authorities and private capital, increasing the quantity and quality of infrastructure services. This trend is observed in the USA, Canada, Australia and many Asian countries. Moreover, in Asian countries today much attention is paid to the social role of infrastructure projects.

The situation is somewhat different in developing countries. According to the World Bank, about 2.8 thousand PPP projects have been implemented in these countries since the 1990s.

During 2010-2018, in developing countries, most of the GSP projects were implemented in the energy sector, the construction of roads, as well as the modernization of water supply and sanitation systems.

Table: Distribution of PPP projects by sector in developing countries (2010-2018).

| Sector | Number projects, % | Investments, % |

| Electricity sector | 66,2 | 56,0 |

| Road construction | 14,2 | 21,8 |

| Water supply and sanitation | 10,1 | 3,5 |

| Sea and river ports | 4,4 | 4,3 |

| Natural gas production | 2,6 | 3,7 |

| Airport construction | 1,7 | 9,0 |

| Information technologies | 0,8 | 1,7 |

According to the World Bank, during 1990-2018, 7,205 PPP agreements were concluded in developing countries and projects worth $1,788 billion were implemented.

This includes transport, infrastructure, water supply, electricity and other industries. According to the European Investment Bank, in 2006-2017, most projects were localized in the social sector.

The fourth trend of PPP development is the priority state support of certain types of projects and industries. During the preparation of public-private partnership projects, governments promote certain sectors of the economy for which PPPs are deemed most appropriate or socially important.

Table: Priority areas for financing PPP projects in different countries.

| Priority areas | Great Britain | Canada | Greece | Ireland | Australia | Spain | USA |

| Infrastructure | + | + | |||||

| Defence facilities | + | ||||||

| Road construction | + | + | + | + | + | ||

| Electricity sector | + | ||||||

| Transport sector | + | + | + | + | + | ||

| Environment | + | + | + | ||||

| Water supply | + | + | |||||

| Recreation | + | ||||||

| ICT | + | + | + | ||||

| Healthcare & Education | + | + | |||||

| Residential housing | + |

According to the National Council of Public-Private Partnerships (NCPPP), private companies perform about half of the 65 basic activities of municipal government (water supply, sanitation, garbage collection, school education, parking) in U.S. cities.

Priority areas for financing PPP projects can be divided into two groups:

• Projects that represent rapidly growing industries or areas that are undergoing significant innovation change. These are, in particular, information and communication technologies that can provide the private sector with quick profits.

• Projects that represent industries or areas that are slowly innovating but require modernization or restructuring. These are infrastructure facilities, healthcare and education, the energy sector, and transport systems. Such projects are able to provide long-term profits to the private sector in the framework of PPP projects.

The fifth trend is the development of PPPs in the field of innovation. In the United States, the largest example of the use of PPP to stimulate private sector research projects is the Small Business Innovation Research Program (SBIR), which was launched in 1982. Thus, science and education can become an important part of public-private initiatives.

The main global directions for financing PPP projects:

• Gradual change in priorities from traditional financing of transport and infrastructure to a comprehensive solution of social problems through the construction of public facilities and their equipment (schools, stadiums, clinics, water supply and sewerage systems), including the development of large social infrastructure projects.

• Diversification of PPP against the background of geopolitical instability, growing differences between countries and the globalization of the market for financing public-private partnership projects (development of international projects).

• Increasing the role of the state, government agencies and public organizations in the financing and management of PPP projects, which favors their development.

• Evolution of public-private partnership mechanisms towards the emergence of its new forms, such as ESCO contracts in the energy sector.

If you are looking for more information on financing large projects, please contact LBFL.

We provide a full range of services in the field of project finance, financial modeling, investment engineering and consulting.

Mechanisms for financing PPP projects: the role of IFIs and development banks

The key condition for investing in PPP projects is their adequate profitability and security, which means investment attractiveness.The WTO recommends directing government efforts towards creating a favorable investment climate and developing priority economic activities instead of subsidizing unprofitable enterprises.

Significant forms of public-private partnerships that provide partnerships between business and the state are consulting services, the transfer of infrastructure for rent, outsourcing, leasing, concession and other joint activities. According to leading financial experts, the best form of partnership between the state and business on local infrastructure facilities is a concession.

A concession is a system of relations between the state (grantor) and a private legal entity (concessionaire) that arises as a result of granting the concessionaire the rights to use public property on a paid and repayable basis.

These agreements also include the right to engage in certain activities, usually controlled by the state. The obvious advantage of the concession is the lack of competition in the market of social infrastructure facilities, guaranteed sales of products (services), as well as a long-term nature that allows business to plan activities in the long term.

The most common concession schemes in world practice include the following:

• BOT (Build, Operate, Transfer). According to this type of contract, the private partner (concessionaire) builds and operates the facility at its own expense, and after the expiration of the contract returns the asset to the state.

• BTO (Build, Transfer, Operate). This form of contract provides for the transfer of the asset to the state immediately after the completion of construction, and a private partner can only act as its operator.

• BOOT (Build, Own, Operate, Transfer). This type of contract gives the private partner the right not only to use but also to own the asset during the term of the contract, upon completion of which it must be returned to the state.

• BOMT (Build, Operate, Maintain, Transfer). This form of contract determines not only the construction, management and operation of the facility, but also current repairs.

Another form of public-private partnership in the system of financial support for the development of social infrastructure is outsourcing (namely, management contracts).

Their essence lies in the transfer on a contractual basis of the functions of managing an object to an external contractor.

According to financial experts, the implementation of outsourcing agreements as a form of public-private partnership allows the customer company in some cases to reduce operating costs by almost 35% and increase the return on capital by an average of 5-6%.

As part of the financing of PPP projects, leasing agreements are also used in world practice. This medium-term form of partnership leaves the functions of strategic planning and financing of the facility to the state, while the private partner maintains and manages it.

Creating an effective mechanism for financing public-private projects is impossible without the creation of an authorized body that would directly provide financial support to market participants and coordinate projects. In the European Union, this body is the European Investment Bank, in Canada it is the Royal Bank of Canada. Guided by national financial legislation and international standards, these regulators should support strategic initiatives in infrastructure, energy, the environment and other areas.

Along with state support, an increasing role belongs to international financial institutions (IFIs).

According to the World Bank, in the first few years after the 2007-2008 global crisis, the share of multinational or bilateral financial institutions in financing PPP projects reached 8-10%.

Moreover, in the first post-crisis years, the share of IFIs in total capital investment reached 28%.

Long-term investment loans received from government institutions and IFIs are today a stable source of financing for PPP projects, the importance and share of which is growing every year. This can partly be explained by the difficulty of attracting financial resources from traditional sources.

The International Finance Corporation (IFC) syndicated lending program, for example, enabled many commercial banks and other financial institutions in the post-crisis years to implement a number of large projects that would not have been possible otherwise due to high risk and low profitability. Today, IFIs remain important sources of affordable long-term loans that fully meet the needs of PPP projects in terms of their duration and financing structure.

Moreover, international development banks usually have a special status, including tax preferences and immunity, which makes it possible to avoid negative consequences as a result of unforeseen changes in legislation and banking regulation in the participating countries.

Involving such partners in projects helps to reduce political risk and increase the rating of projects, opening up new opportunities to attract investments on favorable terms. The risk of such projects is reduced as a result of strict monitoring and control over compliance with the terms of PPP contracts, their changes and the quality of work of contractors, subcontractors, suppliers and other parties.

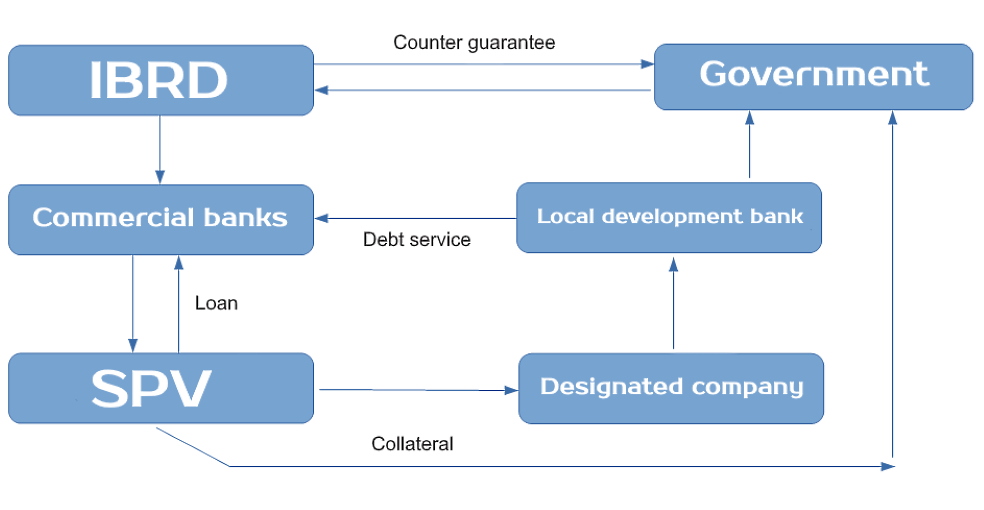

Figure: An example of a mechanism for attracting loans to finance PPP projects

For many developing countries, attracting long-term loans and equity appears to be difficult.

The participation of special development banks in the implementation of large PPP projects helps these countries reduce risks that affect investors and hinder project financing. The 30-year concession agreement for the construction of the fourth subway line in Sao Paulo (Brazil) can serve as a prime example of how development finance institutions help in the implementation of PPP projects.

It should be noted that attracting financial resources on adequate terms becomes more difficult during the global financial crisis or in post-crisis periods, when potential creditors tend to avoid risky projects.

The choice of financial instruments also becomes extremely limited in cases of an underdeveloped financial market and local economic instability.

For this reason, governments, private companies and other participants in PPP projects should consider a wide range of alternative instruments such as project bonds and mezzanine financing instruments. The rational use of this arsenal will allow diversifying the sources of project financing and building an optimal capital structure.

A Special Purpose Vehicle (SPV) can increase senior debt by issuing project bonds with high investment appeal. In this case, the public partner plays a significant role in stimulating investor interest in these bonds. This actually means an increase in the borrower's credit rating in order to reduce the cost of financial resources. A special government bank or investment fund provides loans or guarantees to ensure repayment of the debt, thereby reducing the risk of the bonds to investors.

In addition, the state body (agency) minimizes many of the risks that affect the generation of the cash flow of the project, and also helps to cover the shortage of funds that may arise during the construction of the facility.

Funds provided by the government will be considered subordinated debt, which must be repaid by the SPV within a certain period of time after servicing the senior debt.

Financial experts identify a wide range of mezzanine financing instruments that can be successfully used to implement public-private projects in developing countries. Among them are subordinated loans, preferred shares, convertible bonds with warrants and other instruments. Through the use of mezzanine funding sources, SPV achieves a better debt-to-equity ratio, albeit at a higher cost.

Despite the high cost of mezzanine capital, debt servicing costs do not exceed the cost of equity, which allows reducing the weighted average cost of capital (WACC) and, accordingly, increasing the value of the business.

Since it is difficult to obtain a loan on adequate terms for some long-term projects, the role of mezzanine financing for PPP projects can hardly be overestimated.

Looking for financing for large projects in the energy sector, industry, mining, real estate, tourism or other sectors?

Link Bridge Financial LTDA LBFL is ready to provide you with comprehensive services at any stage of the project.

Contact us for further details.